Bitcoin ETFs lead $3.1 billion weekly inflow record into crypto investment products: CoinShares

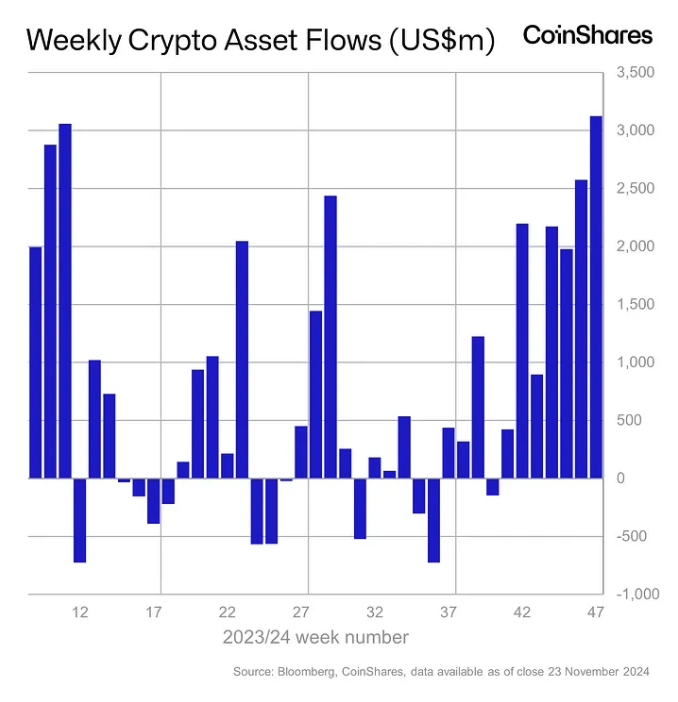

Crypto investment products registered a record $3.13 billion worth of net inflows globally last week, led by the U.S. spot Bitcoin ETFs, according to CoinShares.The funds’ year-to-date net inflows have also reached a record $37 billion, while assets under management hit a new peak of $153 billion.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a seventh consecutive week of net inflows that added $3.13 billion, the largest on record, according to CoinShares.

The positive flows also bring the year-to-date figure to a new record, which, alongside bitcoin’s recent price surge, saw assets under management at the funds climb to a new peak of $153.3 billion, CoinShares Head of Research James Butterfill noted in a Monday report.

“Year-to-date inflows now stand at a record $37 billion, driven primarily by bitcoin, far outpacing the debut of U.S. gold ETFs, which attracted just $309 million in their first year,” Butterfill said.

Weekly crypto asset flows. Images: CoinShares .

US spot Bitcoin ETF weekly inflow record

U.S. spot Bitcoin exchange-traded funds led the net weekly inflows, adding a record $3.38 billion last week, $2.05 billion of which came via BlackRock’s IBIT product alone, according to data compiled by The Block.

U.S.-based funds also dominated overall, with $3.2 billion worth of net inflows offset slightly by net outflows of $84 million, $40 million and $17 million from crypto investment products in Sweden, Germany and Switzerland, respectively.

Globally, bitcoin-based funds registered net inflows of $3 billion. However, higher prices also prompted a further $10 million worth of inflows into short-bitcoin products, contributing to a $58 million monthly figure — the largest since August 2022, Butterfill noted.

Bitcoin battles with the $100,000 milestone

Bitcoin is currently changing hands for $98,396, according to The Block’s Bitcoin Price Page — up 1% during the past 24 hours, around 9% over the last week and 133% year-to-date.

“Bitcoin has been consolidating in the $95K–$99K range since Thursday, with its first attempt at $100K stalling due to a lack of institutional activity over the weekend,” BRN analyst Valentin Fournier said Monday. “However, with improved entry points at the start of this week, we remain confident that retail and institutional demand will drive bitcoin past resistance in the coming weeks.”

Meanwhile, Solana investment products outpaced Ethereum with net weekly inflows of $16 million compared to $2.8 million. Altcoin-based funds such as XRP, Litecoin and Chainlink also witnessed inflows of $15 million, $4.1 million and $1.3 million, respectively, amid the price rises.

The GMCI 30 index, which represents a selection of the top 30 cryptocurrencies, is up 3.4% over the past day to 193.15, gaining 12.8% in the last week and around 94% in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CROSSUSDT now launched for futures trading and trading bots

BULLAUSDT now launched for futures trading and trading bots

BGB holders' summer celebration–a grand community giveaway! Trade 10 BGB to share 10,000 USDT!

New spot margin trading pair — ICNT/USDT!