US Bitcoin Reserve: World On Precipice of BTC Arms Race

Trump Bitcoin policy is fuelling explosive market growth, but how real are the prospects of a US Bitcoin reserve and Global BTC arms race.

Taking profits before the US Bitcoin reserve is established is peak “WTF are you even doing?”

If US President-elect Donald Trump keeps his promises, he will establish a BTC national reserve , remove much of the regulatory red tape surrounding crypto, and possibly eliminate capital gains associated with crypto.

This event would trigger a global race entry into Bitcoin , causing a super cycle and hyperbitcoinization. You have until Trump takes office to stack.

Many nations will use bitcoin as reserves, and other crypto currencies too. https://t.co/d9ZbXYpstq

— CZ 🔶 BNB (@cz_binance) November 12, 2024

The Bitcoin Reserve: A Strategic Asset?

We are going to the BTC future. By the way, we were always going to use blockchain and digital currency, but Trump’s vision is much better than the other version we were going to get under Kamala Harris.

Senator Cynthia Lummis, with her Bitcoin Act, is leading the charge. She aims for a strategic reserve to steady the economy during storms. As this concept picks up steam, the possible effects and hurdles demand attention.

A US Bitcoin reserve would act similarly to the Strategic Petroleum Reserve, stepping in as a financial lifeline when the economy hits a snag. Stockpiling Bitcoin could enable Uncle Sam to dodge inflation and market swings, tapping into Bitcoin’s appeal as a decentralized, scarce asset. Advocates see Bitcoin mirroring gold’s ascent, casting it as a modern-day strategic asset.

Senator Cynthia Lummis champions this vision, stating, “WE ARE GOING TO BUILD A STRATEGIC BITCOIN RESERVE,” highlighting her commitment to integrating Bitcoin into national economic strategy.

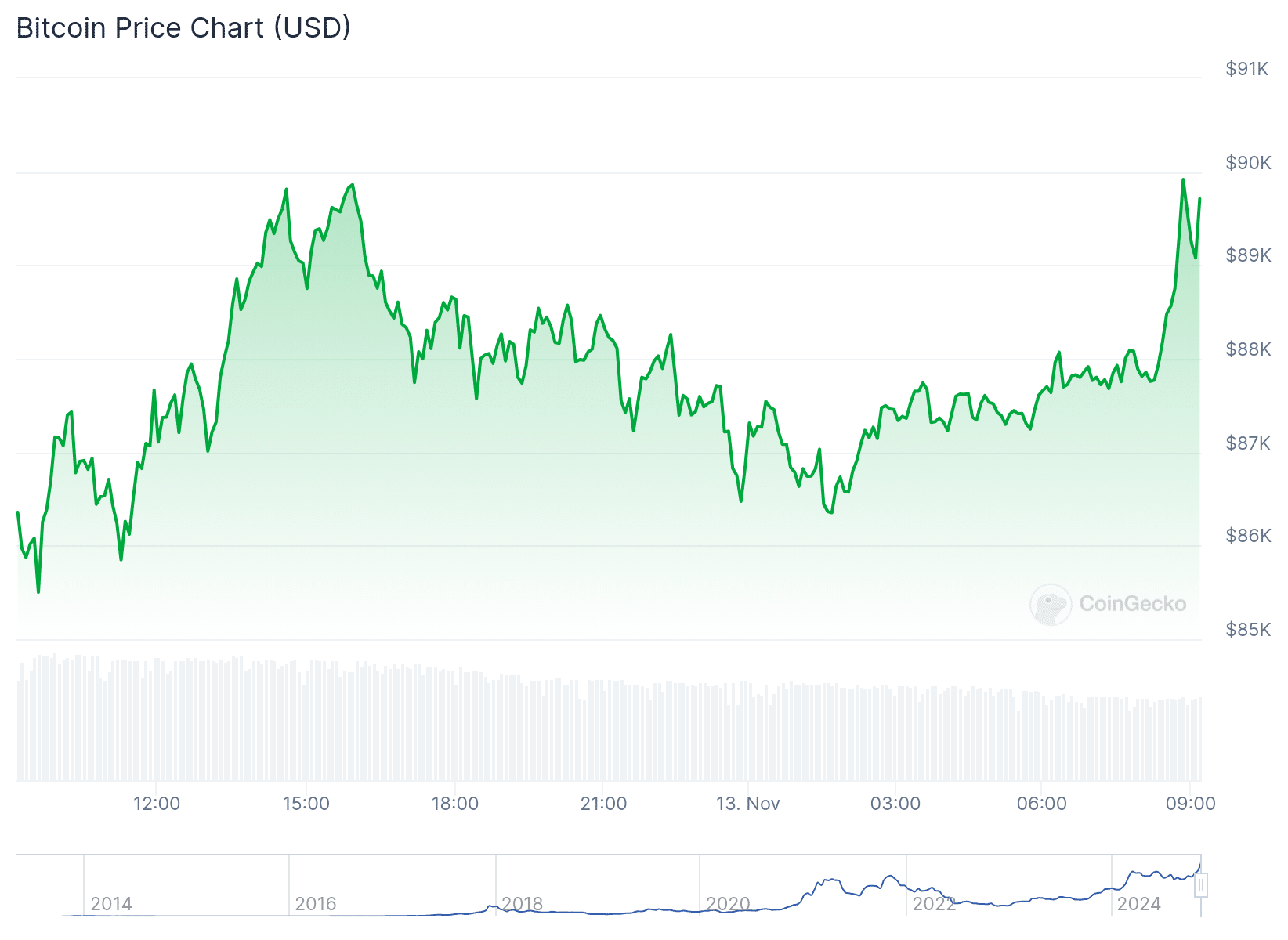

( CoinGecko )

( CoinGecko )

It goes without saying that we at 99Bitcoins are highly bullish. It’s not that complicated. Other countries will have to keep up.

BTC will go ballistic.

DON’T MISS: These Meme Coins Could Produce 1000X Gains In The Next Year

US Bitcoin Reserve Implementation Challenges and Criticisms

Despite the enthusiasm, the path to establishing a Bitcoin reserve is challenging. Critics question Bitcoin’s role as a strategic asset, likening its stockpiling to consumer goods rather than essential commodities like oil. Volatility of BTC doesn’t help. We were at $15,000 only two years ago. (Mad you didn’t buy back then, huh?)

But hey, Donald Trump did create a new government task force called DOGE —crazy times.

Moreover, the logistics of acquiring up to 1 million BTC over five years, as outlined in Lummis’s Bitcoin Act, pose significant hurdles. Funding this ambitious plan through reallocating Federal Reserve assets without increasing national debt remains a contentious point among skeptics.

#Bitcoin , crypto, and blockchain will likely go down as the biggest example of popular delusions and the madness of crowds in world history. The overall losses when the bubble finally pops will be staggering. It's not just the speculators who will be left holding a bag of…

— Peter Schiff (@PeterSchiff) November 11, 2024

If implemented, a Bitcoin reserve could signal a paradigm shift and bolster investor confidence in Bitcoin, reinforcing its status as a viable hedge against economic instability.

Barbara Goodstein of R360 notes the potential for Bitcoin to “augment” gold as a strategic reserve asset, reflecting growing investor optimism and the shifting sentiment towards Bitcoin as a key financial instrument.

The recent Bitcoin rally, which touched $90,000 , highlights BTC’s increasing allure and ties into fresh debates over its strategic role. As Bitcoin ETFs attract substantial inflows, this drive could anchor Bitcoin firmly in institutional portfolios, putting pressure on classic safe havens like gold.

DON’T MISS: Trumps Election Could Trigger These Cryptocurrencies To Explode

A Final Thought On Trump’s Bitcoin Plans

The proposal for a US Bitcoin reserve opens a broader debate about the role of cryptocurrencies in national and global finance. On the one hand, it presents an opportunity for the US to lead in digital asset integration, potentially reshaping economic frameworks. Conversely, it raises concerns about such a move’s volatility and regulatory implications.

If you’re thinking, “Wait, was I actually early when we bought in 2024 and posted frog memes?” Yes. Yes, you were.

EXPLORE: Italy Scales Back Crypto Tax Hike, Proposing 28% Capital Gains Levy

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Experts Anticipate a Surge for SUI Cryptocurrency Based on Positive Indicators

In Brief SUI cryptocurrency shows optimism through positive technical indicators. Experts believe SUI is poised for a potential upward movement. Institutional predictions suggest significant price levels could be reached for SUI.

Massive OM Token Burn Sparks Investor Debate and Market Tension

In Brief Mullin announced a significant burn of 300 million OM tokens to reduce supply. Investor confidence is shaken as whale movements raise concerns about potential sell-offs. Market sentiment remains crucial as analysts call for additional measures for recovery.

Who is Patrice Evra, French football legend, set to speak at Token 2049 Dubai?

Elon Musk Takes Dig at Crypto Scammers Posing as “Hot Girls”