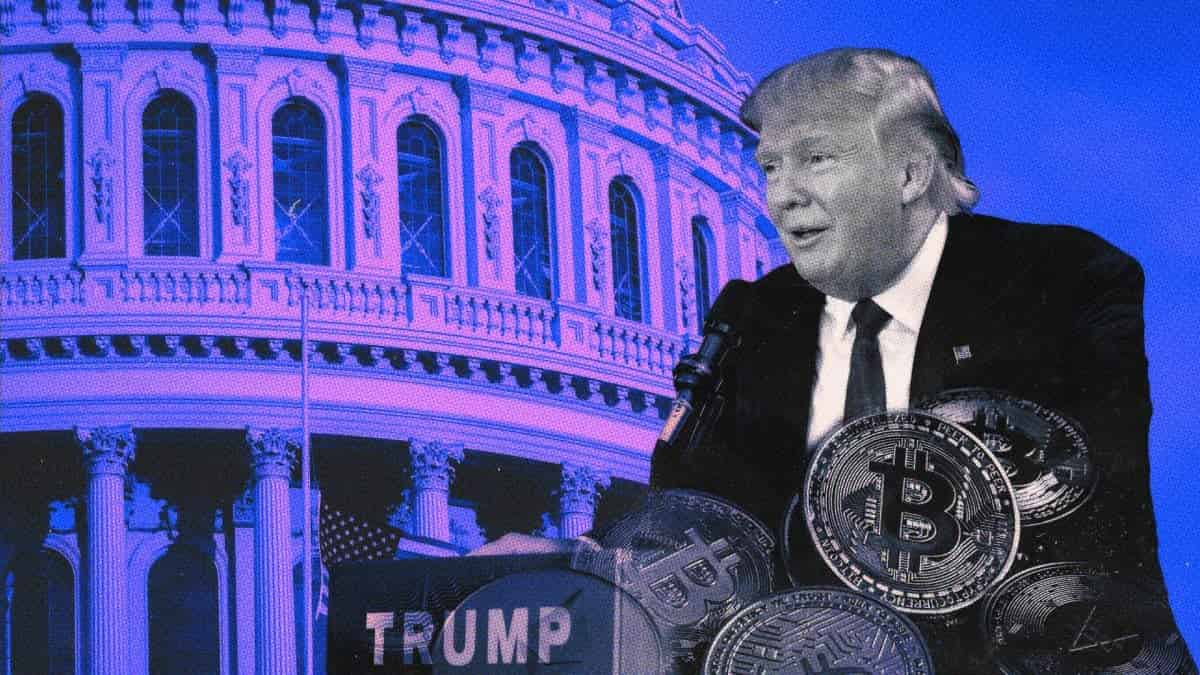

Rising odds of Republican election sweep could pave way for crypto bills, analysts say

Quick Take Rising Polymarket odds of a Republican sweep in next week’s U.S. elections could pave the way for passing a series of crypto-related bills, analysts at Presto said. However, others have questioned the reliability of prediction market platforms, given their divergence compared to traditional polling.

Alongside the widening lead for Donald Trump over Kamala Harris on Polymarket, odds of a Republican sweep on the decentralized predictions platform have also risen, increasing the chances of crypto-related bills passing in Congress, according to analysts at trading and financial services firm Presto.

Odds of a Republican President, Senate and House following next week’s elections have reached 48% on Polymarket, up from 28% at the beginning of the month.

This outcome would give the largely pro-crypto party greater control over legislation and the U.S. policy agenda, potentially resolving regulatory uncertainty that has held back the industry, Presto analysts Peter Chung and Min Jung argued on Tuesday.

Out of more than 50 proposed crypto bills , six — including “FIT21,” a crypto market structure bill that aims to regulate the industry at large — have passed the House and are now awaiting approval in the currently Democratic-controlled Senate.

The last GOP trifecta occurred during Trump’s first term, prior to his newfound pro-crypto stance, but it lasted only two years until Democrats regained the House in 2018, the analysts noted.

Trump currently leads Harris on Polymarket by odds of 66.1% to 33.8% to win the presidential election on Nov. 5, similar to the U.S.-regulated predictions market Kalshi’s odds of 63% to 37% in Trump’s favor.

The former President has also taken the lead in all six swing states on Polymarket, with the platform showing 83% odds of a Republican Senate, 51% odds of a Republican House and a 48% chance of a Republican sweep compared to 14% for the Democrats.

Meanwhile, the latest national polling averages continue to call a narrowing but close race, with numbers within the margin of error showing Harris leading Trump by 48% to 47%, according to analysts at research and brokerage firm Bernstein. They argued that traditional polls have historically underestimated Trump, suffering from outdated sampling techniques.

Should you rely on US election odds on Polymarket?

Polymarket has emerged as the largest offshore predictions market, with U.S. players like Kalshi rising in betting volumes and Robinhood even getting in on election contracts, Bernstein analysts led by Gautam Chhugani wrote in a note to clients on Tuesday.

Despite their increasing use, many have questioned the reliability of prediction market platforms, given their divergence from traditional polling. Last week, Polymarket claimed there was no evidence of market manipulation in U.S. election bets on the platform despite slippage issues, but concerns remain.

Polymarket has grown from 4,000 active bettors in January to just under 200,000, according to The Block’s data dashboard , with total monthly volume rising from around $54 million to $2 billion during that time. U.S. election markets have dominated, accounting for more than $3 billion in cumulative volume, Chhugani said.

However, the significant trading volume masks a relatively illiquid market, with open interest for U.S. election bets — the total value of outstanding positions on Polymarket — remaining low at around $200 million . This metric led analysts at Kaiko to recently suggest that Polymarket likely offers minimal predictive value for the U.S. election outcome.

While a small group of large investors can move the markets in a specific direction, Chhugani noted that the variation in the candidate leading during the campaign demonstrated there was no intrinsic Trump bias on the platform.

“What critics miss is that this is not play-money but real money with a specific predetermined time based outcome and bettors have real ‘skin in the game’ to simply trade to manipulate the markets. One group of investors can be easily countered by another group taking a contra bet, and some investors would be hurt in the process.

“Thus, our only counsel here is you cannot afford to ignore prediction market signals, just like you would not ignore what the capital markets are telling you,” he said.

Certain stocks and cryptocurrencies rise amid Trump’s lead

With only seven days until the election, certain stocks and cryptocurrencies are benefitting from Trump’s lead, according to Presto's Chung and Jung.

Shares in the Trump Media Technology Group Corp rallied more than 8% in the last 24 hours, according to TradingView . Memecoin DOGE has also surged by 15% over the same period amid comments from billionaire and Trump advocate Elon Musk on creating a so-called “ Department of Government Efficiency ,” or D.O.G.E, to cut back on what he deems wasteful spending and complicated regulations.

Bitcoin has also gained 4% during the last 24 hours and is trading for $71,864 at publication time, according to The Block’s Bitcoin Price Page , closing in on its prior all-time high of nearly $74,000 in March.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mitsubishi UFJ’s stablecoin is coming to Japan

Ronin Bridge CCIP Migration Begins with Chainlink-Powered Security

Celo and Bando Makes Crypto Easy for Buying Gift Cards and Data

VeChain Partners with 4ocean to Advance Ocean and Land Sustainability with Blockchain