MSTR Stock Soars 30%, Reaching New High After Bitcoin Boost

MicroStrategy’s stock (MSTR) has surged approximately 30%, reaching a new all-time high above $351 over the past five days. This significant increase is closely linked to the company’s recent substantial Bitcoin acquisition and the cryptocurrency’s own price surge.

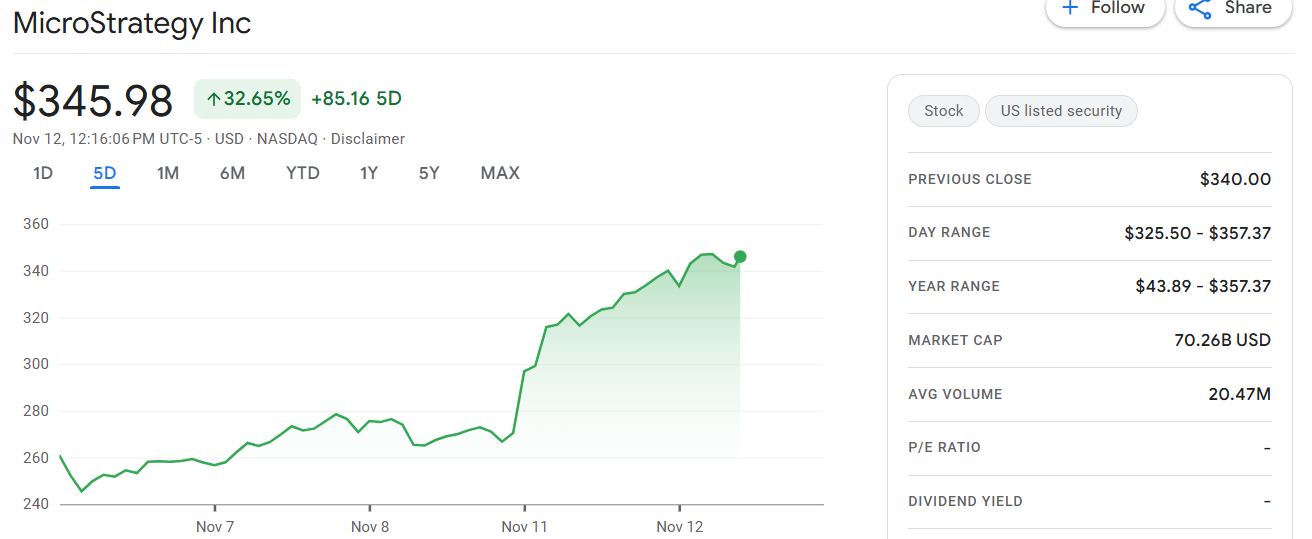

At the time of writing, the stock price of MicroStrategy has reached $345.98. The company has a market capitalization of approximately $70.26 billion, with about 202.64 million shares outstanding. The average daily trading volume over the past 30 days is 20.47 million shares.

MSTR Stock Soars 30%, Source: Google

MSTR Stock Soars 30%, Source: Google

Between October 31 and November 10, 2024, MicroStrategy purchased 27,200 Bitcoins for about $2 billion , bringing its total holdings to 279,420 BTC, valued at approximately $24.3 billion.

Bitcoin’s price has recently reached new highs, surpassing $89,000 . This rally has positively impacted companies with significant Bitcoin holdings, like MicroStrategy.

MicroStrategy announced a three-year plan to invest $42 billion in Bitcoin through capital raises, reinforcing its commitment to Bitcoin as a treasury reserve asset.

MicroStrategy President and CEO Phong Le stated last month, “Our focus remains to increase the value generated to our shareholders by leveraging the digital transformation of capital. As a Bitcoin treasury company, we plan to use the additional capital to buy more Bitcoin as a treasury reserve asset.”

MicroStrategy’s premium to net asset value has reached a historic 2.8x, underscoring its position as a favored Bitcoin proxy even as Bitcoin ETFs attract inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst: Indicators suggest Bitcoin may be about to pull back

Pump DEX’s 24-hour trading volume is $777 million, surpassing Raydium to rank second