Ethena (ENA) Rallies 36% as Arthur Hayes Commits $11M Investment

- Arthur Hayes invested $11.21M in 16.79M ENA tokens after shifting funds from Aethir, signaling confidence in Ethena’s growth.

- Ethena surged 36%, with a 12% price increase, $374M open interest, and $1.29M liquidations, reflecting rising market activity.

- Hayes’ diverse portfolio includes ETH, FLOWER, EETH, SUSDE, and PENDLE, showcasing a balanced crypto investment strategy.

Arthur Hayes, co-founder of BitMEX, has drawn attention with a significant investment in Ethena (ENA). Hayes shifted $11.21 million into 16.79 million ENA tokens. This move highlights his strategic confidence in the cryptocurrency, as the token experiences a 36% surge in value.

According to Lookonchain, Hayes transitioned his holdings from Aethir (ATH) to ENA over the past two days. This decision has ignited discussions about Ethena’s potential, given Hayes’ reputation as a leading figure in crypto investments.

Ethena Gains Momentum with Market Activity

Notably, Ethena has displayed robust performance, recently increasing by 12%, with its price rising by $0.71. Coinglass data reveals a notable rise in ENA’s open interest by 23%, reaching $374 million. Additionally, liquidations surged to $1.29 million, including $335,000 in long liquidations and $956,000 in short liquidations.

More so, these developments indicate growing activity and interest in Ethena. Technical indicators, including a Relative Strength Index (RSI) nearing 60, suggest the rally may continue. This level signifies increased buying interest without crossing into overbought territory.

Hayes’ Portfolio Diversification Remains Notable

However, despite his focus on ENA, Hayes has maintained a diverse portfolio. His investments include Ethereum (ETH), FLOWER, EETH, SUSDE, and PENDLE. This reflects his continued strategy to balance high-confidence investments with broader diversification.

In addition, the decision to reallocate funds from ATH to ENA demonstrates Hayes’ ability to pivot toward emerging opportunities. Analysts speculate this move could enhance Ethena’s credibility and appeal, especially with a high-profile backer like Hayes signaling confidence.

Market Observers Eye Long-Term Implications

Therefore, Hayes’ significant allocation to Ethena underscores its growing prominence in the crypto market. As the community watches the token’s trajectory, Hayes’ investment is expected to influence both sentiment and trading patterns.

Moreover, the rise in ENA’s value coincides with increasing interest in the broader crypto market, where strategic investments by major players often serve as key indicators of potential growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 RWA Tokens to Buy in April 2025 Before They Skyrocket

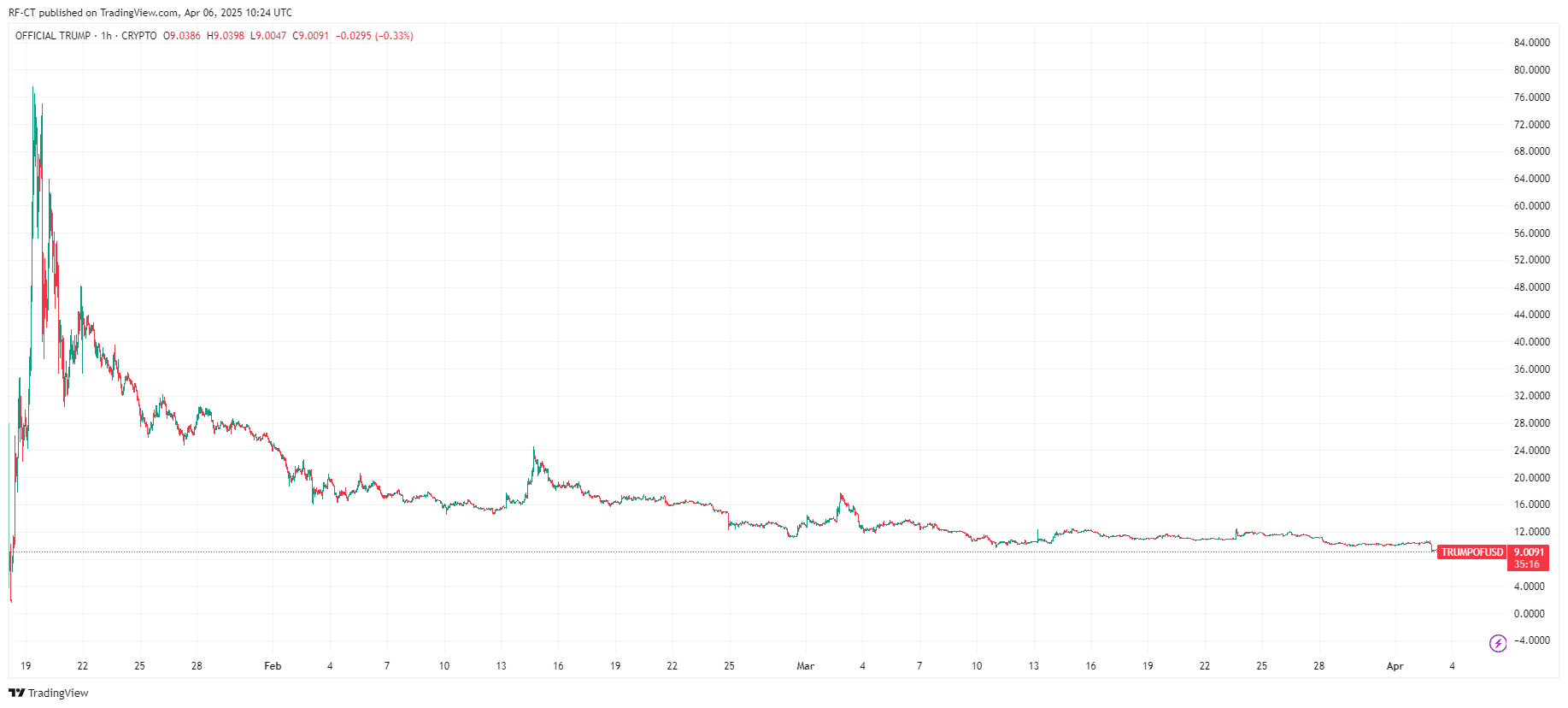

TRUMP News: Is the TRUMP Coin a Smart Bet in a Tariff-Driven Recession?

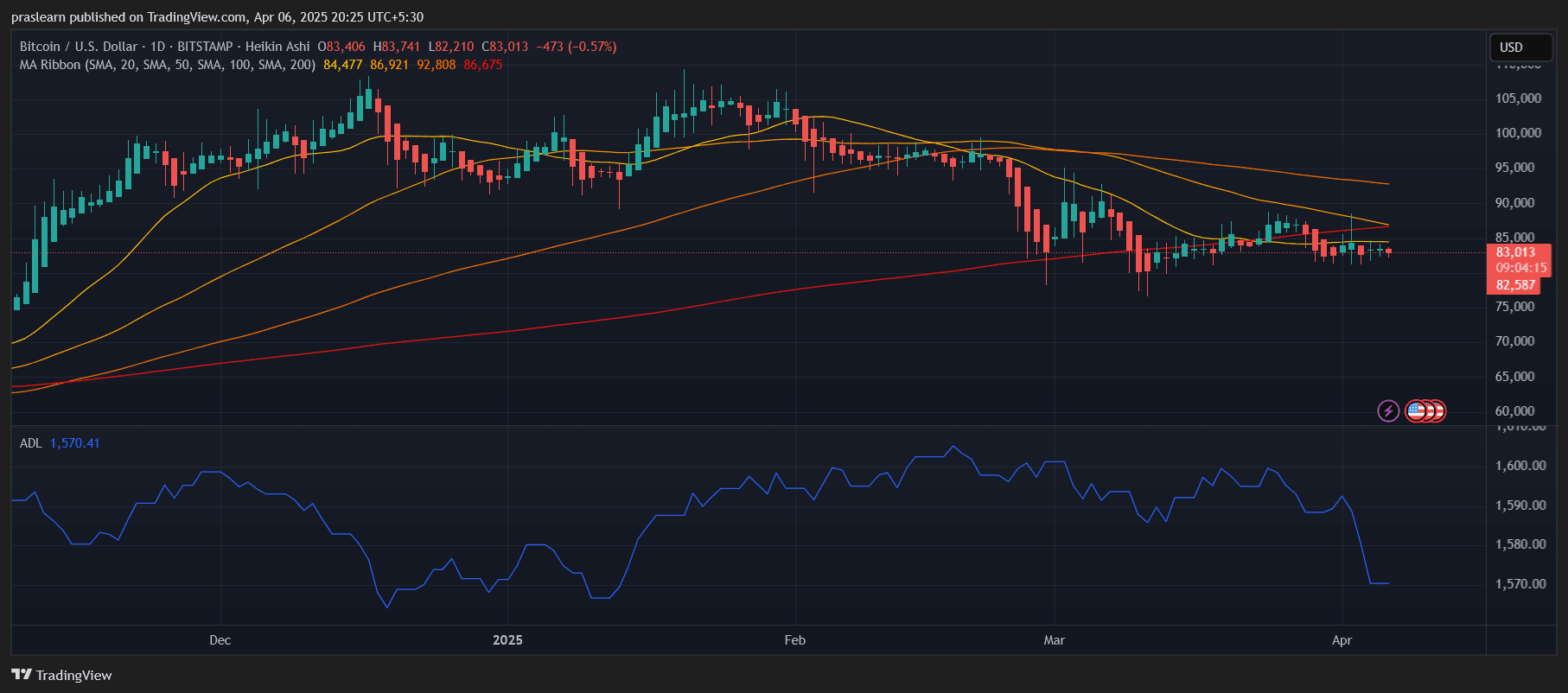

Bitcoin Price Crash to $60,000? Here's What the Charts Say Now

Bitcoin Price Holds Steady at $83K Amid Market Turmoil: Is a Breakout on the Horizon?