Will Bitcoin (BTC) Price Break $100,000 Before the Year Ends? Here’s Bullish Oracle Tom Lee’s Latest Insights

The Bitcoin price has been hovering around the $100,000 mark for a long time, but this important psychological threshold has not been crossed yet.

Fundstrat Global Advisors Chief Investment Officer Tom Lee confidently predicted in a forecast that Bitcoin will close “well above $100,000” before the end of 2024.

Speaking on CNBC, Lee touched on the growing momentum in the cryptocurrency market despite recent price hesitations around six-figure figures.

Lee pointed to the limited supply of Bitcoin on over-the-counter exchanges as a key factor driving this potential surge. He suggested that the limited supply could lead to a “big chase” as prices rise, creating further upward pressure. While he acknowledged that the psychological resistance is at $100,000, he said he was optimistic that Bitcoin could break out decisively in the next four weeks.

That bullish sentiment also aligns with Lee’s broader outlook for financial markets. Lee also predicted a year-end rally for the SP 500, potentially reaching 6,300 points. Lee cited favorable seasonality, falling bond yields, contrarian market sentiment and supportive fiscal and monetary policies as driving factors.

*This is not investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

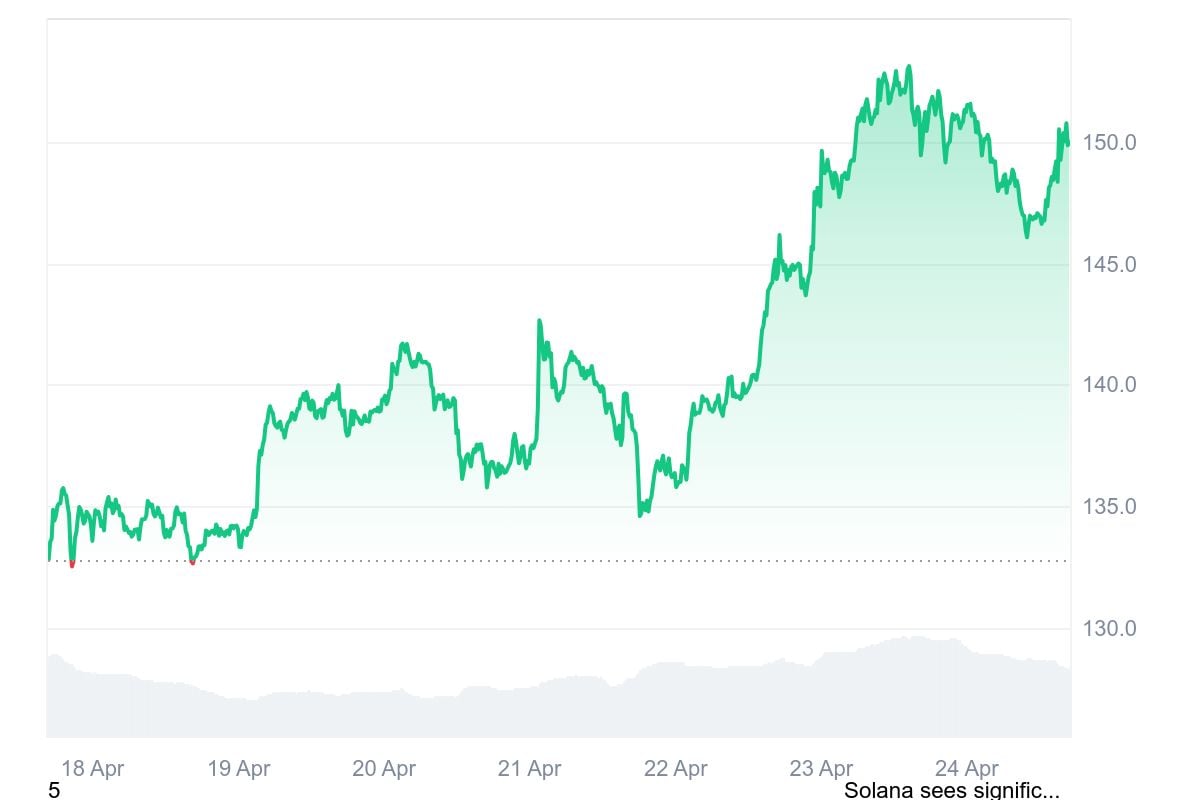

Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level

Tariffs and Bitcoin, what is the connection?

Charles Hoskinson Claims Ethereum May Collapse as Layer 2s Drain Value

Bitcoin Price Breakdown Alert – $78,000 Incoming as Head & Shoulders Pattern Confirmed