Bitcoin futures basis yields at multi-month highs may signal potential leverage unwind risk: analysts

Bitcoin futures basis yields have surged to 7-month highs, raising concerns over market leverage, QCP Capital analysts say.However, the analysts noted strong demand for high-strike call options, signaling investors’ anticipation of further breakout potential.

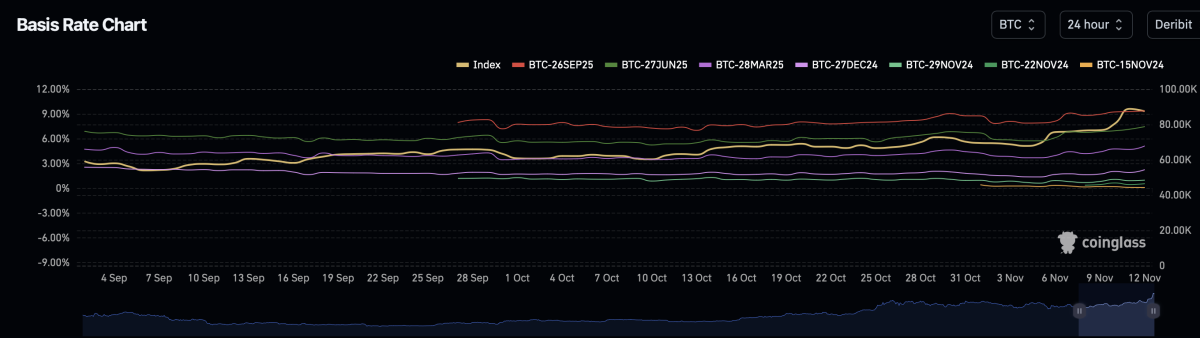

Bitcoin futures basis yields are at seven-month highs, signaling an elevated premium for holding futures relative to spot prices. This suggests a strong bullish sentiment, with traders paying a premium to go long on bitcoin. However, elevated basis yields can also indicate a highly leveraged market , which some analysts warn could be vulnerable to a correction if leverage unwinds.

"Perp funding is very elevated and basis yields are at 7-month highs. While we remain structurally bullish, we are cautious of any pullbacks, especially from leveraged washouts, as historically, such spikes in basis yields have not lasted very long," QCP Capital analysts said. They also noted that with bitcoin hovering just below the critical $90,000 level, the end-November basis has surged past 18%.

Bitcoin futures basis rate on Deribit has increased steadily over the past month. Image: Deribit.

Bitcoin options traders position for potential further upside

Although The QCP Capital analysts caution about the potential for a pull-back if prices turn against leveraged longs, they highlighted strong demand in the options market, with significant interest in call options at $110,000 and $120,000 strike prices. "This trend points to heightened demand for margin and leverage as investors position for further breakout potential," the analysts said.

Swarm Markets co-founder Philipp Pieper said that the recent bitcoin rally is largely a result of capital that has been sitting on the sidelines waiting for the result of the U.S. election . "This could lead to some profit taking in the medium-term which will cause price volatility, as market ebullience is never a permanent state," Pieper told The Block.

The GMCI 30 , which represents the top 30 cryptocurrencies by market cap, is up 10.2% to 165.33. Bitcoin is now sitting at around $87,165. Ether climbed 4% to trade at $3,306, and dogecoin surged 35% to $0.39 , according to The Block's Prices Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MANTRA Co-Creation: OM token destruction plan will be announced soon

End to Bitcoin’s Price Volatility: Are ETFs the New Stable Investors?

Exploring the Impact of ETFs Buoying Bitcoin and Potential for an $80K Breakout amidst Reduced Market Volatility