Metalayer Launches $25 Million Crypto Venture Fund Led by Former Two Sigma Executives

Metalayer, a crypto-focused investment firm, has secured $20 million in a first close toward its $25 million crypto venture fund target.

According to a recent Fortune report, the fund’s early backing came from institutional investors, including executives from Two Sigma Ventures.

Metalayer Targets Crypto and Fintech Startups

Metalayer has reportedly drawn backing from family offices and executives at blockchain projects, in addition to capital from Two Sigma Ventures’ leadership. The fund expects to close the remaining $5 million by the end of the year.

Based on the report, the founding team includes Andy Kangpan, previously Two Sigma Ventures’ digital asset lead, and Mickey Graham, who worked on blockchain initiatives after leaving Two Sigma.

Metalayer filed with the Securities and Exchange Commission (SEC) last week to establish its crypto-focused venture fund. Based on the report, the company has already invested in three blockchain-focused projects.

The investments include Ethena, which is focused on yield-generating digital assets; Crossover, a crypto exchange designed for institutional use; and Clear Token, a blockchain clearinghouse platform.

Monkey Tilt Secures $30M for Blockchain Gaming Expansion

Monkey Tilt recently raised $30 million in a Series A funding round to expand its blockchain-driven gaming and entertainment platform. The round was led by Pantera Capital , with additional backing from Polychain Capital, PokerGo, Hack VC, and others.

Launched in March 2024, Monkey Tilt combines traditional casino games like dealer-led craps and roulette with blockchain technology and crypto payment options. The platform also features a 24/7 sportsbook and supports multi-currency wagering.

The company highlighted its payment infrastructure, which allows users to place bets using a variety of digital assets. This capability has positioned Monkey Tilt as a hub for seasoned gamblers and newcomers exploring blockchain-based gaming solutions.

Monkey Tilt plans to allocate the new funding toward platform enhancements and the development of a gamified crypto trading product slated for 2025. CEO Sam Kiki described the platform as a new gaming experience, addressing modern players’ evolving preferences.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

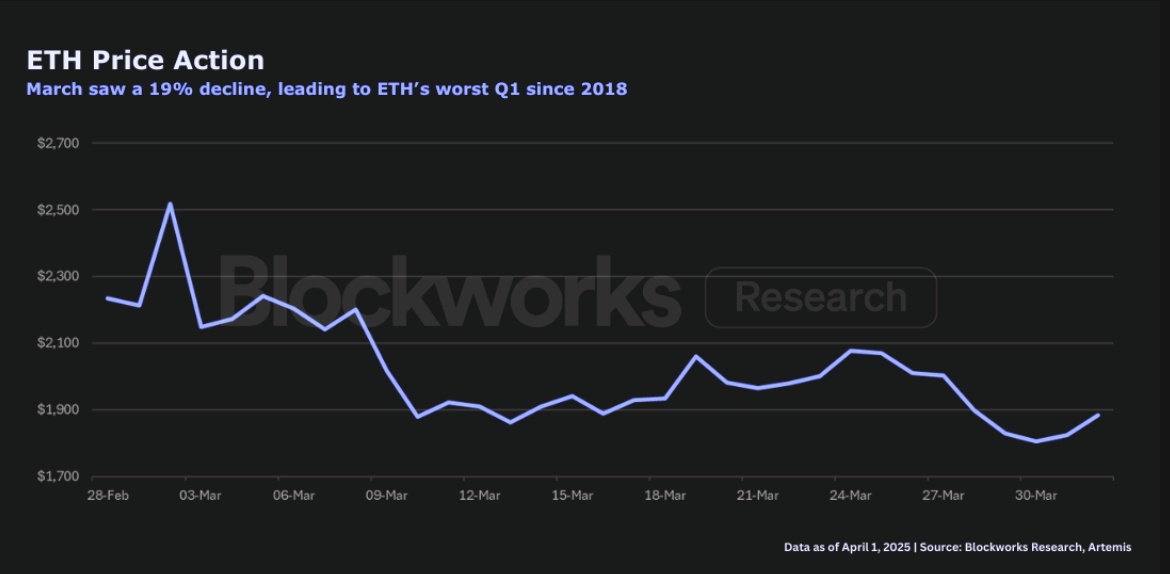

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far