Outlier Ventures says four-year cycle is dead after bitcoin's 'worst price performance following any halving to date'

Outlier Ventures Head of Research Jasper De Maere said that investors should move away from the notion of a four-year cycle.De Maere’s comments come amid bitcoin’s worst price performance four months after its block-reward halving event.

Web3 accelerator Outlier Ventures said it is time to accept that the four-year cycle is dead, with bitcoin experiencing its worst price performance post-halving so far this year.

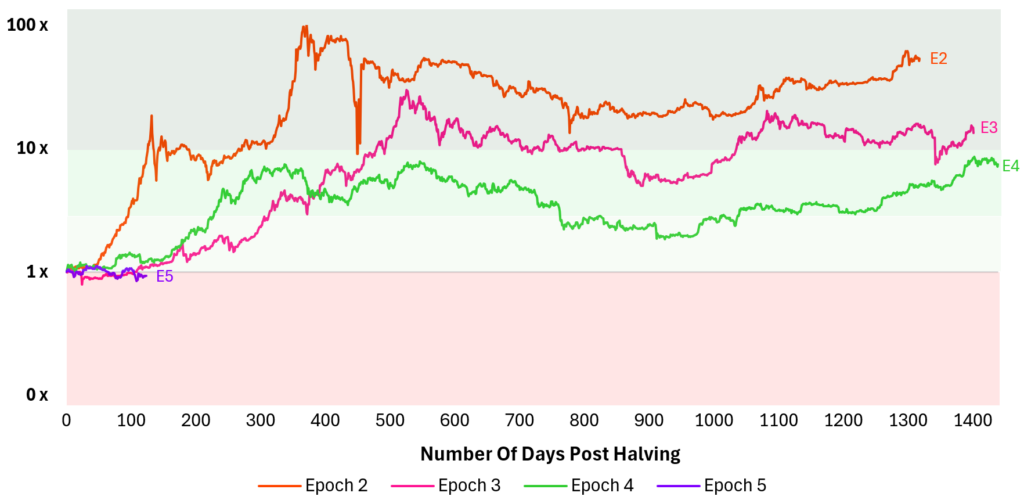

“Four months after the latest Bitcoin BTC -4.20% halving, we’re witnessing the worst price performance following any halving to date,” Outlier Ventures Head of Research Jasper De Maere wrote in a Tuesday report .

“The halving no longer has a fundamental impact on the price of BTC and other digital assets, with the last time it had dating back to 2016,” he said, adding: “It’s time for founders and investors to move away from the notion of a four year cycle as digital asset markets mature.”

Bitcoin halvings are programmed to occur automatically every 210,000 blocks — roughly every four years. Once a halving event occurs, miners receive 50% fewer bitcoins as a subsidy reward for every block of transactions they mine and add to the blockchain. However, they continue to earn additional transaction fee rewards for each block mined as normal. Bitcoin’s fourth halving occurred on April 20, when miners’ block subsidy rewards dropped from 6.25 BTC to 3.125 BTC.

This time it's different

Looking at bitcoin's price performance 125 days after each halving event, the foremost cryptocurrency is down around 8% compared to gains in previous epochs. More specifically, it witnessed a 739% rise 125 days following the 2012 halving, 10% after 2016, and 22% after 2020, according to De Maere’s data.

Bitcoin post-halving performance. Image: Outlier Ventures .

The Outlier Ventures analyst said that 2016 was the last time the halving had a “significant, fundamental impact” on the price of bitcoin — and, since then, Bitcoin miners’ block subsidy rewards have become negligible in the context of a maturing and increasingly diversified crypto market. However, he acknowledged halvings may still have some psychological effects.

De Maere said the strongest argument for the halving’s impact on the market is that, beyond reducing bitcoin’s inflation, it affects miners’ treasury management. However, in the extreme scenario of all miners instantly selling their rewards, until mid-2017, this would have had a 1% to 5% impact on the market, whereas today, it would account for just 0.17% of volume, he noted.

Strong price action following the 2020 halving was also a coincidence, De Maere added, occurring during unprecedented global capital injection post-Covid, with the U.S. alone increasing its money supply by more than 25% that year, and alongside "DeFi Summer."

It’s important to note that bitcoin reached a new post-bear market all-time of $73,836 on March 14 before this year’s halving amid increased activity related to spot Bitcoin exchange-traded funds approvals — something that did not happen until after prior halving events.

However, De Maere said the argument that a four-year cycle still holds but that the ETF approvals in January pulled forward demand, leading to a strong run-up pre-halving, is flawed. “The spot Bitcoin ETF approvals were a demand-driven catalyst, while the halving is a supply-driven catalyst, making them not mutually exclusive,” he explained. Bitcoin also had similar percentage run-ups pre-halving in prior cycles.

While bitcoin’s price significantly influences the broader cryptocurrency market and the ability for web3 projects to raise funds, De Maere said it was vital for founders to understand market drivers and better predict fundraising opportunities, adding that debunking the four-year cycle did not make Outlier bearish on the overall market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Best Long-Term Memecoins — Low Caps, High Upside, and 150%+ Growth Forecasts

ADA ETF Approval Odds Hit 79%—Are We Closer Than Expected in 2025?

Shiba Inu Set Ablaze: Massive Burn Sparks 195% Price Hopes

RootData: FLOCK will unlock tokens worth about $1.4 million in a week