Cardano Soars to 32-Month High Following $276 Million Whale Inflows

Cardano's price surge to $1.15 marks a 32-month high, driven by strong whale accumulation and reduced sell-offs from long-term holders. This signaled the potential for further price gains.

Cardano (ADA) has surged by double digits over the past week, reaching $1.15 — a price last seen in April 2022. This rally is fueled by reduced selloffs from long-term holders and increased accumulation by large investors.

With growing bullish momentum, ADA could see further gains in the near term. Here’s why.

Cardano Long-Term Holders and Whales Join Forces

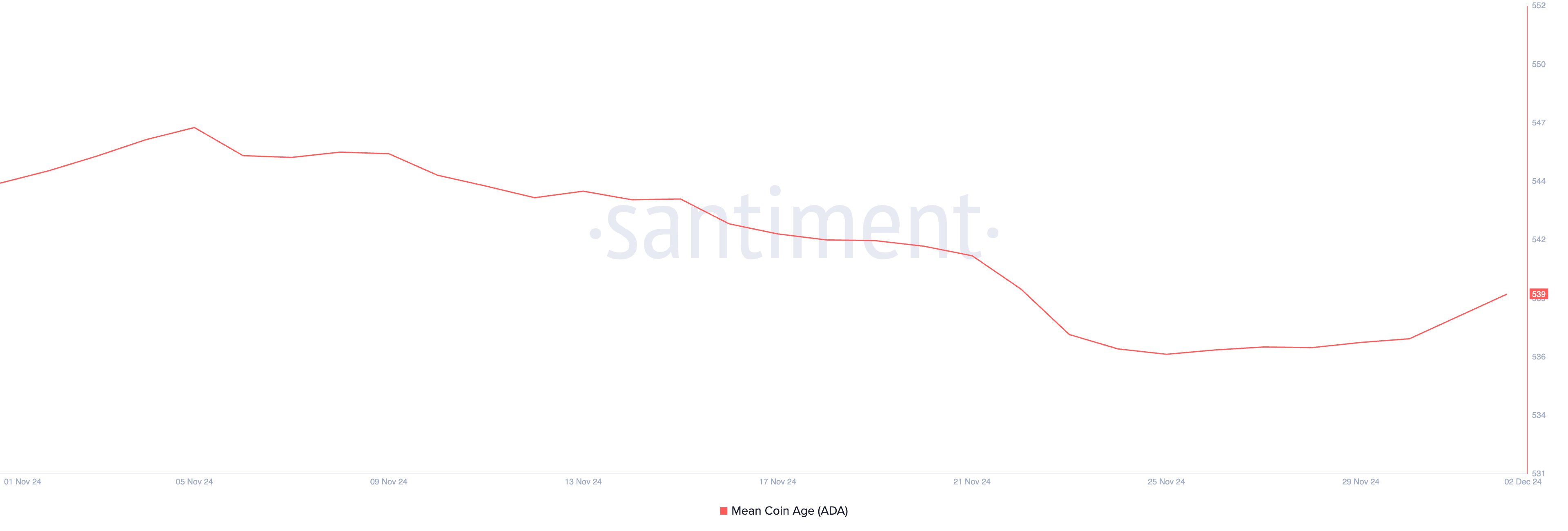

November’s 217% surge in Cardano’s price sparked the movement of previously dormant tokens, as reflected in its declining Mean Coin Age over the 30-day period.

This metric measures the average “age” of all coins in an asset, weighted by their holding duration. When it declines, it suggests increased on-chain activity, as previously idle coins are being spent or transferred, mostly for profit.

However, over the past week, this trend has shifted. Per Santiment, ADA’s Mean Coin Age has been in an upward trend, indicating network accumulation. This reduced selloff from ADA long-term holders has led to a 10% rise in value in the past seven days.

Cardano Mean Coin Age. Source:

Santiment

Cardano Mean Coin Age. Source:

Santiment

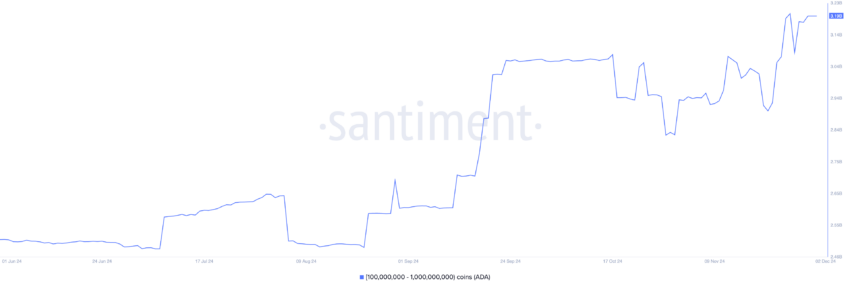

Additionally, ADA whales or large investors have increased their holdings during the period in review. On-chain data shows that ADA addresses holding between 100 million and 1 billion coins have collectively acquired $276 million worth of ADA over the past seven days.

When whales increase their holdings, it signals confidence in the asset’s future price movement, potentially driving further market demand. This accumulation can lead to price appreciation due to reduced circulating supply, as whales hold a larger portion of the total supply.

Cardano Supply Distribution. Source:

Santiment

Cardano Supply Distribution. Source:

Santiment

ADA Price Prediction: New Highs Remain Within Reach

On a daily chart, Cardano’s Elder-Ray Index confirms the bullish bias toward the altcoin. At press time, the indicator’s value is 0.31.

This measures the strength of a trend by comparing the buying and selling pressure in the market. When it is positive, it indicates that buying pressure outweighs selling pressure, suggesting a bullish market trend. If this trend continues, ADA will extend its gains and climb toward $1.30, a price it last traded at in January 2022.

Cardano Price Analysis. Source:

TradingView

Cardano Price Analysis. Source:

TradingView

On the other hand, an uptick in coin distribution will cause a decline to $1.09. Should the bulls fail to defend this price level, the Cardano coin price value will slip under $1 to trade at $0.92.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump administration walks back tariff ‘exemption’ on electronics

Trump says he’s “flexible” on electronic tariffs, and that more developments are “coming up”

Charles Hoskinson Weighs in: Is Bitcoin Surging to $250K?

Unpacking Charles Hoskinson's Bold Bitcoin Prediction in Light of Current Market Trends

Market Insights: Short-Term Recovery Signals for BONK, ALCH, and Bitcoin

In Brief Analyst Pseudonym identifies recovery signals in BONK, ALCH, and Bitcoin. Short-term trading strategies recommended for cautious positions. Increasing interest in meme tokens amid market volatility.

Ethereum Price Fluctuations Ignite Technical Analysis and Strategic Forecasts

In Brief Ethereum's price fluctuations shift focus to technical indicators among market players. Analysts signal potential recovery and long-term growth opportunities for Ethereum. Competition from networks like Solana raises challenges for Ethereum's market position.