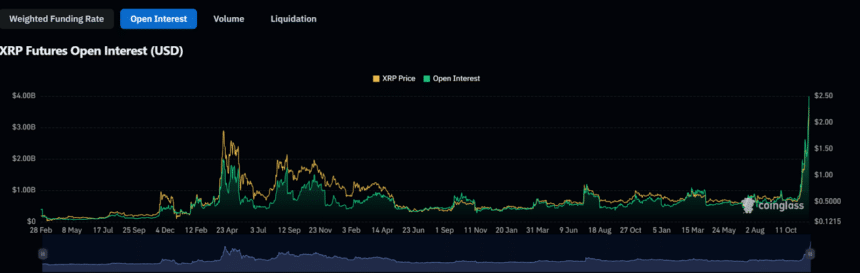

XRP Futures Open Interest Soars to $3.91B Volume

XRP has hit a new milestone as its futures open interest soaring 17% to $3.91 billion. According to data from CoinGlass, Binance leads the XRP futures market with $1.3 billion contracts, accounting for 32.04% of the total open interest.

Bybit and Bitget also contribute substantially to the market activity. Additionally, XRP’s futures trading volume escalated by 289%, reaching $60 billion, while options open interest rose 16.2% to $992.33K, indicating intensified market participation.

Source: Coinglass

Source: Coinglass

Meanwhile, Ripple’s efforts to expand XRP’s role in cross-border payments have contributed toward the momentum. Ripple’s On-Demand Liquidity (ODL) service, which transfers money across borders and utilizes XRP for cost and time efficiency, has had good reception with the financial institutions.

Additionally, the RLUSD stablecoin , a new product from Ripple set to launch in the next 2 days, adds some thrust by offering simple and fast global transactions.

There are ongoing tests with speculation about its integration with DeFi networks of multiple blockchains.

Despite these, XRP is still handling challenges like its ongoing battle with SEC which ruled that XRP isn’t a security on public exchanges.

However, analysts including @odrabraa on X predict XRP could reach $3 in the near future, with some predicting as much as $5.34 by 2025.

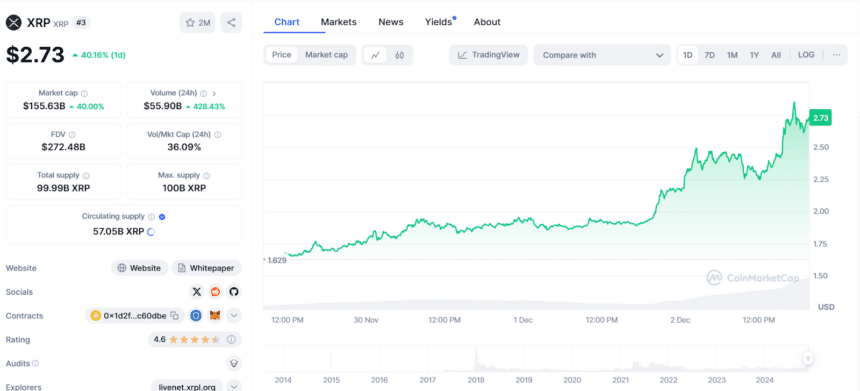

XRP/USD Price Chart | Source: CoinMarketCap

XRP/USD Price Chart | Source: CoinMarketCap

But at the moment, the crypto is trading for $2.72 – a 39% surge in a single day with a massive 428.23% increase in trading volume to $55 billion, according to CoinMarketCap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Long-Awaited Good News for Bitcoin Comes from Texas

Tether Mints 2 Billion USDT On Tron For Future Utility As Bitcoin Climbs Above $100K

Bitcoin Rebounds as Markets Price in 'Short-Lived' Iran Conflict

Crypto Market Sees $875M Liquidated in 24 Hours

Crypto market wiped out $875 million in liquidations in the past 24 hours—major losses amid sharp BTC/ETH drops. What it means for traders.Massive Liquidation Wave Sweeps the Crypto MarketBitcoin & Ethereum Hit HardestWhat This Means for Crypto Traders