Qiming Venture Partners Larry Liu's In-Depth Analysis of Cryptocurrency Payments (Part 3): Innovation Trends and Ideal Scenarios

Cryptographic payment, the last and also the final big event.

Original Link: ++《The Last Big Thing - Crypto Payment Part3》++

Original Author: Larry Liu, Qiming Venture Partners

Compiler: Scof, ChainCatcher

Editor: flowie, ChainCatcher

Editor's Note: Crypto payments are one of the hottest sectors recently. In addition to Stripe's acquisition of the stablecoin payment startup Bridge for $1.1 billion, creating the largest acquisition in crypto history, many mainstream financial institutions have begun to accelerate their layout in crypto payments:

- PayPal completed its first commercial payment using the stablecoin PYUSD.

- Visa launched the tokenized asset platform VTAP to help banks issue fiat-backed tokens.

- BlackRock partnered with Ethena to launch a new stablecoin supported by BlackRock BUIDL.

- Coinbase and A16Z jointly invested in the AI crypto payment company Skyfire.

- ……

Crypto payments are also experiencing a financing boom. As seen in the crypto payment financing statistics article published by ChainCatcher in September, recent financing in crypto payments has attracted major players from various fields, including payments, stablecoins, and traditional finance. Visa, Tether, Circle, JPMorgan, and Standard Chartered are all rushing to enter the market, while top-tier capital such as Sequoia Capital, Temasek, and A16Z are also placing their bets.

Recently, well-known investment fund Qiming Venture Partners investor Larry Liu released a lengthy series of articles titled "The Last Big Thing - Crypto Payments," systematically discussing the future of crypto payments from the perspectives of payment history transformation, the current state of crypto payments, and trends. ChainCatcher has compiled this.

The first article of the series, ++Part One++ , explores the origins of credit card payment history to modern digital transformation, providing a panoramic view of traditional payment systems. ++Part Two++ discusses the unique advantages of blockchain technology in payments and assesses the current state and challenges faced by crypto payments.

This is the final part, analyzing emerging trends and innovative solutions that can overcome existing barriers in payments. The author states that the rise of non-custodial payment solutions and the integrated development of payments with DeFi may fundamentally reshape the way value is transferred in the cryptocurrency era.

4. Trends

4.1 The Rise of Non-Custodial Solutions

In the past two years, many innovative account designs have emerged, gradually overcoming previous barriers. In the future, users will no longer need to convert cryptocurrencies into fiat in advance. Resource Lock

Resource Lock is a tool that helps users make credible commitments regarding account activities. It allows users to ensure that their accounts will not or will only under certain conditions perform certain actions. One of the most common applications is to prevent double spending, where users can credibly guarantee that the assets in their accounts will not be spent multiple times. This assurance allows service providers to continue executing subsequent operations even when transactions have not yet fully settled or been confirmed.

I borrowed this term from a research paper by Frontier, but its implementation has been widely used in the industry long before One Balance was launched.

Case 1 - StablesMoney

For example, StablesMoney (an Australian issuing institution) retains user funds on-chain until a payment occurs. Stables uses an MPC wallet, where the private key is split into three parts, managed by the user, StablesMoney, and Fireblocks (one of the largest custody service providers globally). When initiating a payment, StablesMoney assists in co-signing, initiating the transaction, and instantly confirming the transaction with the card organization. At the same time, they update the user's balance in their database before the transaction is finally confirmed on-chain. When the user initiates a subsequent transaction, Stables first compares the user's balance with its internal records, rejecting any attempts at double spending. In this setup, for a user to double spend, they would have to bypass StablesMoney and collude with Fireblocks in a very short time, which is highly unlikely to occur. However, this method is still centralized, and theoretically, StablesMoney and Fireblocks could collude to steal user funds.

Case 2 - Gnosis Pay

Gnosis Pay takes a different approach, prioritizing decentralization over efficiency. In the Gnosis Pay system, transactions are divided into card transactions and non-card transactions, with the latter typically initiated directly by users through wallets. Card transactions are confirmed instantly, while non-card transactions experience a delay—usually a three-minute waiting period, during which any previously initiated card transactions have typically been settled and notified to the relevant service providers. This design choice effectively reduces the risk of malicious double spending.

Gnosis Pay implements this method by adding a "delay module" developed by Zodiac on top of a standard SAFE account. This solution is clever and elegant but also highly customized, leading to some limitations in efficiency and flexibility. For example, if a user needs to quickly reallocate funds to prevent liquidation, a three-minute waiting time could have fatal consequences. Additionally, it is worth noting that this transaction processing method does not support all card transactions, such as complex cancellations or delayed refunds.

Resource locks can also be programmed to operate under specific conditions. For instance, in the cross-chain NFT purchase scenario mentioned by Frontier, locked funds can be claimed by any solver providing valid performance proof or returned to the user after a set expiration time. Today, the cross-chain transaction experience has significantly improved between L2 and high-speed chains, but through resource locks, waiting times can be minimized even in cases bridged from the mainnet. This example showcases the various applications of resource locks, which are not limited to payments or cross-chain transactions.

Source: Frontier Tech

Another implementation worth exploring is utilizing TEE (Trusted Execution Environment). In TEE, resource locks would be fully programmable and efficient. By combining decentralized networks and proof mechanisms, many concerns related to centralization and collusion can be alleviated. If implemented correctly, this approach could also achieve high security.

Resource locks may introduce additional trust assumptions, but if implemented properly, they have the potential to unlock many currently unfeasible use cases, significantly enhancing user experience. The greatest advantage of this concept is that it allows subsequent operations to proceed as if the previous operation has already been completed, thereby eliminating the friction that typically hinders user experience. As Frontier states, "It decouples performance from settlement."

For example, issuers can confirm that a transaction has been settled, and solvers can provide users with funds on the target chain as if the assets were already locked on the source chain.

Imagine a future where not only users but also solvers, market makers, and other service providers adopt a unified, interoperable resource lock standard. In such a scenario, the entire process—from initiating a transaction to routing, performance, and confirmation—could be completed instantaneously. This would ultimately lead to an instant, low-cost, and rich cryptocurrency usage experience, comparable to Web2.

Fast Confirmation

Another approach to addressing finality and delays is to achieve fast confirmation. One viable method is to develop high-performance, stable chains that can settle a large number of transactions in real-time. When transactions are completed within milliseconds, service providers and merchants receive definitive results immediately, making it difficult for even advanced attackers to double spend or exploit system vulnerabilities. Teams like MegaETH are actively working in this area.

Additionally, on mainnet or Rollup-based chains, if implemented well, pre-confirmation can achieve similar effects. Pre-confirmation allows L1 proposers to choose to enter a new supply branch, allocate part of the block space, and pre-commit to including certain transactions before constructing and broadcasting the complete block. Projects like Commit Boost, Luban, and Chainbound are working on designs and engineering to make this goal a reality.

Smart Contract Accounts

For the signing experience of payments, using crypto-native applications for payments is usually quite natural, as these applications typically have embedded wallets, and users sign transactions when they choose "pay now" or "transfer." However, for designers of non-custodial crypto debit cards, this becomes a challenge, as they must require users to explicitly approve transactions after swiping the card. Tangem is developing a product that combines hardware wallets and payment cards, but this approach requires customization of the card, thereby increasing costs.

Moreover, since the signature curve Secp256k1 used by most mainstream blockchains is not integrated or supported by most mobile manufacturers, the private keys of EOAs are usually managed at the software level rather than utilizing the secure enclaves used for key management on modern mobile devices. This presents additional risks for users of mobile payment applications.

As the demand for refined payment access control continues to grow, businesses may wish to grant employees access only during business trips and set specific spending limits; parents may want to allow their children to use cards for specific purposes under certain limits.

To address these needs, smart contract accounts are actively being developed by several startups. These accounts allow users to delegate balance deductions on behalf of others and specify details such as spending limits and time constraints.

Gas Payment

Abstracting gas fees from the user experience is crucial for making blockchain technology more accessible and user-friendly.

The content above can be summarized in the following chart:

Barriers to Non-Custodial Crypto Payments and Helping Components

4.2 Integration with DeFi Protocols

Users are increasingly inclined to seek payment products that seamlessly integrate with DeFi protocols, which can provide yield opportunities and complex asset management while being trustless.

Traditional payment systems, despite their complexity, essentially revolve around two basic instructions: debit and credit. As described in Holyheld's white paper:

"……There are numerous intermediaries between consumers and products, each executing, transmitting, or forwarding instructions. But at each step, it only involves reconciling the two instructions of debit and credit. These instructions cannot be programmed or enriched……"

To gain more asset management tools and opportunities, users are forced to rely on other institutions and third parties. Relying on these mutually isolated, independently maintained ledgers incurs significant costs and friction.

The emergence of DeFi aims to address these issues. Although DeFi is still in its early stages, it has already generated various on-chain yield opportunities, including:

- Staking and Restaking: Earning yields by helping to operate blockchains or protocols.

- LP Fees: Earning income by providing liquidity, especially in scenarios with high depth or immediacy requirements.

- RWA: Bringing on-chain funds into off-chain assets to earn yields.

- CeDefi: Redirecting on-chain funds to off-chain strategies to earn yields.

Additionally, we have seen the development of many automated tools, portfolios, derivatives, and strategies based on these protocols. The next logical step is to complete the last mile by integrating payment applications with DeFi protocols. This will enable users to seamlessly, trustlessly store, manage, and spend their assets in one account.

Case 1 - Etherfi

Etherfi recently partnered with Scroll to launch a "real" crypto credit card, perfectly aligning with this vision. Currently, Etherfi is best known for its liquidity re-staking protocol built on EigenLayer. However, with the launch of Cash, users will be able to use the Visa credit card issued by the platform to borrow and spend stablecoins against their staking positions. Debts can be automatically repaid through the interest generated by their staking. Etherfi also launched Liquid, which provides vaults with automated DeFi strategies. Users simply deposit their tokens, and the vault will allocate funds to DeFi positions in the background.

Case 2 - RoboSaver

In contrast, Onchainification Labs advocates a non-custodial approach. They released the alpha version of RoboSaver, a smart contract module that can be integrated into the Safe smart accounts behind each Gnosis Pay card. This module allows users to deposit idle balances into DeFi protocols like Balancer or Aura, where they can earn yield. When the card balance falls below a certain threshold, RoboSaver automatically withdraws assets from the pool to replenish the card balance. They have deployed contracts and conducted experiments, successfully triggering withdrawals when purchasing coffee.

Here are two products or features that I believe have tremendous potential:

- Allowing users to borrow and spend stablecoins against their staked/re-staked assets (as Etherfi Cash does):

Staking is the cornerstone of the crypto world, often seen as the risk-free interest rate of the crypto realm. It provides simplicity and predictable yields, attracting a large number of participants and substantial assets. Many stakers, especially large investors (whales), may need credit cards that can be used for everyday spending.

It sounds like a credit card, but it can be achieved by adding a liquidity pool between the user and the issuer. This way, the issuer does not need to use its own funds and can achieve instant settlement of funds.

Additionally, we can leverage existing lending protocols, such as AAVE or Compound. The Holyheld team has internally tested credit loans using wstETH (Lido) and AAVE's V3 delegation module. While the system operates normally, there is a significant limitation: AAVE's credit delegation only supports "0 or all" modes. This means that it is not possible to delegate only a portion of a position or a specific amount. Compound faces the same issue.

- Allowing users to hold and pay with (risk-free) yield-bearing assets:

Ironically, most crypto users—from small investors to most professional institutions—still lend their funds to Tether and Circle without receiving any returns. In a highly digital world, users should have more transparency and fairness rather than continue to be exploited by centralized entities. RWA, especially yield-bearing stablecoins, is poised for iteration on the existing foundation. The importance of risk-free, yield-bearing stablecoins cannot be underestimated, as bonds and treasury bills have long been the preferred investment tools in many parts of the world. These tools are highly standardized, easy to understand, and backed by sovereign nations. Many view USDT or USDC as digital substitutes for the dollar, primarily because they offer better inflation protection than their local fiat currencies. Naturally, these users also wish to earn risk-free interest on their held assets. However, the adoption of yield-bearing stablecoins remains low, which can be attributed to two main factors:

- On-chain challenges: The current yield-bearing token standards are difficult to integrate with existing systems, causing friction.

For a token to be considered a stablecoin, its value must remain stable, but the underlying yield-bearing assets, such as treasury bills and bonds, appreciate over time. To pass this appreciation on to users while maintaining the stablecoin's price stability, many yield-bearing stablecoins (like Mountain's USDM and Matrixport's STBT) adopt a rebase token model. This model proportionally adjusts the balances of all holders using a rebaseFactor to reflect the accumulated appreciation. Although this is a clever design, it has not received widespread support from DeFi protocols, wallets, and exchanges, which still primarily rely on the simple ERC-20 standard. Additionally, these protocols typically trigger the rebase process once a day, which may create arbitrage opportunities for traders and lead to price volatility, which many users do not wish to see. One possible solution is to smooth rewards by block, which helps to mitigate price fluctuations. However, this approach incurs significant gas fees, and the possibility of arbitrage still exists.

- Off-chain challenges: Issuing these types of assets may expose projects to significant legal risks, especially from the SEC, as they may be considered "unregistered securities."

This is why many of these projects explicitly exclude U.S. residents or citizens from using their services. These protocols often invest significant time and resources in developing legal frameworks to ensure that even if the protocol itself fails, users can still retrieve their assets (bankruptcy isolation). However, until new legislation is passed or any precedent-setting cases are adjudicated, the legal outlook for these projects remains uncertain.

Another key factor in establishing a widely adopted stablecoin system is the need to create a globally distributed banking support network. While onboarding is crucial, ensuring a smooth withdrawal process for merchants or institutions is even more critical. Tether achieves this through a distributor network, while Circle does so through compliance and strong relationships with major banks. New market participants will need to decide on their strategies. For RWA, obtaining deep liquidity, such as that provided by companies like BlackRock, may be crucial.

In the near future, payment systems will seamlessly integrate with the entire DeFi ecosystem. Individuals will be able to access various investment tools, management tools, and strategies in a unified account.

Moreover, digital currency payments will increasingly integrate with traditional financial systems. Currently, issuing banks are the first to adopt cryptocurrencies, as they manage the initial stages of fund flows and are downstream in the information flow. Once these issuing banks handle the conversion between cryptocurrencies and fiat, other participants, such as card organizations and acquiring banks, can operate without needing to know about the involvement of cryptocurrencies.

However, in the long run, we can expect cryptocurrencies to further integrate downstream in fund flows (i.e., upstream in information flows) due to their efficiency and low-cost advantages, reducing the need for conversions. We have already seen Visa and MasterCard actively exploring the integration of cryptocurrencies into their networks and traditional payment systems, marking a significant shift in the industry. Similarly, Stripe's recent move to allow stablecoin payments further emphasizes this trend.

As cryptocurrency adoption increases, more funds will remain on-chain for secure and convenient management, leveraging better yield opportunities, and will only convert to fiat when necessary.

5. Conclusion

5.1 What Should Crypto Payments Look Like?

While the specifics of the future remain uncertain, we can envision an ideal scenario based on current knowledge and trends.

In the future, the process of crypto payments should be as seamless and fast as today's digital payments. Users should only need to engage in brief interactions with merchants, similar to how we currently use QR codes, NFC, or biometric authentication. This simple interaction will allow merchants to recognize the user's abstract or smart account, supported by the foundational components discussed in section 3.2.1.

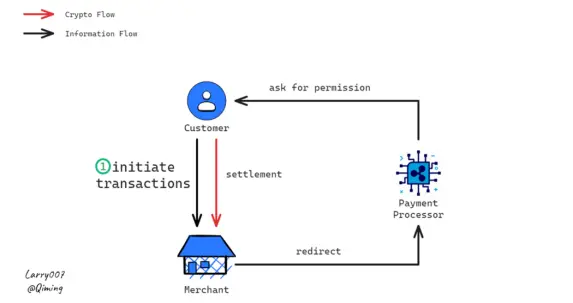

As one of the few intermediaries in this streamlined system, payment processors will handle a series of security checks for merchants and users. These checks may include identity verification, balance confirmation, anti-money laundering compliance, fraud detection, and access control. Once these checks are successfully completed, the payment request will be routed to the user's smart account.

This smart account can typically be used to store various assets, such as those related to staking, liquidity provision, RWA, CeDefi products, or other yield opportunities and their combinations. These assets will remain non-custodial, fully controlled by the user. Pre-authorization and access control will be defined and authorized through smart contracts, with gas fees typically borne by the application or service provider.

Ideal Crypto Payment Process Diagram

To ensure speed and security, the system can utilize resource locks, fast confirmations, or high-performance chains. This will enable payment processors or other service providers to confirm transactions instantly, thereby minimizing the risk of malicious activities. Merchants will receive immediate notifications of transaction completion status, while the actual settlement of funds can be instantaneous or occur later. Ultimately, the corresponding assets will be transferred to the merchant's account, completing the transaction.

5.2 Unification, Democratization, and De-Mediation

The Era of Payments

In summary of the entire article:

Card payments mark the beginning of the digitalization of financial transactions, utilizing computers and the internet for accounting and information transmission. As the payment industry grows and technology advances, the number of specialized intermediaries involved in the process has gradually increased. Digital payments further propel this digitalization process, making the payment process more efficient by leveraging emerging technologies and the widespread use of consumer internet, while also removing direct contact between customers and banks.

Blockchain and crypto payments further advance de-mediation, providing a system where users can control their assets and access a variety of composable yield opportunities and asset management tools. This technology offers a decentralized and permissionless network, allowing almost everyone globally to access digital assets and ownership. It provides all participants with a transparent and neutral environment where all parties can collaborate without needing to establish trust in advance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report