Bitcoin leads global crypto investment products' $436 million rebound as Ethereum products struggles: CoinShares

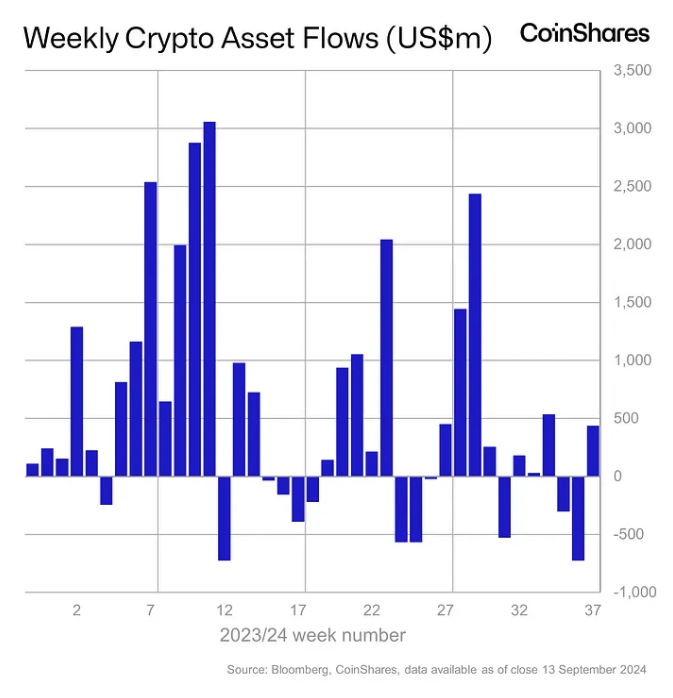

Quick Take Global crypto investment products rebounded with $436 million in net inflows last week led by Bitcoin, according to CoinShares. However, Ethereum-based funds continued to struggle, experiencing weekly net outflows of $19 million.

Crypto funds at asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares returned to net inflows of $436 million globally last week, according to CoinShares, after two consecutive weeks of net outflows.

“We believe the surge in inflows towards the end of the week was driven by a significant shift in market expectations for a potential 50 basis point interest rate cut on September 18,” CoinShares Head of Research James Butterfill wrote in a Monday report, following comments from former Federal Reserve Bank of New York President Bill Dudley last week.

However, trading volume remained flat for the week at $8 billion — well below the $14.2 billion average for 2024, Butterfill noted.

Weekly crypto asset flows. Images: CoinShares .

Bitcoin dominates as Ethereum investment products struggle

Bitcoin-based funds again led the flows, rebounding to generate $436 million in net weekly inflows after a 10-day streak of net outflows totaling $1.2 billion. Short bitcoin investment product flows also reversed, registering net outflows of $8.5 million following three consecutive weeks of inflows.

The U.S. market also dominated, with spot Bitcoin exchange-traded funds based in the country accounting for $403.9 million in net weekly inflows alone. Switzerland and Germany-based funds also saw $27 million and $10.6 million worth of net inflows, respectively, while Canada-based products witnessed net outflows of $18 million.

Solana investment products also witnessed net inflows of $3.8 million last week — the fourth week in a row.

However, Ethereum-based funds continued to struggle, generating a further $19 million worth of net outflows last week, adding to $98 million in negative flows the week before. The ratio between bitcoin and ether dropped below 0.04 over the weekend for the first time since April 2021, according to TradingView .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CROSSUSDT now launched for futures trading and trading bots

BULLAUSDT now launched for futures trading and trading bots

BGB holders' summer celebration–a grand community giveaway! Trade 10 BGB to share 10,000 USDT!

New spot margin trading pair — ICNT/USDT!