Mt. Gox-linked cold wallet moves over $2 billion worth of bitcoin to new address: Arkham

Quick Take A cold wallet that received 30,371 BTC from Mt. Gox last week sent $2.24 billion worth of bitcoin to a new wallet on Sunday. Mass bitcoin movements seen in Mt. Gox and related wallets typically precede creditor repayments.

Defunct crypto exchange Mt. Gox has sent over $2 billion worth of bitcoin to two addresses on Sunday, possibly signaling the next round of creditor repayments.

At 11:39 p.m. on Sunday, UTC, a wallet marked “1FG2C…Rveoy” sent around 27,871 BTC ($2.24 billion) to a new wallet named “1Fhod…QLFRT,” and 2,500 BTC ($200 million) to Mt. Gox’s cold wallet, according to data from Arkham Intelligence. The sender wallet had received the combined 30,371 BTC from Mt. Gox six days ago.

The recent string of movements in Mt. Gox’s remaining bitcoin started at the end of October, after a hiatus of over a month.

While it is unclear whether Monday’s transfer is part of Mt. Gox’s future distributions to creditors, such movements in the past have preceded repayments via centralized exchanges including Bitstamp and Kraken. Mt. Gox currently holds 44,378 bitcoin, Arkham data shows.

Mt. Gox, founded in 2010, operated the largest bitcoin exchange in the world until the platform suffered a major security breach in 2014, causing the loss of at least 850,000 BTC. Thousands of creditors have been waiting to have their bitcoin returned, a process that has been unfolding over the past few months.

Last month, the defunct exchange pushed back its repayment deadline from Oct. 31, 2024, to Oct. 31, 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

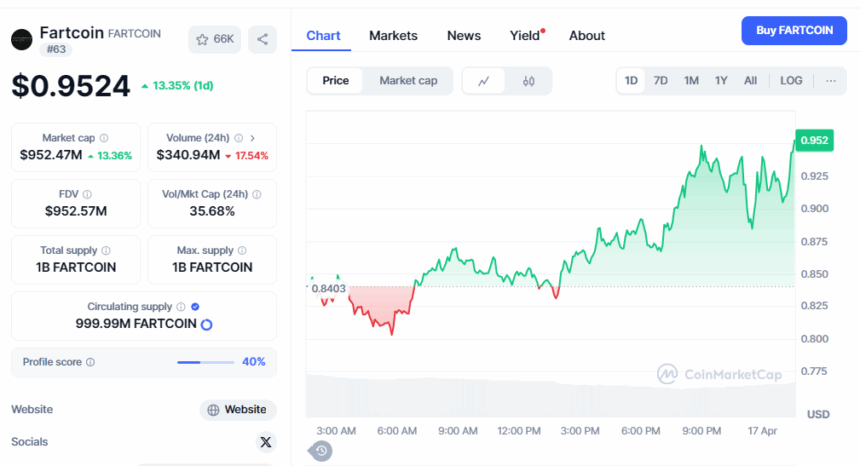

Fartcoin Pumps More 12% As Whales Keep Buying; Can it Break $1 by Sunday?

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Bitcoin Slips Below Trendline—Can $82.8K Hold the Line?

Bitcoin’s Bull Score Index Hits 58 Days Below 50: What’s Next?