Tradias, Bankhaus Scheich’s Digital Asset Arm, Now a Licensed Securities Trading Bank

With a new securities trading bank license and a strengthened capital base, Tradias aims to drive digital asset adoption in Europe and enhance its product offerings.

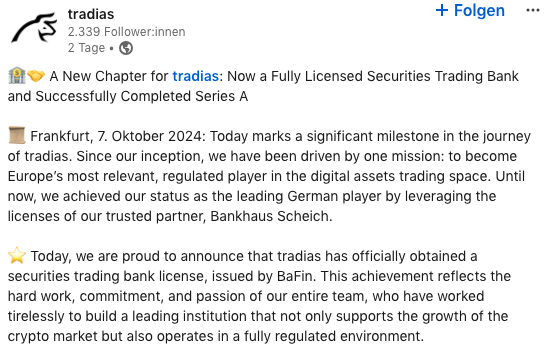

Tradias, Frankfurt-based crypto provider and Bankhaus Scheich’s digital asset arm, has officially received a securities trading bank license from Germany’s Federal Financial Supervisory Authority (BaFin).

Tradias can operate as an independent securities trading bank with this new license . Previously, the firm operated as Bankhaus Scheich’s over-the-counter trading platform for cryptocurrencies and security tokens, using Bankhaus Scheich’s BaFin license.

Source: Tradias

Source: Tradias

Expansion Plans for 2025

According to the bank’s press release from Oct. 7, Tradias successfully closed a Series A funding round , securing capital for further growth.

However, the company did not disclose further details about its latest funding round. According to Bloomberg , several family offices have invested in Tradias, and the new capital will allow the company to expand its workforce from 90 to 100 by the end of the year.

Previously, Deutsche Bank’s subsidiary DWS considered investing in Tradias. However, this deal fell through. A reason for the failed investment was reportedly Tradias’ reliance on the licenses of Bankhaus Scheich – a hurdle that has now been overcome.

With its new status as a licensed securities trading bank and a strengthened capital base, Tradias seeks to drive European expansion in 2025 and enhance its product offerings.

Driving Digital Asset Adoption in Germany

Bankhaus Scheich is one of the leading market makers on the Frankfurt Stock Exchange. In 2020, Bankhaus Scheich expanded its business into digital assets and launched Tradias.

In 2023, Tradias partnered with Deutsche WertpapierService Bank (Dwpbank) on its wpNex platform. This partnership allows Dwpbank’s 1,200 customers to access Bitcoin ( BTC ) investments.

In February 2024, Tradias tokenized the “first” money market fund on the Polygon blockchain, the Allianz Securicash SRI Fund.

Tradias is the crypto partner of neobroker Trade Republic, Dwpbank, and T-Systems. Several German states, such as Hesse, also sell their cryptocurrency holdings through the bank.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARPA Integrates Random Number Generator into CARV and Sonic SVM

MANTRA Co-Creation: OM token destruction plan will be announced soon