Bitcoin Drops Towards $60,000 On Iran-Israel Tension: Why Are Analysts Concerned?

Bitcoin is down as the escalation in Iran and Israel dampened sentiment. Will Bitcoin recover or drop below $60,000?

Bitcoin is under immense selling pressure.

In two days, the world’s most valuable coin is down nearly 5%, sliding from $66,000 and September 2024 highs.

The sell-off was worsened by the escalation between Iran and Israel on October 1.

Bitcoin Price Drops Amid Heightened Tensions

Last month marked a solid close to Q3 2024, and September ended up bullish for the first time in years.

As the markets prepare for a historically bullish Q4 2024 and “uptober”, eyes are on the immediate-term performance of Bitcoin.

At press time, the coin remains above $60,000. On the upper end, the resistance is at $66,000.

( btcusdT )

Provided prices are inside the September 2024 trade range, the uptrend remains.

Admittedly, there are cracks visible on the daily chart.

However, most analysts are bullish, expecting Bitcoin to bounce strongly in the medium to long term.

Selling Pressure In The Short-Term Is Low

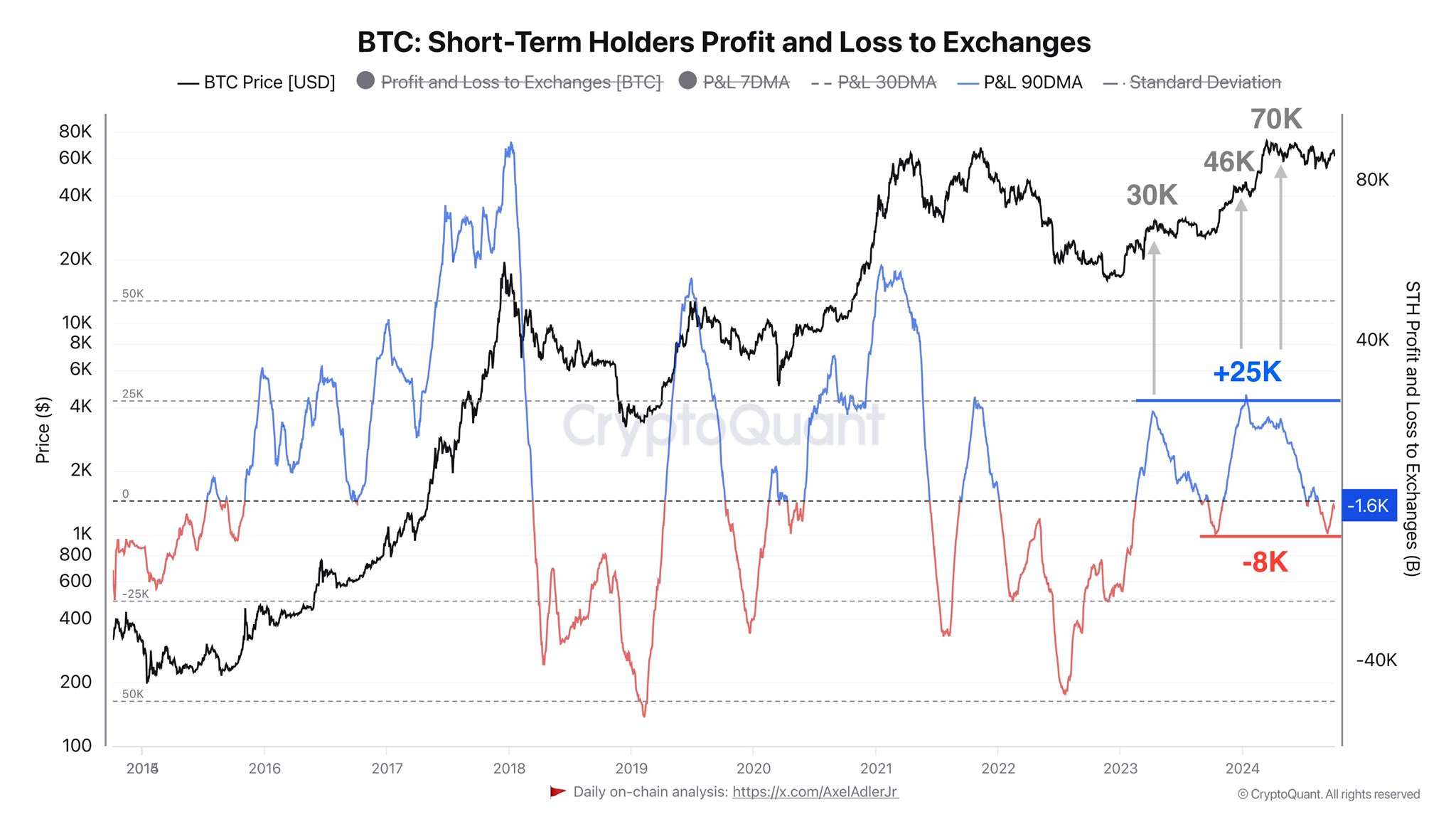

Even with BTC slipping in the past two days, one on-chain analyst observes that the short-term selling pressure has been relatively low.

Specifically, the analyst notes that the quarterly profit and loss (PL)to exchanges for short-term holders (STHs) is currently at -1,600 BTC. STHs are traders who bought the coin within the last 155 days.

At this PL level, the analyst said holders shouldn’t be worried.

( Source )

If this reading exceeds 20,000 BTC, there will be concerns. Then, sellers will be in a prime position to press on, reversing gains.

The BTC Downtrend Remains As Long As Price Is Below $71,000

From a technical perspective, one analyst on X is worried .

The trader said the leg up that took Bitcoin above $66,000 in late September did not disrupt the seven-month sequence of lower highs and lower lows.

( Source )

As things stand, prices are within a descending channel. Accordingly, sellers of Q2 2024 remain in charge despite the general optimism across the board.

This preview will only change once there is a close above $71,000.

Technically, if this breakout is with rising volume, the uptrend will be clear, confirming gains of late Q4 2023 and the continuation of gains from November 2022.

Replying to this assessment, another on-chain trader confirmed that the mid-term structure for BTC is bearish. However, it is transitioning towards neutral.

Based on this outlook, the all-time high might take longer than expected before it is broken.

Moreover, before the uptrend resumes, Bitcoin is likely to recoil, falling lower before resuming its upward trajectory.

Even so, the analyst said Bitcoin is bullish, regardless of challenges and headwinds from fundamental and geopolitical factors.

Explore: Robinhood Wallet Expands Crypto Offerings With Solana Support

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Forget bull or bear — Bitcoin’s in a new era, says onchain analyst James Check

Whale Sells $5.48M in TRUMP Token, Gains $483K

A crypto whale offloaded 630,339 TRUMP tokens for $5.48M, pocketing nearly $483K in profit at $8.70 per token.Whale Exits TRUMP Token with Nearly Half a Million in ProfitSmart Profit-Taking or Early Exit?Whale Moves as a Market Signal

Buy Low, Fly High: Arctic Pablo at $0.000099 Eyes $0.008 Surge, While Fwog And Pudgy Penguins Push Boundaries

Explore Arctic Pablo Coin's presale, Pudgy Penguins' gaming expansion, and Fwog's market trends. Discover the Top New Meme Coins to Invest in April 2025.Arctic Pablo Coin (APC): Staking and RewardsArctic Pablo Coin (APC): Presale Reaches Frostbite CityPudgy Penguins: Expanding into Mobile GamingFwog: Gaining Momentum in the Meme Coin MarketWrapping Up: Arctic Pablo Coin (APC) Stands OutFor More Information:

Australian Court Overturns License Ruling Against Block Earner, Sides with Fintech in Landmark Crypto Case

In a significant legal win for Australia’s crypto and fintech industry, the Federal Court has overturned a previous ruling that required digital finance firm Block Earner to obtain a financial services license for its discontinued fixed-yield crypto product.