AAVE’s Bullish Rally: Can It Overcome Key Resistance at $250 Amid Positive On-Chain Signals?

-

AAVE’s recent bullish momentum highlights the altcoin’s strength in a competitive crypto market, positioning it for potential gains.

-

With a current trading price of $202.53, AAVE is gaining traction as it approaches key resistance levels, supported by robust trading metrics.

-

“The market is showing promising signs for AAVE, as both retail and institutional interest surges,” commented a source from COINOTAG.

AAVE exhibits bullish momentum, breaking accumulation barriers and testing key resistance as positive on-chain metrics fuel trader confidence.

Price action – Breakout and approaching resistance

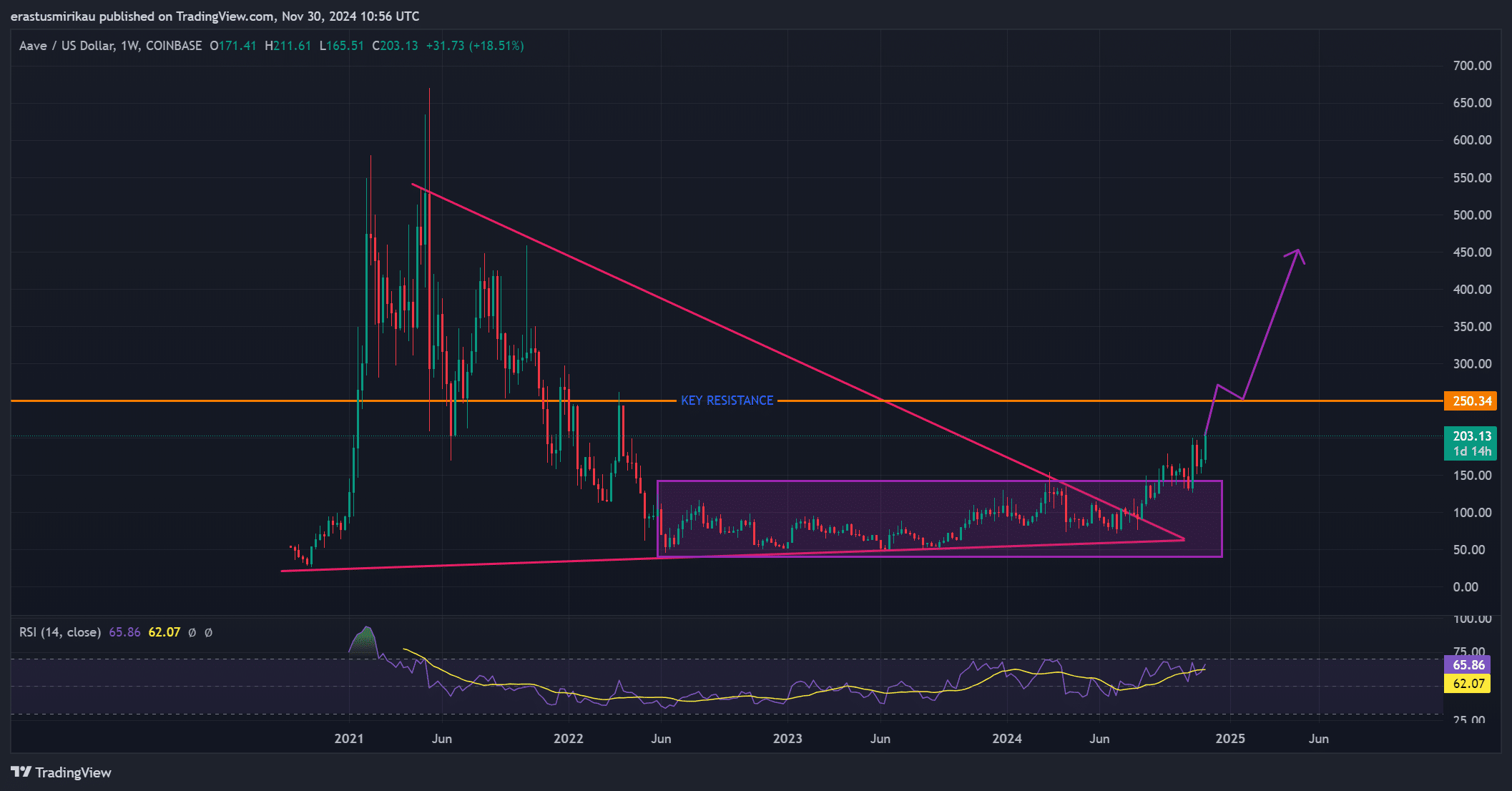

AAVE’s price activity has drawn investor attention, showcasing a significant breakout from its previously established accumulation phase. Currently trading at $202.53, the token is making strides towards a critical resistance point at $250. This level has historically presented challenges for AAVE, thus raising questions about its ability to maintain upward momentum.

Notably, the Relative Strength Index (RSI) reading at 65.86 indicates a strong bullish trend, although it also suggests that AAVE is edging close to overbought territory. This condition implies that while the current rally appears robust, the token may encounter resistance before successfully breaching the $250 mark.

Source: TradingView

On-chain signals – Bullish metrics support the rally

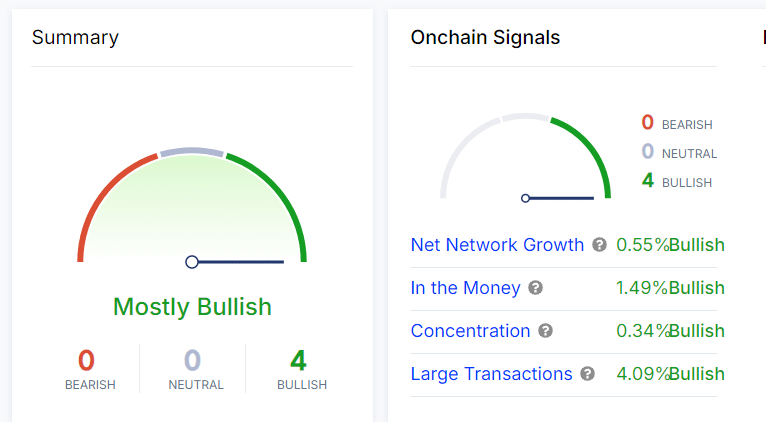

On-chain analytics are revealing strong signals that provide further credence to AAVE’s bullish stance. The network growth figure recently climbed by 0.55%, indicating heightened interest and activity across the AAVE ecosystem. This uptick supports the sentiment that a broader market interest is driving the recent price increases.

Additionally, the “Into the Money” metric exhibited a 1.49% rise, suggesting that an increasing number of traders are finding themselves in profitable positions, which typically correlates with further bullish activity. The concentration metric, showing an increase of 0.34% combined with a 4.09% rise in large transactions, signals robust demand from both institutional and retail investors, fortifying the positive outlook for AAVE’s price trajectory.

Source: IntoTheBlock

Liquidations – Shorts and longs in play

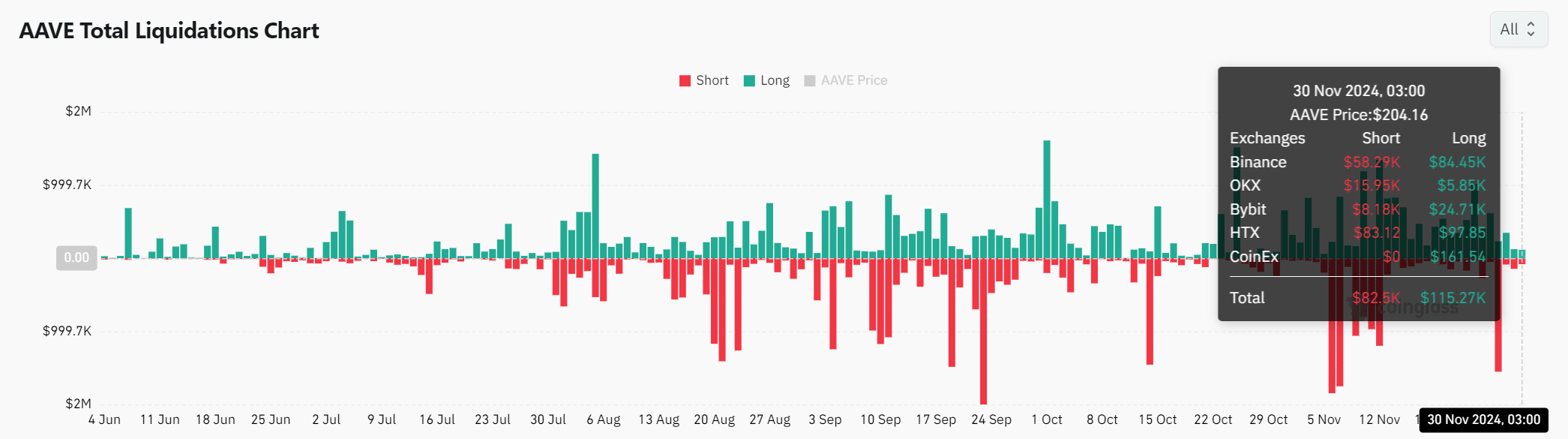

The market has witnessed significant liquidation activity with shorts amounting to $82.5k and longs reaching $115.27k. This heightened liquidation environment suggests increased volatility around AAVE. Such activity generally leads to pronounced price fluctuations as traders unwind their positions.

As liquidations occur for both long and short positions, the potential for rapid price movements increases. If bulls maintain control, this could drive prices higher; conversely, if bearish sentiment prevails, it may lead to a retracement.

Source: Coinglass

Open interest – Rising confidence in AAVE

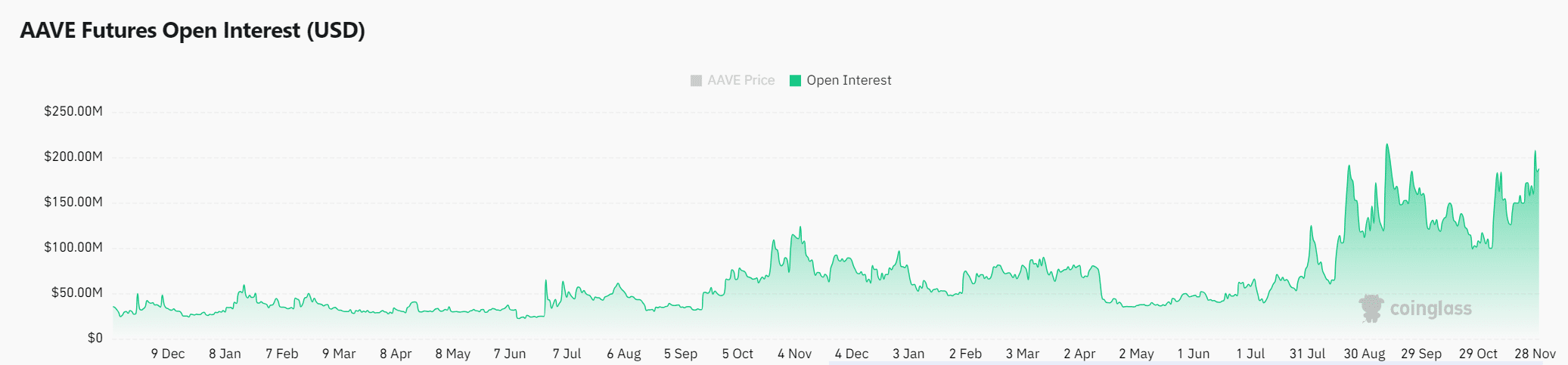

Open interest in AAVE options surged by 10.35%, reaching a total of $186.22 million. This increase signals growing confidence among investors, indicating that many traders are preparing for potential bullish movements in AAVE’s price. The uptick in open interest often precedes significant price fluctuations as it reflects heightened activity and interest in the asset.

As AAVE approaches its resistance levels, this rising open interest could facilitate heightened volatility, increasing the likelihood of both upward and downward price swings.

Source: Coinglass

Can AAVE break through $250?

AAVE’s current bullish trajectory, reinforced by substantial price action and favorable on-chain metrics, hints at the possibility of reaching new peaks. However, the $250 resistance still looms as a key target. If AAVE manages to decisively break through this ceiling, it could trigger a rapid uptrend towards greater highs. Traders are advised to remain vigilant as they assess whether AAVE can sustain its momentum amid potential shifts in investor sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Healthcare Expands in Africa with Pharma Ville Acquisition

Inflation print calms markets, but tariffs still loom

Commerce Secretary Howard Lutnick said tariffs are “worth it” even if they plunge the US economy into recession territory

XRP News: XRPTurbo Set To Enhance XRP DeFi Ecosystem With AI-Powered DApps And Tokenization Tools

‘Markets Are Gonna Soar’: Trump Shows Confidence as Inflation Cools and Stocks Rise