Bitcoin Miners Discuss Ways To Stay Efficient As BTC Reaches All-Time Highs

Bitcoin miners are taking steps to ensure operations continue to be efficient as the price of Bitcoin (BTC) surges.

Nick Hansen, CEO and Co-Founder of Luxor Technology, told Cryptonews that although Bitcoin price action is relatively positive at the moment, this hasn’t necessarily reflected in the mining sector.

This is because mining economics are influenced by multiple factors beyond Bitcoin price. Hansen pointed out that a more relevant metric to focus on in this case is hash price.

Bitcoin’s hash price quantifies how much a miner can expect to earn from a specific quantity of computational power. Unfortunately, Bitcoin’s hash price – which measures the revenue miners earn per terahash per second – remains conspicuously low.

When writing, the Bitcoin Hashprice Index shows the hash price to be around $56.

Hansen elaborated that the hash price takes Bitcoin’s price into account but also includes mining difficulty and the number of transaction fees miners collect.

“Over the past 3 months, hash price has ranged between $40-$50 on a per Petahash (PH) per day basis,” he said. “Compare this to one year ago – before the most recent 2024 halving price was around $80, twice as high.”

According to Hansen, this shows that mining economics have been relatively challenging, even though Bitcoin price has been moving upward.

Bitdeer Looks Past BTC Price Sentiment

Jeff LeBerge, Head of Capital Markets and Strategic Initiatives at Bitdeer Technologies Group (NASDAQ: BTDR), told Cryptonews that new highs for Bitcoin are definitely a reprieve.

“This is because heightened profitability typically incentivizes additional hash rate to come online,” LeBerge said. “Either new rigs or older less efficient rigs that were previously unprofitable can now turn back on. As the industry continues toward commoditization, efficiency will become increasingly important during this next cycle.”

LeBerge explained that one way Bitdeer will continue to stay efficient is through manufacturing proprietary ASIC mining rigs .

“We have approximately 3.7 EH/s (one exahash) hashrate of our SEALMINER A1 machines expected to be delivered to our Texas and Norway facilities by January 2025 for self-mining,” LeBerge said. “Our SEALMINER A2 rigs, with an efficiency of 16.5 J/TH, rigs are expected to generate approximately 18 EH/s hashrate, for sales to external customers and self mining ahead of the bull market.”

LeBerge added that Bitdeer’s business model is crafted to thrive irrespective of BTC price sentiment. Indeed, focusing on ASIC technology already benefits the publicly traded mining firm.

According to Bitdeer’s October 2024 Production and Operations update , the company is discussing with several potential customers. The report notes that “early demand is promising, indicating strong interest in our cutting-edge technology and the industry’s desire for technology and supply chain diversification.”

Riot Platforms Gears Up For Expansion

Bitcoin mining firm Riot Platforms, Inc. (NASDAQ: RIOT) still plans to expand its operations despite the low Bitcoin hash price.

A Riot Spokesperson told Cryptonews that the rise in Bitcoin prices has actually expanded the firm’s profit margins .

Riot recently reported a 65% year-over-year revenue increase in the third quarter of the year . This demonstrates resilience despite the hurdles currently facing Bitcoin miners.

Riot’s Spokesperson further shared that the company will continue expanding its pipeline of infrastructure with power capacity. They remarked that Riot has initiated the Phase 2 development of its Corsicana facility. This will add 600 megawatts (MW) of power, increasing the site to 1 gigawatt (GW) of total capacity.

In addition, Riot has been working to expand capacity to over 300 MW at its recently acquired facilities in Kentucky.

“In addition to these publicly stated growth plans, we continuously evaluate various organic and inorganic growth opportunities. All of this growth supports Riot’s long-term strategic target of reaching 100 exahashes per second (EH/s) in self-mining hash rate,” the Spokesperson noted.

Core Scientific Consolidates Bitcoin Mining and HPC Operations

Core Scientific—one of the most successful Bitcoin miners that also hosts high-performance computing (HPC) data centers— is taking steps to remain efficient.

A Core Scientific Spokesperson told Cryptonews that the mining firm is currently focused on consolidating its Bitcoin mining and HPC data operations. Core Scientific operates nearly 20 EH/s of self-mining hash rate and mines approximately 10 to 12 BTC per day.

According to the Spokesperson, Core Scientific is in the process of consolidating its Bitcoin mining operations at two sites. One of these is located in Pecos, Texas, where the miner recently commissioned 100 MW of new capacity. Another site at a non-disclosed location will also also be consolidated.

“We are planning to allocate a total of 400 MW of infrastructure to our Bitcoin mining operation and approximately 800 MW to our high-performance computing hosting operation, in which we recently contracted approximately 700 gross MW for cumulative, 12-year revenue of $8.7 billion,” the Spokesperson said.

The Spokesperson added that Core Scientific is the first commercial customer for Block’s new 3-nanometer ASIC chip .

“We expect to begin receiving the chips in the second half of 2025, at which point we intend to deploy them to refresh our fleet, improving energy efficiency and boosting our hashrate,” the Spokesperson remarked.

Challenges Moving Forward

Hashprice aside, Bitcoin miners located in the United States still face key challenges.

For instance, Riot’s Spokesperson pointed out that key efforts are still needed to build support among U.S. policymakers. To advance this, the Spokesperson noted that Riot’s Public Policy team is actively engaging in conversations with regulators to secure a strong future for the mining industry.

Echoing this, the Core Scientific Spokesperson noted that regulatory clarity is critical for ensuring the future of Bitcoin mining. They added that access to capital to fund infrastructure expansion and miner acquisition is also needed, especially with the ongoing competition for energy with AI compute companies.

Yet Core Scientific remains hopeful that Bitcoin mining will flourish under the new Trump administration .

“President-elect Trump has indicated his support for Bitcoin and for domestic energy production, which bode well for the entire industry,” the Spokesperson said. “Preliminary results from Senate and Congressional races suggest the strongest support yet for the bitcoin industry in Washington, DC.”

- Dogecoin Price to $10 as Elon Musk Joins Trump Administration, Who’s Next from Crypto?

- Bhutan Reaches $1 Billion in Bitcoin Holdings

- $7 Billion Influx Fuels Bullish XRP Price Breakout – Could It Reach a New All-Time High Soon?

- 13 Million XRP Burned, Analyst Predicts $6.4 Target as Scarcity Rises

- Dogecoin Price Forecast: Can DOGE Hit $3 with Golden Cross on the Horizon? Analyst Weighs In

- Best Crypto Wallets

- Best Crypto to Buy Now

- Best Crypto Presales to Invest In

- Best New Meme Coins to Buy

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

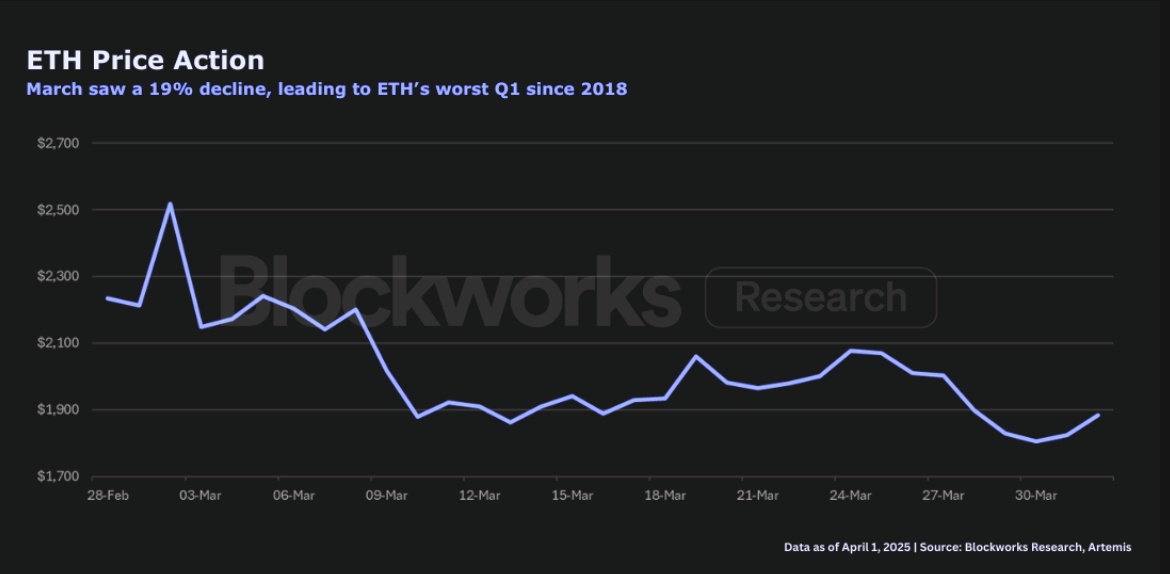

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far