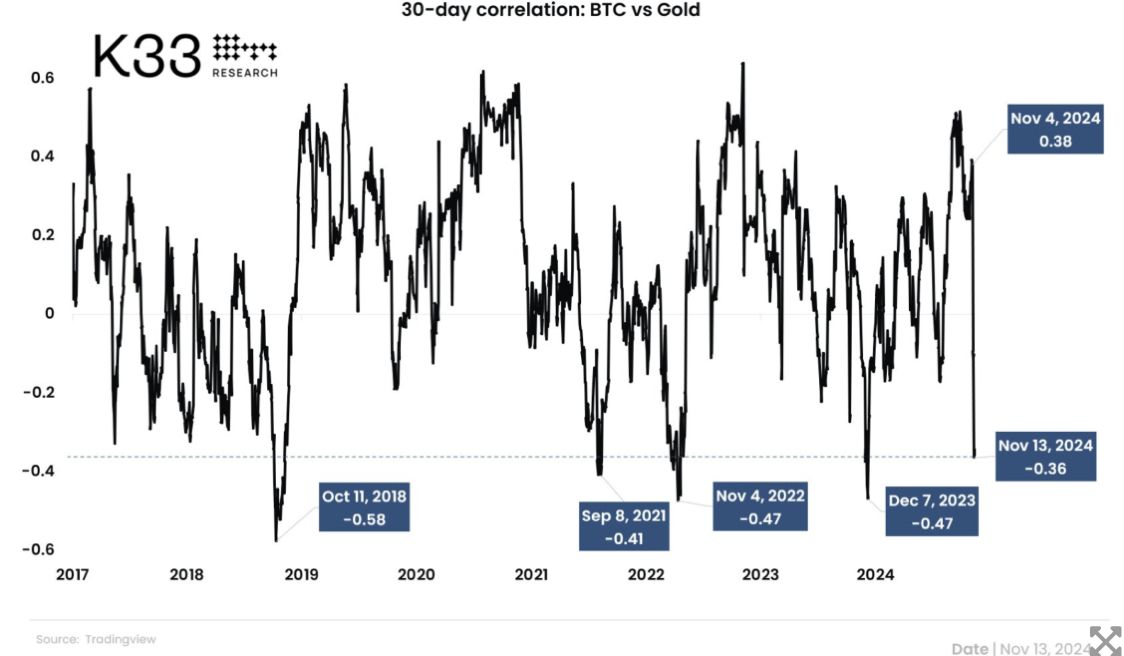

Bitcoin’s Correlation With Gold Hits 11-Month Low

Since the recent US presidential election, gold has fallen by around 5%, while Bitcoin has risen by over 20%, indicating a marked change in the relationship between these two assets.

Analysts believe that capital may move from traditional safe assets such as gold to BTC as investors reassess their strategies in uncertain economic times.

Analysts at QCP Capital say Bitcoin , often referred to as “digital gold“, is increasingly attracting capital that could traditionally flow into gold, signaling a structural shift toward digital assets as alternative safe havens.

With a market capitalization of about $1.73 trillion, Bitcoin recently surpassed the total value of silver, but still lags far behind gold, which has a market valuation of $17.5 trillion. However, QCP Capital analysts believe that a small change – such as shifting just 1% of gold’s capital to Bitcoin – could boost the cryptocurrency’s price to nearly $97,000.

READ MORE:

MicroStrategy’s Bitcoin Bet Faces Potential Risk Amid Recession ConcernsIn parallel, head ofresearchat K33 Vetle Lunde pointed out that Bitcoin’s correlation with gold has fallen to an 11-month low, supporting the idea that BTC is establishing a standalone position in the market. The thirty-day correlation between the two assets has also reached a similar low, illustrating this divergence in performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Experts Anticipate a Surge for SUI Cryptocurrency Based on Positive Indicators

In Brief SUI cryptocurrency shows optimism through positive technical indicators. Experts believe SUI is poised for a potential upward movement. Institutional predictions suggest significant price levels could be reached for SUI.

Massive OM Token Burn Sparks Investor Debate and Market Tension

In Brief Mullin announced a significant burn of 300 million OM tokens to reduce supply. Investor confidence is shaken as whale movements raise concerns about potential sell-offs. Market sentiment remains crucial as analysts call for additional measures for recovery.

Who is Patrice Evra, French football legend, set to speak at Token 2049 Dubai?

Elon Musk Takes Dig at Crypto Scammers Posing as “Hot Girls”