Under the background of etheric depression, where is the breakthrough of the Rollup scheme ❓

Eric SJ(重开版)2024/09/04 03:46

By:Eric SJ(重开版)

General Layer Case Analysis: Entangled Rollup GOAT Network

Today, I will continue yesterday's topic of "General Layer" and develop another solution for building the state of "General Layer" and a case that has already been implemented. The full text is about 3400 words

📍

I think the trend of [General Layer] is the way for Rollup to break through in the context of the decline of the Ethereum system

Seek more application scenarios by connecting oneself to other ecosystems

In terms of functionality, there has been a trend of multi-chain interoperability. I think the primary and secondary relationship is not that other L1s need an L2, but that these L2s need to actively accommodate these relatively active L1s in the ecosystem

1. Leading Universal Layer Solution: Entangled Rollup from @ProjectZKM 🔻

It seems that since OP launched the super chain, coupled with the rise of Modularization narrative, many solutions that can quickly build L2 have emerged in the market (ALT is doing this track).

This is also the source of the later mass appearance of Rollup applications

As previously mentioned, the trend of using Rollup will not stop and will become an alternative solution for a team to build applications in the industry

Therefore, the current main competition is no longer limited to Rollup, but more upstream Rollup construction to support the development of application chains

At present, the solution provided by Entangled Rollup is actually slightly similar to the solution logic provided by OP, but in terms of chain interoperability, it should be one step ahead:

The Entangled Rollup solution allows Rollup to naturally support cross-chain interoperability at the beginning of construction

The core idea of Entangled Rollup is to "entangle" the underlying mechanisms of different blockchains and synchronize states through recursion zero-knowledge proofs

Let two independent L1, through the same framework to build L2 to achieve the purpose of interconnection,

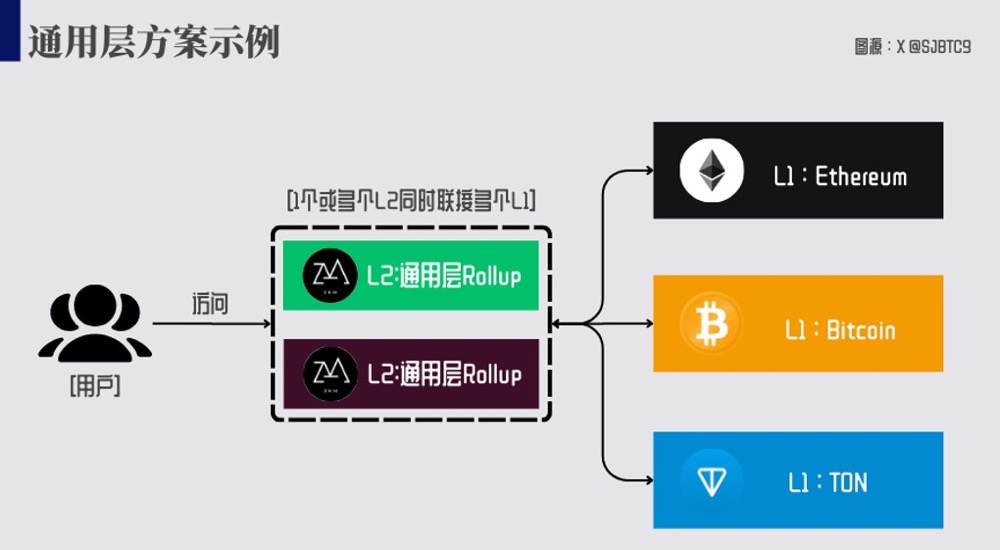

[even possible to achieve a common layer pattern L2 link multiple L1]

The specific implementation principle is not necessary for everyone to know. All you need to know is that under the influence of this plan, there will be two possibilities in the market.

(1) Between two L1s, cross-chain interoperability between two L1s can be achieved because of L2

One L2 link leads to multiple L1s.

What both possibilities have in common is that the

functionality and logic of L2 begins to approximate a cross-chain bridge 🔺

It feels a bit like joining if you can't beat them, but I think it needs to be reiterated that it's not that some L1s need L2s, but that this solution allows the execution layer to have more service objects, expands the client base of potential market use cases, and gives some L2s more possibilities

2. Universal layer solution for releasing $BTC

capital efficiency: GOAT Network @GOATRollup

🔻

The construction of GOAT is based on the Entangled Rollup universal layer scheme introduced above. In addition to the characteristics of the universal layer, it also needs to focus on some differentiated details beyond the universal layer

Colleague GOAT is also phased, although based on the Entangled Rollup scheme, it will focus more on becoming a BTC L2 in the first phase

In the composition of the sorter, GOAT prioritizes the decentralization of the sorter network: This concept is a state that almost all rollups need to pursue. It is not that this stage will bring much growth to the business, but as the infrastructure and application of Web3, [decentralization] naturally has the highest priority

In the Rollup lineage of the Ethereum system, Metis was the first to implement this stage of Rollup, while GOAT is currently a Rollup that enters the BTC ecosystem, and also places the decentralization of the sorter in a relatively high priority. In addition, the operation of the sorter, the pledged assets are BTC (goatBTC) encapsulated in a 1:1 ratio on the BTC original chain

In addition to obtaining certain interest income as pledged assets, the BTCFI market constructed on GOAT will create derivative income with encapsulated BTC as the core

This is also the common point of the vast majority of BTCFI transactions, all of which attempt to further unlock the capital efficiency of BTC beyond holding

In terms of asset attributes, the capital efficiency of BTC in the past was almost equal to 0, neither like securities that can be held for dividends, nor like $ETH that can participate in the on-chain ecosystem to obtain some potential currency-based returns

It's almost like I hold BTC,

I can only wait for it to rise and then clear it to get this kind of capital gain from buying low and selling high A few channels for further interest may be to put it on the exchange to get some interest

However, with the proposal and development of the BTC ecosystem,

BTC holders can obtain potential benefits from multiple aspects such as potential new project airdrops, Defi income pool, and node operation , adding asset holding rights and creating richer market demand

If you are familiar with the L2 of the Ethereum system, you can understand GOAT as:

BTC version of Metis + Blast 🔺

Under the priority of implementing decentralized sorting in the underlying architecture, further unlocking the capital efficiency of BTC is its main task

3. Does BTC need BTCFI ❓

Yesterday in a community, I saw an interesting debate: BTCCFI is a group of people without BTC trying to empower BTC.

At first glance, this statement seems quite correct, but upon careful consideration, this formula can actually be applied to any L1, which is why I emphasized the issue of BTC capital efficiency above

Although GOAT's ultimate goal is to become a universal layer for multiple chains based on the Entangled Rollup scheme, it is currently focused on BTCFI

Including continuing the more traditional path, airdropping its own L2 tokens to BTC holders (nodes, ecosystem builders) on the network, and allowing ecological construction around its encapsulated BTC assets, whether anchoring BTC as a trading pair or building cross-ecosystem liquidity, all promote the native demand for BTC

I even see a view in the market that BTC does not need an ecosystem, it only needs to become a reserve currency for one or more countries to enjoy the benefits

However, this matter itself is not conflicting. In terms of capturing the value layer, BTC has not achieved more derivative benefits for holders, which is not an attribute that a good asset should have. Indeed, like gold, it has its certain industrial value

4. GOAT's core economic driver 🔻

This paragraph summarizes the seemingly complex network economy design of GOAT. From my perspective, it has actually made many improvements in the current mainstream ETH L2 scheme

The economic components of GOAT are as follows

Decentralized sorter network based on encapsulated BTC 🗝️

GOAT's orderer node staking asset is a kind of encapsulated BTC (goatBTC), which is a traditional original chain encapsulation and target chain casting anchoring scheme. BTC is locked on L1 through a special script for a locking period of 6 months, which is the basis for becoming an orderer node.

Proof of equity for yBTC 🗝️

In addition to becoming a sorter node themselves, ordinary small BTC holders can participate in the distribution of benefits of sorter nodes by participating in the POS mechanism. By staking BTC on GOAT, they can obtain yBTC, which is a reference to the current mainstream design of liquidity staking and interest generation (and also planted the seeds for future re-staking nesting dolls).

(3) Using yBTC as a split economic design 🗝️

This yBTC can be divided into pBTC and yToken, which is somewhat inspired by Pendle's design of debt-interest separation. Based on similar designs, GOAT has a rich gameplay for derivative BTC income markets

These two assets are also designed with maturity dates like Pendle. If you think this design is a bit abstract, I suggest you learn about the Pendle protocol, which may be more helpful for you to understand this design

GOAT is equivalent to a native [BTC Pendle] built-in.

Using goatBTC as the on-chain GAS 🗝️

This is a more traditional design for L2, using L1 assets as on-chain GAS. The only difference between BTC and ETH is that they use encapsulated assets instead of native assets. This design also means that the revenue of the orderer node also comes from BTC.

(5) Native token equity: GOAT 🗝️

Holders of native tokens can increase sorting rewards and obtain rewards for minting and redemption by staking GOAT

Explanation on Minting and Redemption Rewards: Due to the one-to-one minting relationship between BTC and goatBTC, the GOAT Foundation will charge a certain redemption fee during this minting and redemption process, such as 0.2% (maximum value is 0.002 BTC).

Some of the fees for this part will be allocated to holders of locked GOAT, and the rest will be used for market repurchase tokens and ecological development expenses

The above five points are the economic composition of the entire GOAT network that I have sorted out. It is not difficult to see that this design is mainly based on the native BTC encapsulated assets, and through the decentralization of the sorter, holders of different scales can participate in the basic network operation and benefit from it

However, the supply and demand design inside naturally depends on the demand for GAS generated on the development stage chain, so as to supply the operation of the orderer node and L1 mainnet validator

It can be said that the source of the benign operation of the economic model comes from the active ecology of the network. The more active the network, the greater the demand for equity assets such as yBTC in the market, and the more active the Defi market that can be derived, thereby bringing more commission income to the sorter and further encouraging the positive locking of GOAT

5. Token economy analysis: GOAT veGOAT 🔻

GOAT forms a mining pool with the vast majority (42%) of the entire token as a long-term incentive for the sorter. This is a common practice for POW and even heavy node-designed networks. However, this design can easily lead to centralized token distribution during market downturns or in protocols with high-incidence mining designs with built-in node center clusters. I have not seen GOAT demonstrate this feature (although their early nodes were through an allowlist).

(2) The proportion of investors is less than 20% (including KOL rounds), except for 42% of the mining pool, the proportion of the team is relatively large

(3) Currently, I have not found details about the release of large proportions, so I cannot comment too much. However, one thing is certain: there are many parts allocated to community airdrops, even in the proportion of multiple parties, which are relatively large. I just don't know if this airdrop is a one-time distribution or a long-term linear distribution design

(4) Regarding the pledge rights of GOAT, the more practical way is to divide the redemption fee of BTC and increase the reward bonus for ranking

(5) veGOAT: It is a kind of [governance proof] obtained by locking GOAT. This token does not participate in circulation, but only serves as a certificate for network governance and long-term locking. This token is more like a special on-chain identity. Through this on-chain identity, you may receive bonuses wherever there is income involved on the chain. In summary, this is the point, without going into too much detail

Regarding the design of the general layer, GOAT is currently being launched as a BTC L2 solution. I am not sure if the design will be reconstructed from the source as more ecosystems are connected in the future

Or should we still use the current design centered around $BTC?

Or in the future, the use of GAS will be optional or automated, because the current intention execution and chain abstraction schemes have been successively launched, and this development trend of the general layer is actually in line with it

Imagine if GOAT were compatible with the TON network in the future, it would be awkward for TON ecosystem users to still use $BTC as the core asset for interaction

At present, I see that it is necessary to make some improvements in the design of account abstraction for users

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

All Franklin Templeton products will one day be onchain, exec says

CryptoNewsNet•2025/07/10 05:00

Ether, Dogecoin Lead Crypto Gains as Firms Signal 'Prime' Breakout Chance for Market

CryptoNewsNet•2025/07/10 05:00

Trump’s Truth Social Teases Upcoming Utility Token, Shills ‘Patriot’ Subscription

CryptoNewsNet•2025/07/10 05:00

DOGE Hits Resistance on Bull Flag Breakout, But 'Cup and Handle' Points to Higher Moves

CryptoNewsNet•2025/07/10 05:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$111,002.8

+2.24%

Ethereum

ETH

$2,778.62

+6.50%

Tether USDt

USDT

$1

+0.02%

XRP

XRP

$2.42

+4.51%

BNB

BNB

$672.62

+1.53%

Solana

SOL

$157.34

+3.75%

USDC

USDC

$0.9999

-0.01%

TRON

TRX

$0.2918

+1.46%

Dogecoin

DOGE

$0.1807

+5.68%

Cardano

ADA

$0.6224

+5.65%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now