RESEARCH: Implied volatility of major maturities rises slightly in last two days as options market diverges

Bitcoin is on a roll, hitting $90,000 today, which seemed like a distant goal a month ago, but now $100,000 is within reach, according to a post by Adam, Macro Researcher at Greeks.live, on the X platform. Implied volatility has risen slightly across all major maturities in the last two days, fuelled by the big market, with short-term IVs rising significantly, but still quite low compared to the election period. Looking at the options market, the market is clearly divided and trading is very fragmented, with some of the big players going long towards the sky, while more traders are currently in a short position.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

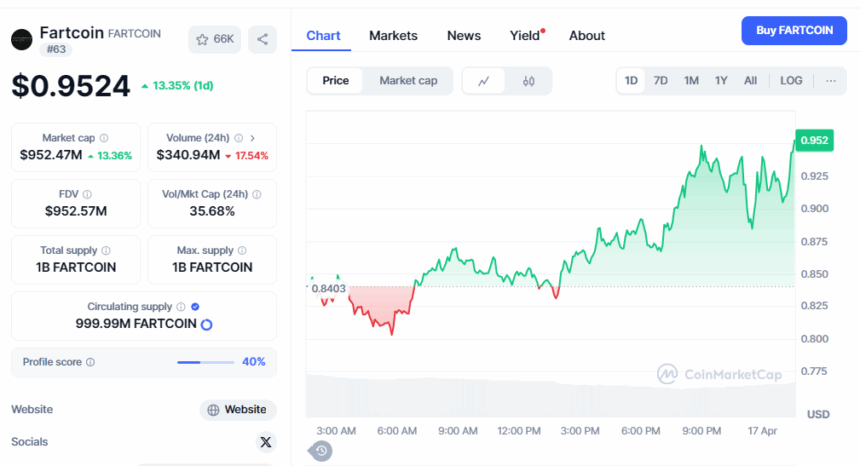

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?