The Scoop: CME emerges as the big winner in the post-ETF crypto landscape

Quick Take We now live in a post-ETF world where crypto is no longer an isolated asset class. This column is adapted from The Scoop newsletter.

The implications are enormous. The market structure of crypto is changing rapidly, creating unprecedented opportunities for spreads and arbitrage as traditional financial players integrate digital assets into their strategies. The amount of capital willing and able to hold risk has surged, reshaping the ecosystem’s center of gravity. And that center is the CME Group.

CME’s Dominance in the Trump Win Trade

As Bitcoin rallies in the wake of Donald Trump’s election victory, CME has emerged as the premier venue for sophisticated crypto trading. Open interest on CME has reached all-time highs, driven by large call buyers positioning for upside. This isn’t just a retail-driven market anymore—these trades are a strong signal that traditional market makers and institutions see CME as the best proxy for the Trump win trade.

Unlike offshore platforms that cater to retail and smaller institutional players, CME has become the go-to hub for deep-pocketed investors. Its robust infrastructure, regulatory clarity, and liquidity are unparalleled, making it the venue of choice for institutional capital.

The Broader Landscape

In this new environment, crypto has transitioned from being an isolated “alternative asset” to a piece of a much larger puzzle for global asset managers. Its role is increasingly akin to commodities or equities, offering portfolio diversification and macro exposure rather than being a standalone bet on technological adoption.

The ETF era has amplified this shift, creating a bridge between crypto and traditional finance. Now, large pools of capital can enter the market seamlessly, leading to more efficient price discovery and a deeper integration into the global financial system.

The Bottom Line

CME’s rise underscores a broader reality: the crypto market’s center of gravity is moving toward regulated, institutional-grade platforms. For asset managers and sophisticated traders, the action is no longer just offshore—it’s on CME. And as Bitcoin rallies alongside broader macro and political narratives, CME’s role as the market’s beating heart will only grow stronger.

This cycle belongs to CME, where the big players place their bets. For traders and investors, understanding this new dynamic is key to navigating the post-ETF crypto market.

The Block’s Frank Chaparro serves up the latest headlines, charts, trends, and views on crypto and DeFi from around The Block, Twitter, and The Scoop pod. Subscribe to The Scoop newsletter , which hits inboxes on Tuesday and Friday mornings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

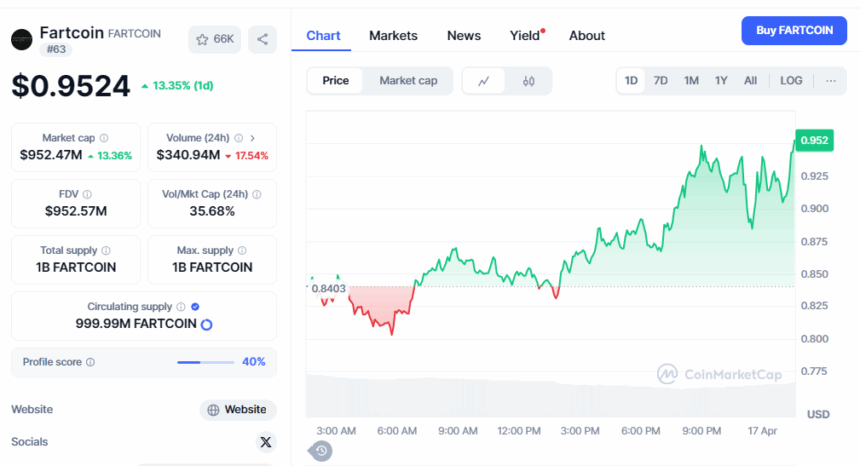

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?