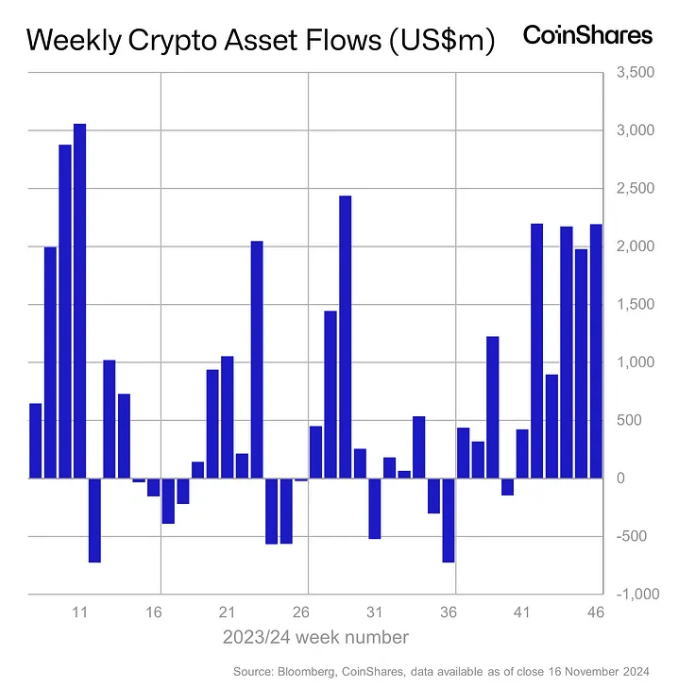

Crypto funds add another $2.2 billion in a week as YTD inflows and AUM hit record levels

Crypto investment products registered $2.19 billion worth of net inflows globally last week, according to CoinShares.The funds’ year-to-date net inflows have reached a record $33.5 billion, while assets under management hit a new peak of $138 billion.

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered a sixth consecutive week of net inflows, adding $2.19 billion, according to CoinShares — bringing the year-to-date figure to a new record $33.5 billion.

Combined with a price surge that saw bitcoin reach fresh all-time highs above $93,000 on Wednesday, assets under management at the funds have climbed to a fresh peak of $138 billion, CoinShares Head of Research James Butterfill noted in a Monday report.

Weekly crypto asset flows. Images: CoinShares .

“This recent surge in activity appears to be driven by a combination of looser monetary policy and the Republican party’s clean sweep in the recent U.S. elections,” Butterfill said.

It was a week of two halves, however, with an impressive $3 billion worth of net inflows added in the first few days subsequently dampened by $866 million in net outflows post all-time high, Butterfill wrote.

U.S.-based funds dominated as usual, accounting for $2.21 billion in net weekly inflows, followed by crypto investment products in Hong Kong, Australia and Canada with net inflows of $27 million, $18 million and $13 million, respectively. Meanwhile, investors in Sweden and Germany "took profit," with regional net outflows of $58 million and $6.8 million, respectively, Butterfill said.

Bitcoin-based products again led on the asset side, registering $1.48 billion worth of net inflows globally last week. However, Wednesday’s all-time high also spurred investors to add $49 million to short-bitcoin investment vehicles, the analyst noted.

The U.S. spot bitcoin exchange-traded funds notched up net weekly inflows of $1.8 billion alone, with the $2.4 billion added by Wednesday reduced following $640.3 million worth of net outflows on Thursday and Friday, according to data compiled by The Block.

Meanwhile, Ethereum-based investment products seem to have broken their “negative funk,” registering net inflows of $646 million globally for the week — 5% of AUM — likely due to a combination of Justin Drake’s Beam Chain network upgrade proposal and recent U.S. elections, Butterfill said.

The U.S. spot Ethereum ETFs accounted for $515.3 million of those net weekly inflows — the largest since they began trading in July.

Bitcoin consolidating above $90,000

Bitcoin is currently changing hands for $90,535, according to The Block’s Bitcoin Price Page — trading flat during the past 24 hours and up around 12% over the last week.

“Bitcoin is consolidating above $90,000, a bullish indicator as bearish forces have failed to trigger even minor corrections,” BRN analyst Valentin Fournier said earlier today. “This resilience persists despite a 40% rally since Trump's election. Technical indicators suggest ongoing accumulation and potential for a breakout, with no immediate signs of reversal.”

Meanwhile, analysts at Bernstein outlined five key catalysts for bitcoin to reach their 2025 price target of $200,000 in a note to clients on Monday. These include progress on establishing a bitcoin strategic reserve, a new potential crypto-friendly Securities and Exchange Commission Chair and an improved crypto regulatory environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report