OpenSea users drop securities lawsuit after market demands arbitration

On November 7th, Anthony Shnayderman and Itai Bronshtein submitted a voluntary request to withdraw their securities lawsuit against Ozone Networks (operating under the name OpenSea) to the federal court in Florida. Previously, Judge Cecilia Altonaga allowed OpenSea to file a motion last month to force these two individuals to engage in arbitration.

OpenSea insisted on forcing these two users to engage in arbitration and claimed in a document in October that they agreed to its terms of use, which stated that all claims would be resolved by an arbitrator - including whether the claims should be arbitrated in the first place.

In the October document, the NFT market also stated that it "intends to act quickly to compel the plaintiffs to arbitrate their claims in the agreed-upon forum" and will appeal any dismissal by the court to suspend the case.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

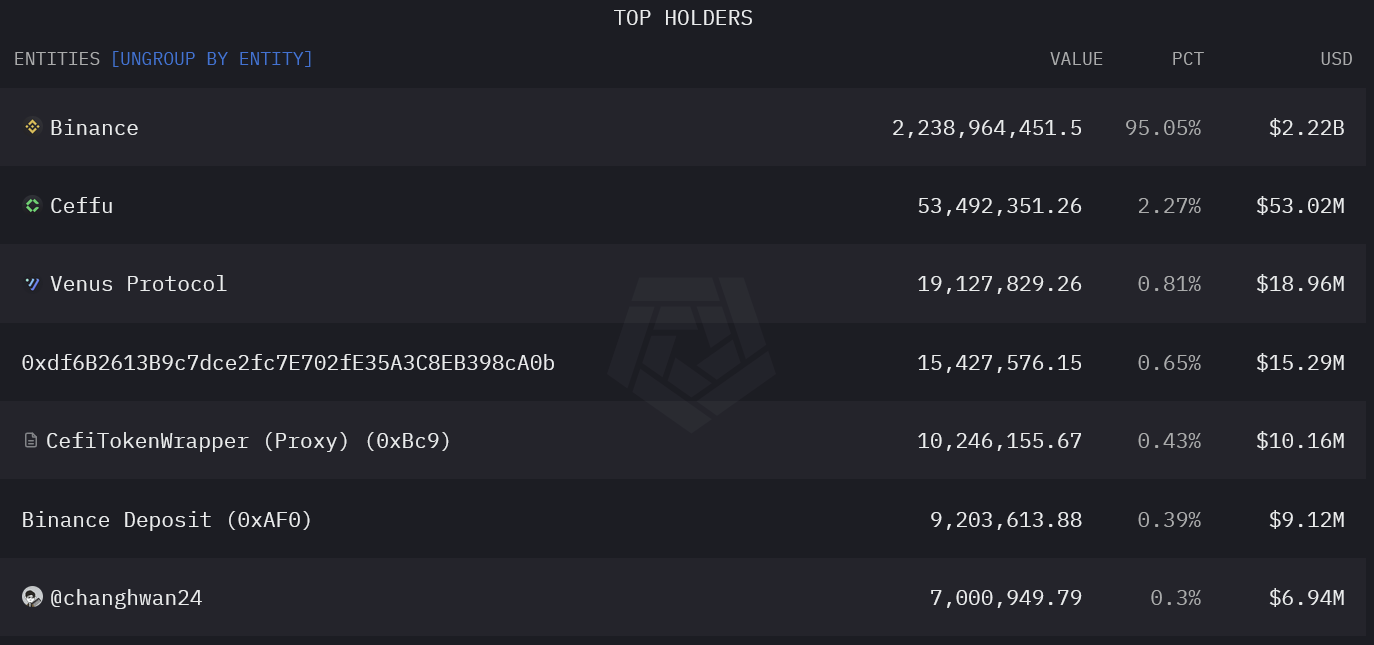

Justin Sun’s allegations of FDUSD insolvency cause 9% depeg

The Binance-affiliated stablecoin lost about $200M of market capitalization

Trump's tariffs hit US stocks hard, Nasdaq plunged more than 1,000 points

Global stocks pay for Trump's tariff plan, with U.S. stocks performing worst since September 2022