Many

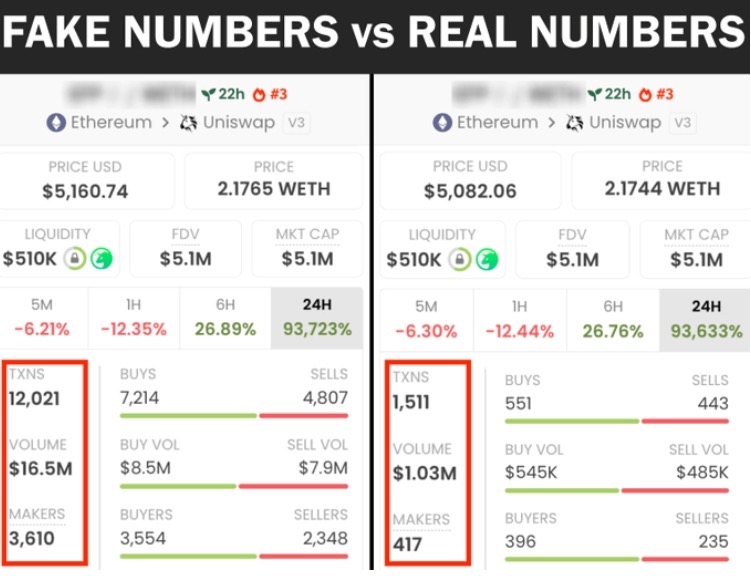

cryptocurrency transaction data are artificially manipulated, especially on Dexscreener, where the Statistical Data of many meme coins is false. This article details how developers attract investors through false transaction volume and shares methods to identify these fraudulent methods, helping you avoid traps and protect your funds.

If you are not familiar with these scams, you may suffer serious losses in the cryptocurrency world, especially on platforms like Dexscreener. Most of the trading data of meme coins is false, and developers attract investors to enter the game and earn huge profits by manipulating the trading volume and number of holders.

Part 1: How developers manipulate data

Developers manipulate the number of token holders and trading volume through three main methods.

1. Personal

buying and selling operations (worst effect)

2. Collaborate with friends (medium effect)

3. Automate operations with thousands of wallets (most effective)

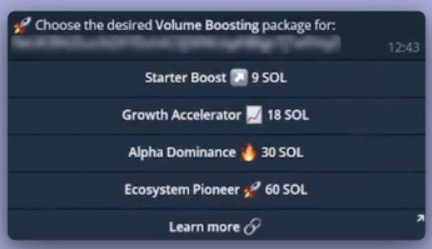

Especially the third method, developers use servers, node validators, and financial support to run automated scripts around the clock, simulating huge transaction volumes. Now, anyone can easily achieve this manipulation through public robots on Telegram.

Part 2: How to identify these manipulations

Although tools like Bubblemaps are difficult to reveal these manipulations because these wallets are usually independent, you can identify them by the following methods:

1. Observe the active level of the Telegram group: Large transactions usually correspond to highly active communities. If there are few messages in the group, it may mean that the transaction volume has been artificially increased by robots.

2. Check the buying and selling records on Dexscreener: Robot transactions usually repeat the same amount of buying and selling operations.

Identifying false transaction volume is not difficult, just stay vigilant, observe unreasonable trading behavior, and avoid falling into scams.

Conclusion:

In the cryptocurrency market, especially on platforms like Dexscreener, false trading volume and manipulation are widespread. Developers attract investors by falsifying data, but you can identify these scams by observing cybertribe engagement and trading patterns. Understanding these methods is crucial to help you avoid being deceived by manipulated tokens and protect your funds from loss.