'Stage 1 or bust': Vitalik Buterin says he’ll only discuss rollups with sufficient decentralization in Layer 2 talks

Quick Take Vitalik Buterin said he will change how he discusses Layer 2 rollups in public communications, such as blogs and talks, starting next year. Buterin plans to only mention Layer 2 solutions that achieve “stage 1+” in decentralization.

Ethereum co-founder Vitalik Buterin declared a new approach to how he will engage with Layer 2 rollups in his public communications, including blogs and talks.

Starting next year, to promote decentralization among Layer 2 rollups, Buterin said he plans to mention only Layer 2 solutions that are “stage 1+” in decentralization unless they are part of a short grace period allocated for particularly innovative new projects.

Buterin expressed his stance via X, stating that personal investments or friendships will not influence his decision to highlight certain Layer 2 technologies. “It doesn’t matter if I invested, or if you’re my friend; stage 1 or bust,” Buterin said .

According to Buterin, the criteria for “stage 1+” rollups require that a council reach a 75% consensus to override the proof system. No fewer than 26% of the council members must be independent of the roll-up team itself, emphasizing security and decentralization.

Buterin noted that this is a “very reasonable moderate milestone” and a necessary progression in the security of Layer 2 networks.

Most rollup-based Layer 2 blockchains on Ethereum have yet to decentralize their networks by reaching stage 1, attained by processes like incorporating fault proofs . The only exception is optimistic rollup Arbitrum.

Buterin added that several teams working on ZK rollups have informed him they are on track to achieve stage 1 status by the end of this year.

Buterin also highlighted the importance of moving away from “glorified multi sigs” — a term for more straightforward, less secure systems for Layer 2 rollups — towards a framework built on cryptographic trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report | Detailed Analysis of Sign Protocol & Sign Market Value

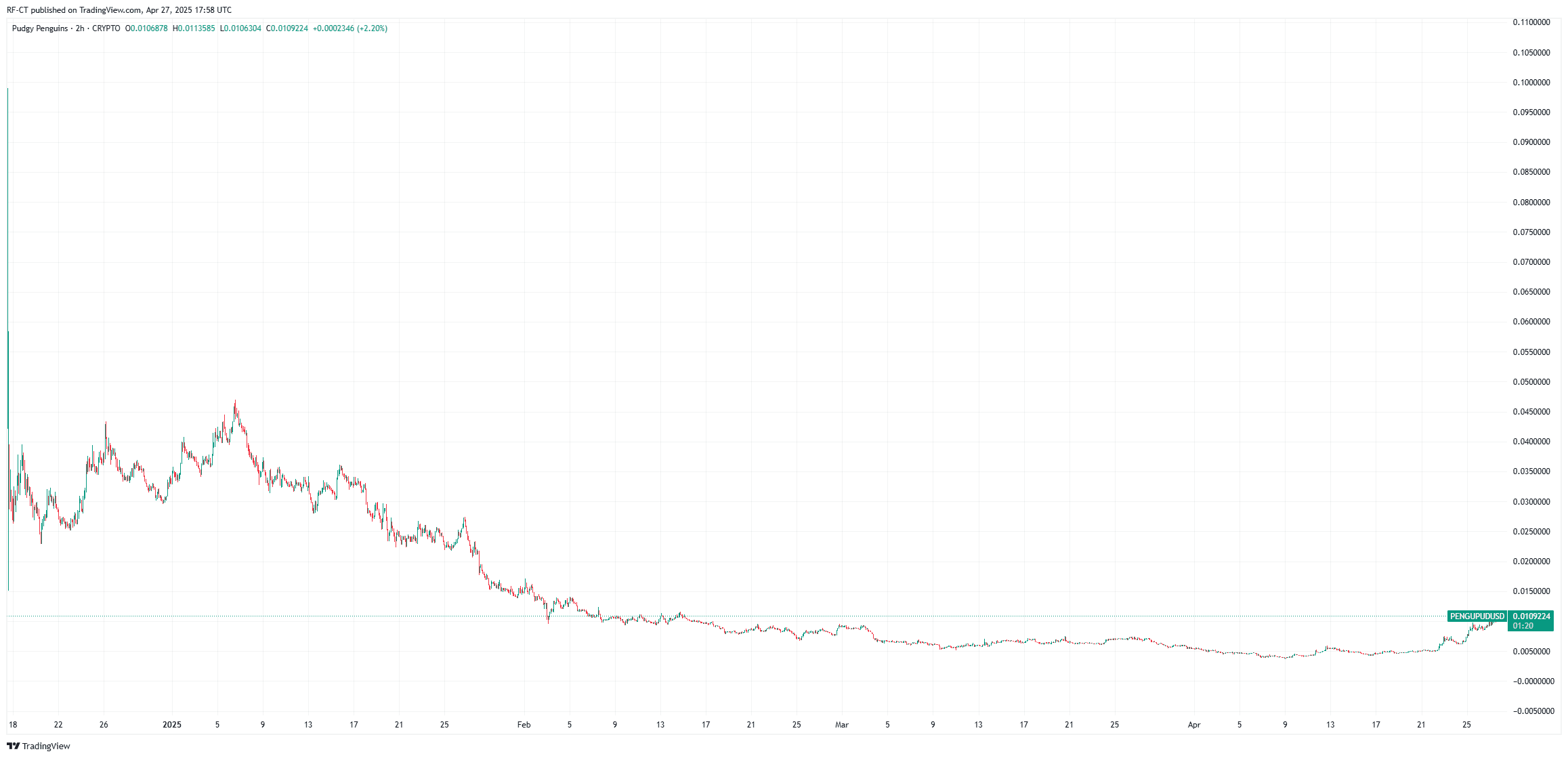

Pudgy Penguins Token PENGU Makes 100% Gains Amid Meme Coin Mania

Solana (SOL) on Verge of Critical Downfall, Bitcoin (BTC) Eyeing $100,000, XRP: Sleeping or Skyrocketing?