Bitcoin Frontier Fund, Home of the Top Bitcoin Accelerator, To Invest in Teams Built on sBTC

Bitcoin Frontier Fund announced today its plans to invest in teams building with sBTC, Stacks’ 1:1 Bitcoin-backed asset.

Bitcoin Frontier Fund (BFF) is the leading Bitcoin accelerator, with a portfolio of category-defining Bitcoin companies across the ecosystem, including Xverse, ALEX, Liquidium, Bitflow, and more.

BFF is a pioneer in the Bitcoin venture capital space. It has been a Bitcoin-focused VC investor since its inception in 2021, with 70+ investments to date, supporting the growth of the Bitcoin ecosystem by investing in teams building technology that leverage the power of Bitcoin.

BFF focuses on infrastructure, enabling technologies, developer tools, accessibility products, DeFi, proven web3 use cases, and other foundational technologies. Investing in foundational L1 and L2 use cases.

In addition, BFF operates the leading accelerator in the space. Venture investor Trevor Owens leads the BFF Accelerator and has been an advocate and supporter of the best Bitcoin companies. Trevor Owens, along with Leonidas and Jan Smejkal, are also the hosts behind the leading live podcast for Bitcoin builders, offering twice weekly spaces covering everything across the Bitcoin ecosystem.

Further supporting the growth of the Bitcoin ecosystem, BFF has launched the Dealflow Dispatch , a curated newsletter for those interested in learning about angel investing in Bitcoin startups.

Why Now

BFF has been investing in the Bitcoin ecosystem for years and is ramping up investment, given current ecosystem trends.

- The Bitcoin Renaissance: builders are coming back to build companies on Bitcoin as Bitcoin Layers like Stacks emerge.

- The stark contrast between Bitcoin’s $1.9T+ market capitalization and the relatively limited number of assets operating on its network—especially when compared to other crypto ecosystems—highlights a significant and obvious opportunity.

- There is increasing global regulatory clarity, especially considering recent US election results.

- The Bitcoin ETF approval in the US has increased institutional interest in the space.

BFF to Invest in Teams Building with sBTC

BFF plans to invest heavily in companies that are building with sBTC.

But don’t take our word for it — they have already invested in companies supporting sBTC. Many of their portfolio companies will support sBTC on Day 1.

- Zest and Arkadiko will allow users to borrow and lend against sBTC

- Xverse is a Bitcoin wallet with sBTC capability

- Bitflow will allow users to swap sBTC at the best rates

- ALEX is a finance layer for sBTC and Bitcoin

- Asigna is a best-in-class multi-sig wallet for all Bitcoin assets, including sBTC

“Investing in Bitcoin startups is still the biggest asymmetric bet in this space. We see a huge opportunity as a fund investing in teams leveraging sBTC, says Trevor Owens, Managing Partner of Bitcoin Frontier Fund. “With sBTC, we see a future where Bitcoin becomes not just a store of value but a dynamic entry point for countless DeFi solutions.”

₿est and ₿rightest

Bitcoin Frontier Fund’s announcement is part of the Stacks Foundation's "Best and the Brightest" campaign, which aims to showcase leading organizations that support sBTC. This campaign features top organizations across the Bitcoin ecosystem, emphasizing their commitment to advancing the utility and accessibility of Bitcoin. By aligning with industry leaders, the Stacks Foundation seeks to educate the community about the transformative potential of sBTC and its role in activating a robust Bitcoin economy.

This post is commissioned by Stacks and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

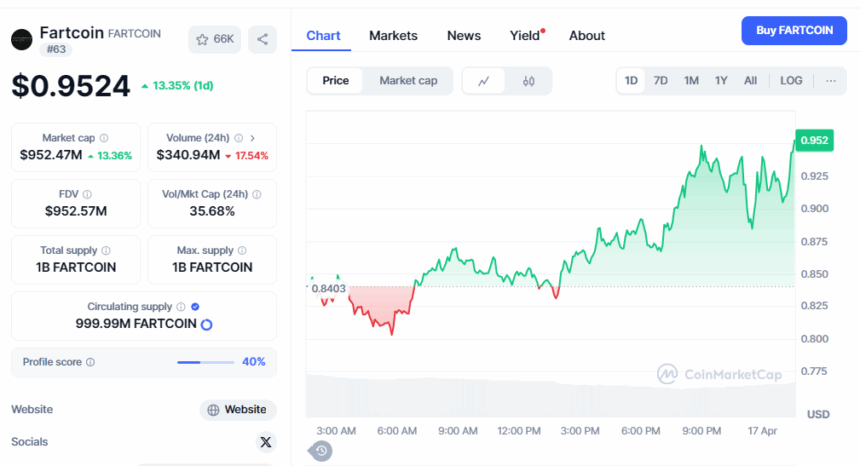

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?