Coinbase Predicts Record-Breaking Quarter for Bitcoin—Here’s Why

- Interest rate cuts by the U.S. Federal Reserve have prompted other monetary authorities to adopt similar policies.

- U.S. GDP growth exceeded expectations at 3.0%, reducing concerns about an imminent recession risk.

Coinbase has expressed an optimistic outlook for Bitcoin as we head into the fourth quarter of 2024, underpinned by increased liquidity resulting from recent policy measures in the United States and China. As Bitcoin hovers around the $65,000 mark, analysts from the cryptocurrency exchange see robust demand setting the stage for a potentially strong end to the year.

In a recent market report , Coinbase analysts highlighted last week’s interest rate cuts by the U.S. Federal Reserve. They suggest that this reduction in rates not only boosts available capital but also enables other monetary authorities to implement more aggressive stimulus measures.

“The decrease in the bank reserve requirement in particular should be beneficial for market liquidity,” Coinbase’s report states. To put this into perspective, it indicates that this measure is positively correlated with BTC performance.

This chain reaction was evidenced by subsequent fiscal and monetary stimulus in China, including interest rate cuts and a reduction in the reserve requirement ratio, aimed at boosting lending and alleviating existing credit burdens.

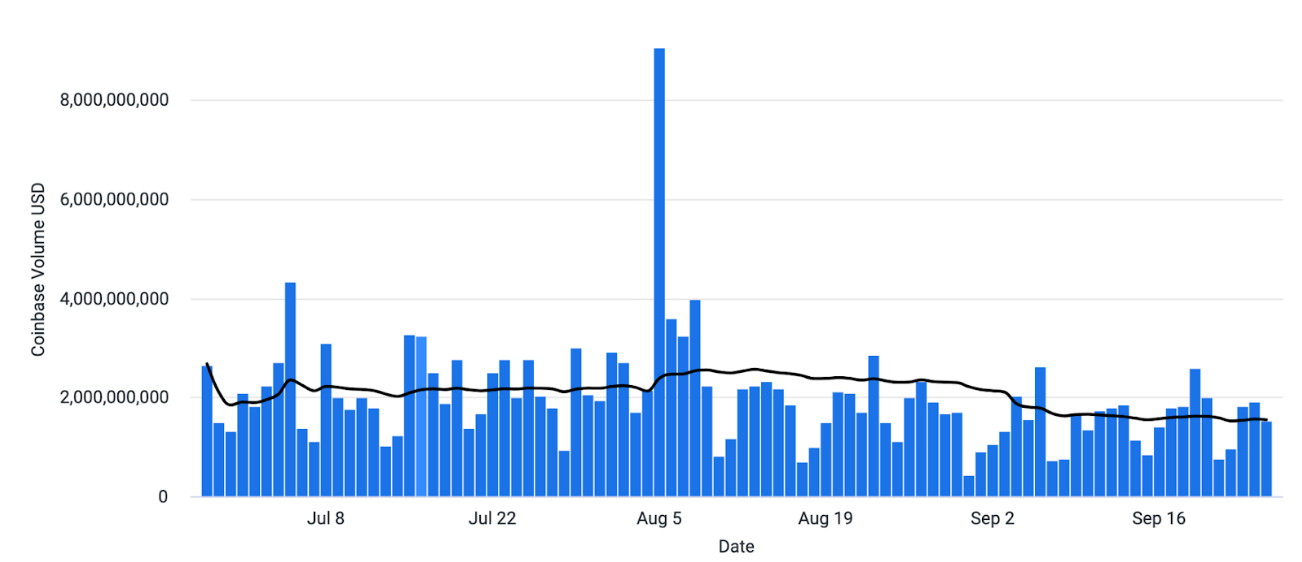

Trading volumes on Coinbase platform (USD)

Trading volumes on Coinbase platform (USD)

However, Coinbase cautions that the impact of increased liquidity on Bitcoin and the broader cryptocurrency market may not be immediate or sustained. The exchange anticipates a possible delay in these measures positively affecting market performance, despite observing signs of economic strength.

“We anticipate a constructive fourth quarter in 2024 due to US rate cuts and significant fiscal and monetary stimulus from China, which should improve market liquidity and support BTC performance,” the exchange team says.

Coinbase also addressed concerns about a potential recession. The U.S. economy continues to exhibit resilience, with second-quarter GDP growth rates exceeding expectations at 3.0% compared to the forecasted 2.9%. This performance supports Coinbase’s view that short-term recession risks remain low.

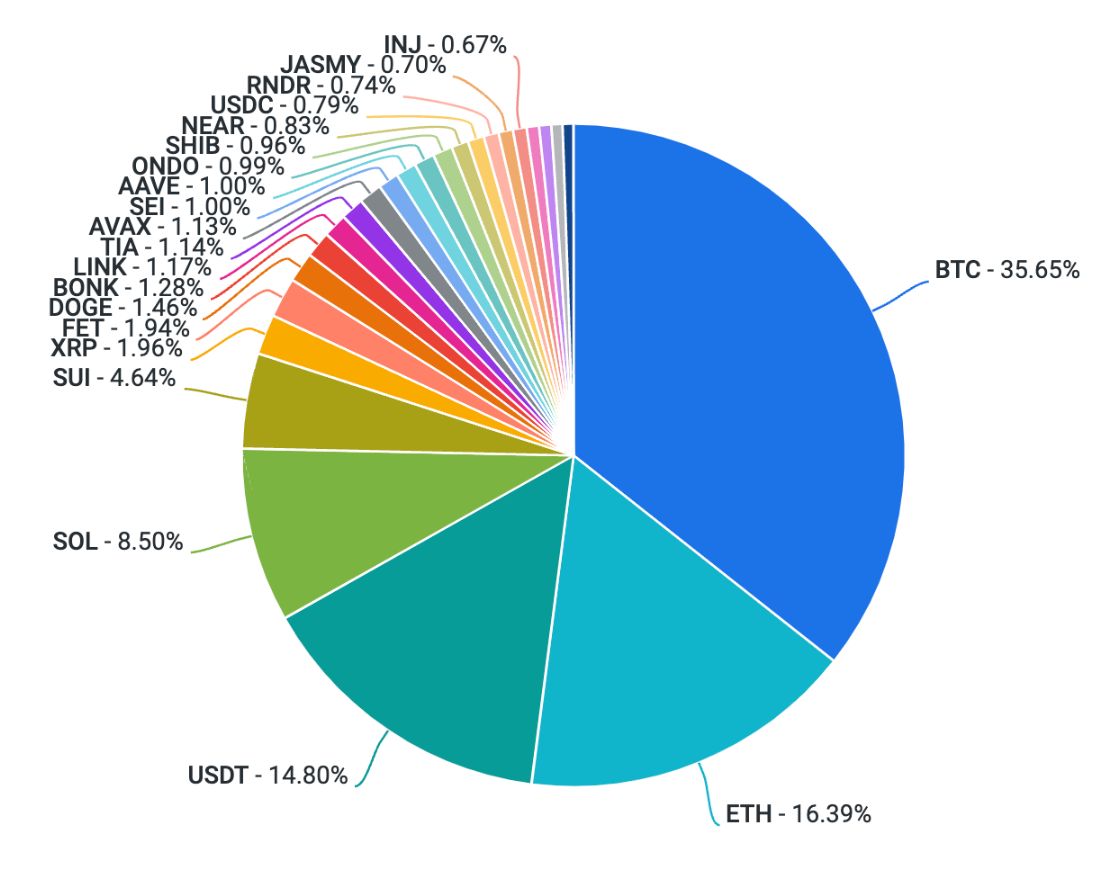

Trading volumes on Coinbase platform by asset

Trading volumes on Coinbase platform by asset

Nonetheless, upcoming East Coast port strikes could pose challenges for the economy in the fourth quarter, although their impact on inflation is expected to be minimal due to the relatively small share of maritime transport in overall goods costs.

Regarding the cryptocurrency market conditions, Coinbase remains confident . Recent U.S. and Chinese monetary easing has had a positive effect on both stocks and cryptocurrencies, as observed in market data.

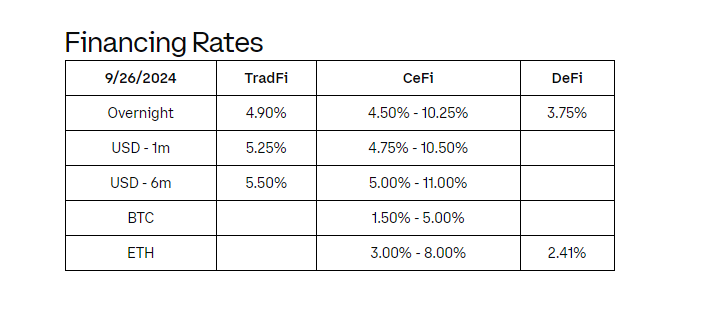

Financing Rates – Coinbase Report

Financing Rates – Coinbase Report

Futures markets show stable financing rates and open interest levels close to six-month averages. This data supports the view that the market is well-positioned for October, historically a strong month for Bitcoin, which has seen price increases in eight of the last ten Octobers.

Adding to the positive outlook, the recent U.S. approval of Bitcoin ETFs is seen as a favorable development. Coinbase believes that these financial instruments could enhance institutional adoption and liquidity, thus bolstering the cryptocurrency market’s prospects for the upcoming quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stocks retreat from session highs as China trade deal remains uncertain

President Trump’s comments that he will not look to fire Fed Chair Jerome Powell sent stocks higher in after-hours trading Tuesday

Is BTC in ‘up only’ mode after rising above $94K?

“Bitcoin does not require a strong equity rally to move higher,” YouHodler markets chief Ruslan Lienkha said

Revenue diversity fuels analyst’s latest COIN ‘buy’ rating

Why an analyst is kicking off COIN coverage with “buy” rating

Bitcoin Rises 6.5%: Potential Catalysts for Future surge Amid Decreasing Demand

Exploring How Stablecoin Demand Could Ignite Bitcoin's Next Surge Amid Market Uncertainties