Bitcoin nears $90K, stages best weekly return since US banking crisis

Bitcoin’s rally shows no signs of slowing as it edges toward $90,000 in what is shaping up to be its best weekly run since the United States banking crisis in 2023.

The Bitcoin ( BTC ) price surpassed the $85,000 record high on Nov. 11, but just as a temporary pit stop. The world’s first cryptocurrency is trading at $88,879 as of 8:14 am UTC, up over 29% during the past week, Cointelegraph data shows.

BTC/USD, 1-month chart. Source: Cointelegraph

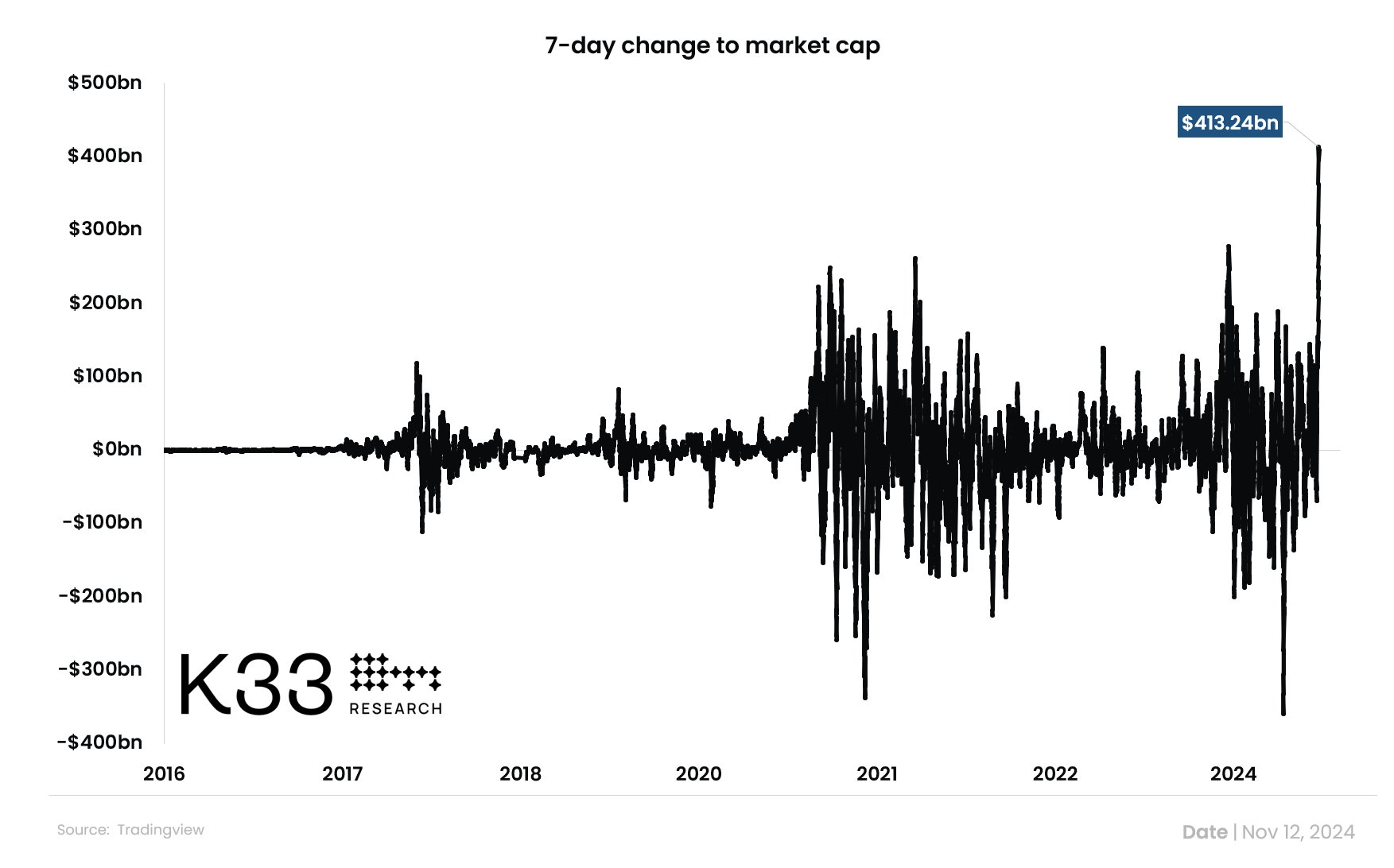

The nearly 30% weekly return marks Bitcoin’s best seven-day period since the US banking crisis in 2023, according to Vetle Lunde, the head of research at K33 Research, who wrote in a Nov. 12 X post :

“Bitcoin has seen its best 7-day return since the U.S. banking crisis on March 18, 2023. Bitcoin's market cap has grown by a staggering $413bn in the past week!”

BTC, seven-day market cap change. Source: Vetle Lunde

The March 2023 banking crisis brought the sudden collapse of Silicon Valley Bank and the voluntary liquidation of Silvergate Bank . Signature Bank was also forced to close operations by New York regulators on March 12, two days after Silvergate Bank’s liquidation.

This turmoil was a catalyst for Bitcoin’s bull run last year , according to BitMEX co-founder and former CEO Arthur Hayes.

Related: 63 US banks on the brink of insolvency: Why Bitcoin’s next target is $100K

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Gains Edge in ETF Race Over SOL and DOGE, Says Kaiko

Strive Pushes Intuit to Add Bitcoin to Treasury

Strive urges Intuit to hold Bitcoin in its treasury to hedge against AI-driven disruption risks.Bitcoin as a Hedge Against AI Disruption?Why Bitcoin, and Why Now?BTC in the Boardroom

JP Morgan Predicts Imminent Interest Rate Cuts

JP Morgan forecasts upcoming rate cuts, signaling a major shift in U.S. economic policy that could impact markets and crypto alike.JP Morgan Signals Upcoming Interest Rate CutsWhy Rate Cuts Matter for MarketsCrypto Could See Renewed Interest

Raydium launches Launch Lab, a token issuance platform