China's fiscal stimulus announcement this Saturday could be market moving for bitcoin, analysts say

China is set to announce fresh fiscal stimulus measures on Saturday that could inject fresh liquidity into risk assets, including cryptocurrencies like bitcoin, analysts said.Polymarket U.S. presidential election odds now favor Trump’s win at 55.5% over Harris at 43.7%, suggesting a Trump win could lead to a significant bitcoin price increase.

The analysts added that China's stimulus packages' exact scale and scope could still surprise the market, and any anticipated effects are still not fully priced in. "This is especially if the measures are larger or more aggressive than expected," the analysts added.

Bitcoin market volatility expected to increase

The Bitfinex analysts added that bitcoin market volatility has been decreasing recently, but the digital asset could react positively to a significant macroeconomic development stemming from China. "Even if the stimulus is somewhat expected, the actual announcement could lead to a temporary spike in volatility, as traders adjust to the details of the stimulus package," they said.

Digital Asset Group Managing Director Alex Tapscott also emphasized that China’s intervention in financial and property markets, aimed at supporting asset prices and stimulating the economy, could fuel buying demand in the cryptocurrency market.

“Easing monetary and fiscal conditions puts a bid under risk assets, and crypto is likely to benefit,” Tapscott said in an email to The Block.

Beijing announced a series of economic stimulus measures designed to lower borrowing costs and stimulate economic activity in late September. These measures included cutting interest rates on existing mortgages by 0.5 percentage points and reducing reserve requirements for banks to encourage lending.

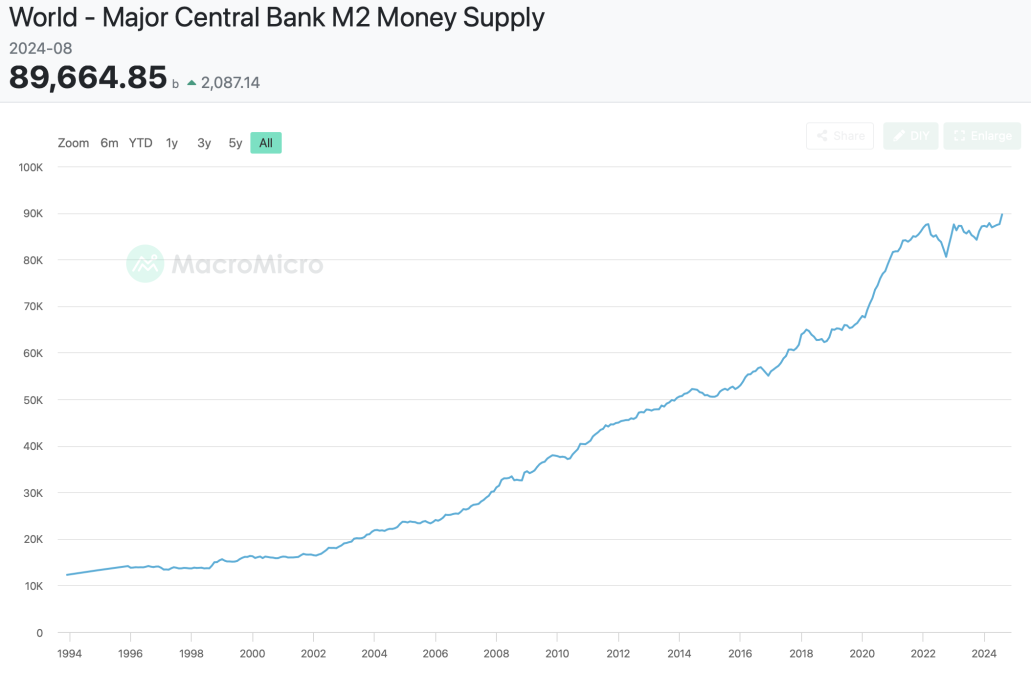

Increased global liquidity correlated with bullish bitcoin trends

In a separate report from the ETC Group, analysts pointed out that the global money supply has reached an all-time high, which has historically correlated with bullish trends for bitcoin. They highlighted three key catalysts that could boost bitcoin in the coming months: supply dynamics because of the bitcoin halving cycle, a global economic recovery spurred by monetary policy pivots, and the upcoming U.S. presidential election.

The report also touched on the U.S. election , with betting markets like Polymarket showing Donald Trump leading Kamala Harris with odds of 55.5% to 43.7%. "If the U.S. elections were held today, a Trump win could imply an approximately 10.7% rise in bitcoin’s price, while a Harris win might lead to a 10.5% decline, based on historical sensitivities," the analysts said.

The ETC report said that bitcoin performed relatively well following past U.S. presidential elections in 2012, 2016 and 2020, regardless of the winning party. Still, it noted that this is the first presidential election where cryptoassets have been a part of the actual discussion, which is why it could have an even more significant impact on bitcoin's price.

In the past 24 hours, bitcoin traded mostly flat, currently changing hands for around $61,277, according to The Block's bitcoin price data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!

AINUSDT now launched for futures trading and trading bots

Bitget releases June 2025 Protection Fund Valuation Report