XRP Price Hits 6-Year High: Is a $10 Target Within Reach?

After a prolonged legal struggle and market stagnation, XRP price has emerged stronger than ever, hitting a six-year high of $2.46.

With its market cap exceeding $140 billion, analysts are asking: could $10 be the next milestone for Ripple’s native token?

XRP Rockets to Six-Year High Amid Market Optimism

XRP’s market performance has stunned investors, rallying to a six-year high of $2.46 and surpassing a $140 billion market cap.

This milestone represents a 341% surge since November 1, driven by a mix of legal victories, strong on-chain metrics, and Ripple’s strategic innovations.

Notably, the recent $50 billion spike in market cap over just three days highlights the overwhelming bullish momentum behind the token.

At present, XRP boasts a 24-hour trading volume of $28 billion, making it the fourth most-traded cryptocurrency globally. It ranks third when excluding stablecoins, trailing only Ethereum and Bitcoin in daily trading activity.

The rally is fueled in part by excitement surrounding Ripple’s upcoming stablecoin, RLUSD. The New York Department of Financial Services (NYDFS) is reportedly close to approving RLUSD, with a decision expected as early as December 4th.

Ripple’s stablecoin is designed to integrate seamlessly into the traditional financial system, enabling banks to adopt Ripple’s software for transactions.

This innovation could significantly boost demand for XRP as more institutions utilize the network.

According to market observers, RLUSD could disrupt the $200 billion stablecoin sector currently dominated by Tether (USDT) and Circle (USDC).

Ripple’s established presence in global payments positions RLUSD to potentially carve out a sizable market share, creating a positive feedback loop for XRP’s price.

Legal Clarity Fuels Optimism

Ripple’s ongoing legal battle with the SEC is also nearing resolution. SEC Chairman Gary Gensler’s announcement of his departure in January has sparked optimism that a more crypto-friendly regulatory approach could emerge.

Legal experts, such as attorney Jeremy Hogan, suggest that non-fraud cases like Ripple’s may soon be dropped, potentially resulting in a settlement.

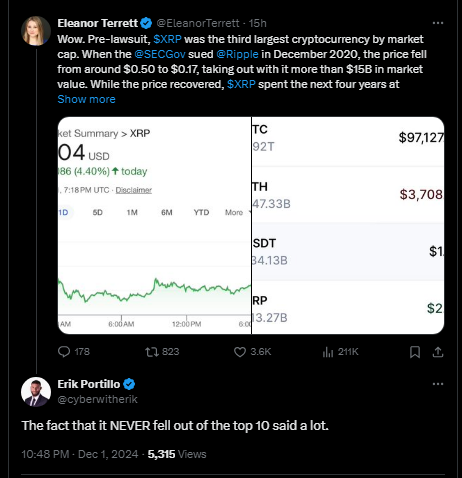

The lawsuit, which once dragged XRP’s price to a low of $0.17 in 2020, now appears to have galvanized the community.

Technical analysis further underscores XRP’s bullish outlook. Key indicators, including positive moving averages and a strong MACD signal, suggest continued upward momentum. XRP’s RSI stands at 93.89, while volatility remains moderate at 7.75%.

On-chain data also points to growing adoption. XRPScan reports that new wallet activations on the XRP Ledger have surged tenfold over the past three months, with nearly 1,000 users joining every hour.

First Ledger, a key platform within the ecosystem, recently processed $40 million in transactions in a single day.

Will XRP Price Reach $10?

Analysts remain divided on whether XRP can hit $10, but many see this as a realistic long-term target. Market participants like Edoardo Farina, CEO of Alpha Lions Academy, believe $10 is just the beginning, urging holders not to sell prematurely.

“Anyone selling at $10 will regret it later,” Farina stated.

As XRP trades at $2.41, its 29% daily gain reflects the token’s growing dominance in the crypto market.

While challenges remain, the combination of Ripple’s stablecoin ambitions, legal clarity, and surging market demand could make the $10 milestone more than just a dream.

At the time of writing, XRP is trading at $2.24 after rallying 17% over the last 24 hours with a trading volume of $33.55 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sui (SUI) Soars Following Key MA Breakout – Can Ondo (ONDO) Do the Same?

Has PEPE’s Comeback Begun? Familiar Fractal Setup Signaling an Upside Move

JasmyCoin (JASMY) Mirrors Past Bullish Breakout Setup — Is a Major Move Ahead?

Aptos (APT) To Continue Rebound? Key Harmonic Pattern Signaling an Upside Move