How Michael Saylor’s Bitcoin Bet is Making MicroStrategy a Wall Street Phenomenon

- MicroStrategy holds a substantial 331,200 bitcoins, reflecting a strategic commitment initiated in 2020.

- Michael Saylor reveals staggering daily gains of $500 million from Bitcoin investments and stock market performance.

MicroStrategy has significantly leveraged its investments in Bitcoin (BTC) since 2020, culminating in a dramatic increase in profitability.

As of November 23, Michael Saylor , announced the company’s staggering gains of $5.4 billion over the last two weeks. This translates to an average daily profit of $500 million.

“We’re making $500 million a day. I’m looking at my screen and we’re selling one-dollar bills for $3, sometimes a million times a minute.” -Michael Saylor, president of MicroStrategy

MicroStrategy’s Bitcoin Treasury Strategy

Initiated in 2020, MicroStrategy’s bold move to integrate Bitcoin into its treasury management has paid dividends.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

The company’s shares, which were trading at $9 when it first invested in Bitcoin, have skyrocketed to over $420. This growth is attributed to both the appreciation in Bitcoin’s value and the company’s stock performance.

Implications for MicroStrategy’s Market Valuation

The rise in share value reflects a surge of nearly 97% in the last month alone. MicroStrategy’s strategy showcases a dual benefit from its Bitcoin investment and its status as a publicly traded entity. This dual-stream growth highlights the potential of integrating digital assets into corporate financial strategies.

Revenue Generation from Bitcoin Investments

Saylor’s announcement on CNBC underscored MicroStrategy’s exceptional profit generation , claiming it to be the highest among U.S. companies currently. This assertion reflects the high turnover the company manages by leveraging the volatility and growth potential of Bitcoin.

Saylor’s comparison of their operations to “selling dollar bills for three dollars” illustrates the lucrative nature of their business model under current market conditions.

Debate and Speculation Surrounding MicroStrategy’s Future

Despite the financial successes, MicroStrategy’s approach draws skepticism. Analysts caution about the speculative nature of valuing the company based on its Bitcoin holdings.

Furthermore, Saylor’s bold long-term prediction for Bitcoin reaching $13 million by 2045 stirs both interest and debate about the realistic future of Bitcoin and its adoption as a mainstream financial asset.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

MicroStrategy remains a pivotal case study in corporate cryptocurrency investment, demonstrating potential high returns but also highlighting the risks and volatilities associated with such strategies.

As the market watches, the company’s next moves could further influence corporate financial strategies concerning digital assets.

Bitcoin (BTC) is currently priced at $97,686 USD, experiencing a slight decline of 1.34% over the last 24 hours. Despite this minor pullback, Bitcoin has demonstrated a 7.23% gain over the past week and an impressive 46.62% growth over the past month. Year-to-date, Bitcoin has surged by 131.09%, reaffirming its bullish momentum in the broader cryptocurrency market.

The market capitalization of Bitcoin now stands at $1.93 trillion USD, with a robust 24-hour trading volume of $55.18 billion USD, highlighting strong liquidity and active investor interest.

Recently, Bitcoin approached its all-time high of $99,800 USD, edging closer to the critical psychological milestone of $100,000 USD.

Source: Tradingview

Source: Tradingview

This upward momentum has been fueled by inflows into U.S. spot Bitcoin ETFs, which saw $2.42 billion in the week of November 18–22, a clear indicator of increasing institutional demand.

From a technical standpoint, Bitcoin faces a crucial resistance level at $100,000 USD. If this level is breached, it could lead to a further rally toward $120,000 USD or higher, as analysts anticipate continued bullish momentum.

Source: Coinmarketcap

Source: Coinmarketcap

On the downside, strong support is seen around $93,000 USD, offering a cushion in case of short-term corrections. Market sentiment remains overwhelmingly positive, classified as “extreme greed,” which could lead to increased volatility in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

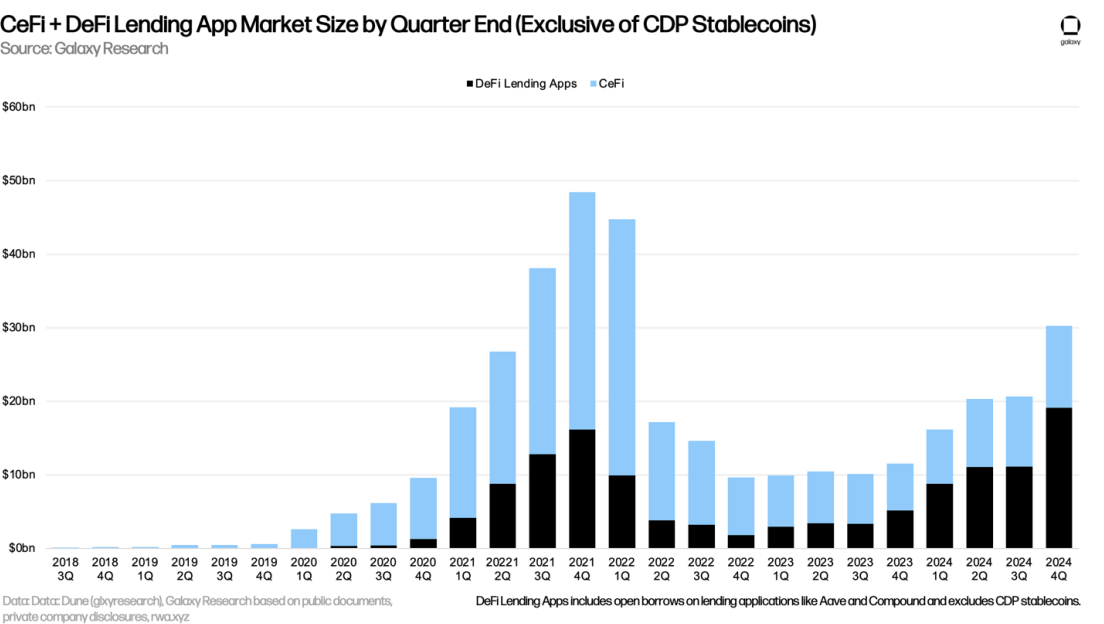

CeFi lending’s up 73% after the sector’s collapse: Galaxy

Both CeFi and DeFi lending have made a comeback, Galaxy noted

USDC’s ‘fueling’ stablecoin market cap rise: Wintermute

Taking a look at the biggest stablecoin players and where they stand

Could Stagnant Bitcoin Dominance Herald the Arrival of Altseason?

Signs of an Emerging Altcoin Season as Bitcoin's Market Dominance Dips to 63.3% Indicating Possible Capital Redirection