Circle Launches New Feature to Simplify Regulatory Compliance for Businesses

Circle launches Compliance Engine, a platform to streamline regulatory compliance for businesses using Circle's programmable wallets.

Circle, the issuer of the USDC and EURC stablecoins , has launched Compliance Engine, a new platform designed to simplify regulatory compliance for businesses using its programmable wallet platform.

Compliance Engine offers customizable, automated compliance checks, streamlining the process for businesses operating in the digital asset space. The platform is natively integrated into Circle’s infrastructure, eliminating the need for separate third-party integrations.

Customizable Compliance Checks

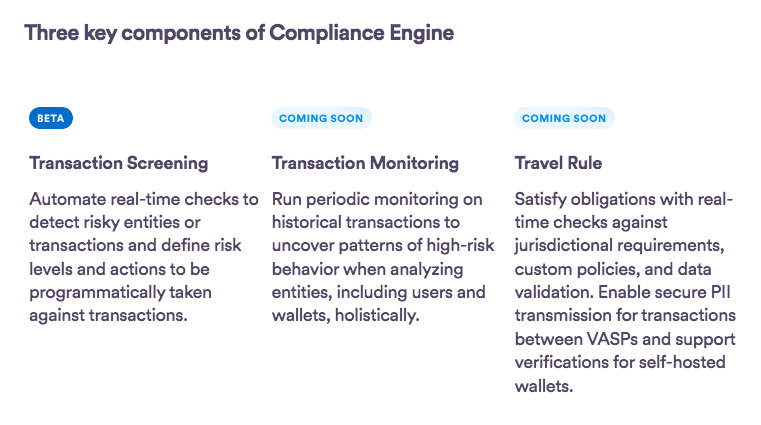

According to the Circle’s post from Sept. 24 , the initial beta release focuses on the “Transaction Screening” feature, allowing real-time checks to identify potentially suspicious activity.

Businesses can customize rules based on risk type or severity and receive real-time reporting through a dashboard or webhooks.

Additional features like “Transaction Monitoring” and “Travel Rule” will be implemented in the coming months.

Transaction Monitoring will allow for periodic reviews of historical transactions to identify potential patterns of high-risk behavior when analyzing entities, such as users and wallets, holistically.

The Travel Rule feature will enable secure transmission of personally identifiable information (PII) for transactions between Virtual Asset Service Providers (VASPs) and support verifications for self-hosted wallets.

Key features of the Compliance Engine. Source: Circle

Key features of the Compliance Engine. Source: Circle

Businesses can also granularly customize transaction and alert policies using Compliance Engine to align with their specific business needs and regulatory requirements.

The platform also supports incoming and outgoing transactions that are performed using programmable wallets. This includes EOA and MSCA wallet account types and developer-controlled or user-controlled wallets.

Compliance Engine supports a wide range of blockchains , including those supported by programmable wallets such as Avalanche ( AVAX ), Ethereum ( ETH ), Polygon PoS ( MATIC ), and Solana ( SOL ).

Circle’s USDC Transforms Humanitarian Aid

Besides international businesses, stablecoins can also be used for global financial inclusion and humanitarian aid.

According to the Circle’s Impact Report 2024 , traditional financial systems often leave billions of people unbanked and hinder efficient humanitarian aid distribution due to slowness, high costs, and lack of accessibility.

“Global finance is now beginning to build solutions for a world where billions of people can access portable bank branches in the palms of their hands,” the report says.

“Today mobile money is an $800 billion market in sub-Saharan Africa, and online “neobanks” have amassed hundreds of millions of users in Latin America – many of whom had previously been unbanked.”

To address these challenges, Circle seeks to offer faster, cheaper, and more transparent cross-border transactions. The report showcases several examples of how USDC is making a positive impact.

In December 2022, UNHCR and Circle partnered to launch a humanitarian cash program that provided borderless digital U.S. dollars – USDC – to Ukrainians displaced by the war. These USDCs were transferred directly to recipients’ digital wallets via the Stellar ( XLM ) blockchain, allowing for almost instant access using a smartphone. The program included fully integrated cash-out options and adhered to all necessary regulations.

Circle allows recipients to convert their digital aid into cash or transfer it to their local bank accounts. Source: Circle

Circle allows recipients to convert their digital aid into cash or transfer it to their local bank accounts. Source: Circle

Rahat , a Nepal-based organization, uses USDC and smart contracts to provide financial aid directly to mobile phones before climate disasters.

WiiQare, a Congo-based startup, enables faster and more affordable cross-border healthcare payments for migrants using USDC.

Kura, a U.S.-Haitian company, reduces remittance costs and facilitates real-world spending for beneficiaries with USDC.

In the report, Circle also highlights USDC’s strengths, including price stability, transparency, regulation, and an open ecosystem, and paints a positive outlook of how stablecoins can address financial inequality and empower individuals and organizations worldwide.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who is Patrice Evra, French football legend, set to speak at Token 2049 Dubai?

Elon Musk Takes Dig at Crypto Scammers Posing as “Hot Girls”

XRP Tops Weekly Crypto Inflows Despite Market Volatility

Polygon NFTs Surpass Ethereum In Weekly Sales Volume With Real-World Asset Surge