Why is FTX Token (FTT) Price UP?

After nearly two years of uncertainty, FTX creditors finally have some good news on the horizon. The much-anticipated reorganization plan is set to begin in January 2025, offering a path forward for those impacted by one of the most talked-about collapses in crypto history. This marks a crucial step in resolving the chaos surrounding FTX and provides hope for creditors waiting to reclaim their funds. Let’s dive into what this means and why it’s a significant moment for the crypto world.

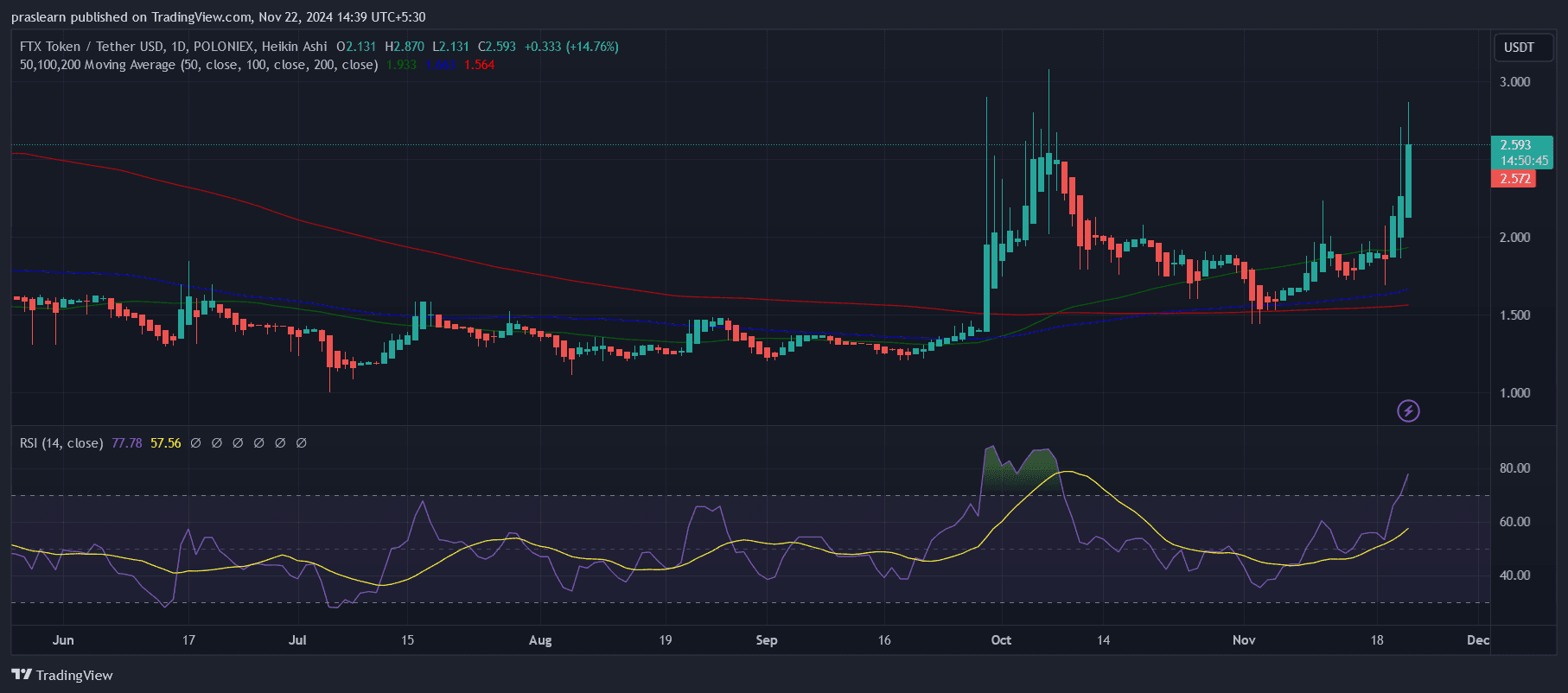

How has the FTX (FTT) Price Moved Recently?

FTT/USDT Daily chart- TradingView

FTT/USDT Daily chart- TradingView

The current price of FTX Token (FTT) is $2.57 , with a 24-hour trading volume of $231.93 million, a market capitalization of $846.82 million, and a market dominance of 0.03%. Over the past 24 hours, FTT's price has surged by 28.05%.

FTX price reached its all-time high of $84.09 on September 9, 2021, while its lowest price was recorded at $0.633373 on September 7, 2019. Since its peak, the lowest price during the downtrend was $0.778732, and the highest recovery point so far has been $5.94. The sentiment around FTX Token is currently bullish, with the Fear Greed Index reflecting 94 (Extreme Greed).

The circulating supply of FTX Token stands at 328.90 million FTT, out of a maximum supply of 352.17 million FTT.

Why is FTX Token (FTT) Price UP?

FTX Token (FTT) has been on the rise recently, and it’s no surprise why. The FTX bankruptcy estate finally provided some clarity, laying out a timeline for creditor and customer reimbursements.

With the FTX reorganization plan in motion and initial payouts expected by March 2025, this progress has brought a wave of optimism to a community that’s been in limbo for nearly two years. It’s a bit of a “light at the end of the tunnel” moment, sparking renewed interest in FTT.

What’s also fueling this surge is the estate’s determination to recover as much as possible for creditors. Over the past couple of months, FTX has been busy filing lawsuits against crypto exchanges like KuCoin and Crypto.com, aiming to claw back millions in assets they believe belong to the bankruptcy estate.

These actions are a clear signal that FTX’s leadership isn’t just sitting back—they’re taking active steps to make things right. That kind of commitment is likely giving the market some added confidence in the process.

At the same time, there’s a bit of tension in the air. Some creditors aren’t thrilled with the repayment plan, mainly because the amounts are based on cryptocurrency prices from the petition date when the market was in a slump. This has created a buzz, with some speculating that FTT could play a bigger role in the recovery process, possibly driving up demand.

Looking ahead, FTT’s price could keep climbing as we inch closer to the reimbursement dates, especially if the estate continues to show progress. But let’s not forget—things could go sideways if lawsuits don’t pan out or if there are delays in payouts. For now, though, the rising price of FTT feels like a mix of hope, excitement, and maybe a touch of speculation as the market reacts to these long-awaited updates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x BOOST: Deposit or Trade to share 8,332,000 BOOST!

Crypto Loan Carnival round 24: Borrow USDT, USDC to enjoy an APR discount of up to 40%

New spot margin trading pair — JTO/USDT!

Announcement on Sonic(S)tokenomics changes