CryptoQuant says bitcoin retail activity picked up in October after summer lull

According to CryptoQuant analysts, retail investor activity in bitcoin increased in October and has gained over the past 30 days.This increase in retail demand for bitcoin is happening in tandem with growing institutional interest, analysts said.

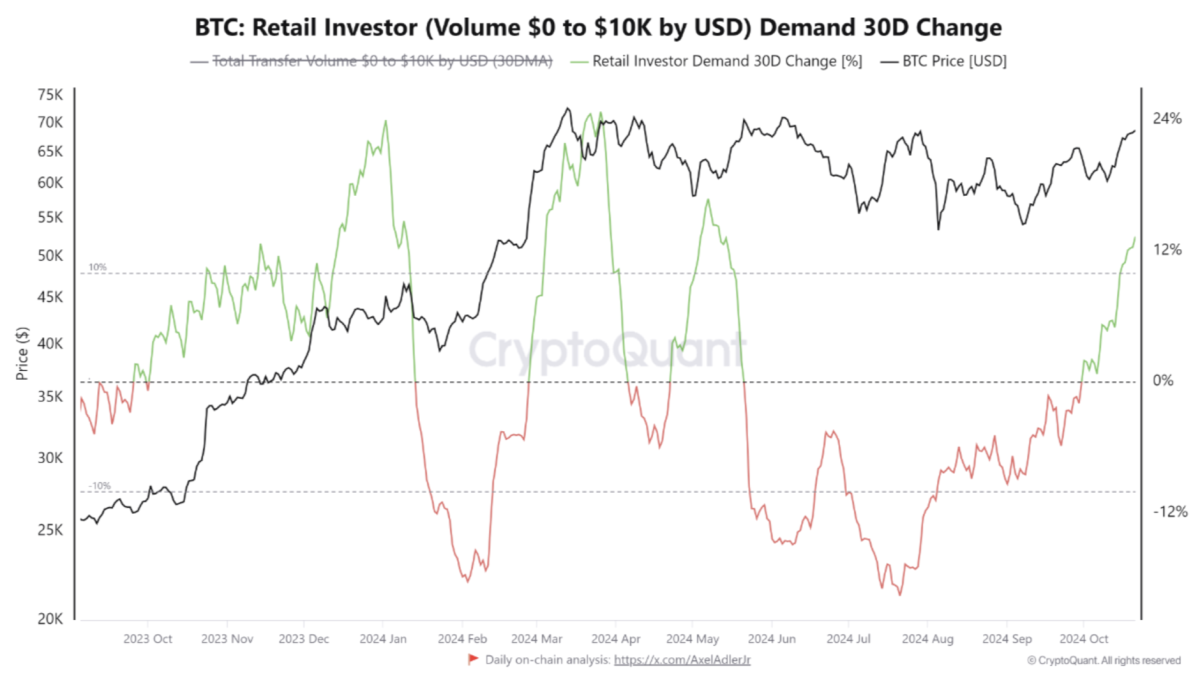

Retail investor interest in Bitcoin increased in October, with on-chain activity from this cohort gaining over the past 30 days and approaching levels seen before the all-time high in March 2024, according to CryptoQuant.

CryptoQuant’s Retail Investor Demand Change metric showed that retail investor activity, which had slowed between June and late September, has begun to pick up throughout October. "In the last 30 days, retail demand grew by about 13%, highlighting a scenario similar to March when we were close to the last historical high," CryptoQuant analysts said in a report on Tuesday.

Retail demand rising alongside institutional interest

This increase in retail demand for bitcoin is happening in tandem with growing institutional interest , according to CryptoQuant Head of Research Julio Moreno. He noted that while retail investors are returning to the market, institutional investors have steadily increased their exposure to bitcoin throughout the year. "This contrasts with what happened in Q1 2024, where demand was mostly driven by larger investors," Moreno told The Block.

Moreno said that the current retail and institutional demand dynamics appear to be similar to what happened in previous bitcoin market cycles. "In 2017, retail accumulated bitcoin aggressively after the price broke above its previous all-time high, and continued to buy as bitcoin rallied towards $20,000," he said, adding that the recent uptick in retail activity could indicate a similar pattern of renewed optimism.

To measure retail investor demand, CryptoQuant looks at a few key indicators. One method is tracking the total amount of bitcoin held by wallets that contain less than one bitcoin. Moreno said that this amount has grown from 1.734 million BTC in mid-March to 1.752 million BTC currently, an increase of 18,000 bitcoin. Another metric is the volume of on-chain transactions valued at less than $10,000, which reflects the activity of small investors and provides a sense of market sentiment among non-institutional participants.

Bitcoin retail investor demand spiked before March's all-time high. Image: CryptoQuant

Alongside the surge in retail investor demand, institutional interest has also been climbing, notably reflected in the increasing inflows into spot bitcoin exchange-traded funds (ETFs). As of mid-October, cumulative net inflows into spot bitcoin ETFs surpassed $21 billion. However, after seven consecutive days of positive net inflows, ETF activity reversed to show negative daily flows on Tuesday. According to data from SoSoValue, the 12 spot bitcoin ETFs reported total net outflows of $79.09 million. The day’s entire outflows came from Ark and 21Shares’ ARKB, which saw $134.74 million leave the fund.

Bitfinex analysts told The Block that while ETF inflows have bolstered confidence in bitcoin as a legitimate investment vehicle, in recent weeks, prior attempts by the digital asset to break past the $70,000 level have failed, even though similar ETF inflows have accompanied them.

"We remain cautious, noting that inflows do not always lead to sustained price increases and previous attempts by bitcoin to break past the $70,000 level, accompanied by large ETF inflows, have failed. The historical volatility of bitcoin prices suggests that further fluctuations may occur, despite the inflows boosting confidence in bitcoin ETFs as a viable investment vehicle," Bitfinex analysts said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report