US Spot Ethereum ETFs Ends the Prolonged Outflows

- The US spot Ethereum ETF market recorded a net inflow of $5.84M.

- BlackRock’s ETHA ETF witnessed the largest one-day inflow of $8.40 million.

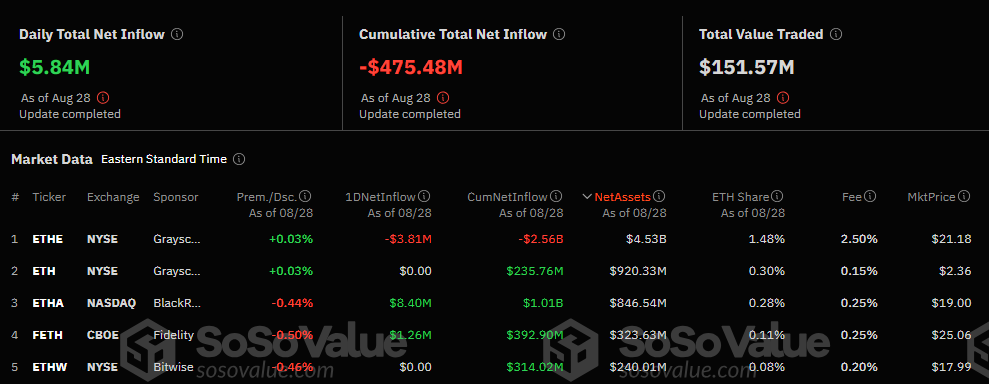

After the nine consecutive days of outflows, the US Spot Ethereum ETFs witnessed a net inflow of $5.84 million. The inflows were led by BlackRock’s ETHA and Fidelity’s FETH. Conversely, Grayscale’s ETHE continues to experience outflows.

According to the SoSoValue statistics , BlackRock’s ETHA ETF witnessed the largest inflow of $8.40 million, with the current total net asset worth $846.54 million. Followed by the key player, Fidelity’s FETH ETF saw an inflow of $1.26 million, with the total net asset worth $323.63 million, contributing to the overall net flows of the Ethereum ETFs. In contrast, Grayscale’s ETHE ETF experienced an outflow of $3.81 million, indicating the ongoing selling pressure with a total net asset value of $4.53 billion.

ETH ETF chart (Source: SoSoValue )

ETH ETF chart (Source: SoSoValue )

Moreover, in the past week, the total net inflow of spot Ethereum ETFs was observed at $10.83 million. The spot Ethereum ETFs have experienced a cumulative net inflow of $475.48 million to date. On the other hand, Ethereum ETFs witnessed a significant outflow of $39.21 million on August 15.

Meanwhile, US Bitcoin spot ETFs also witnessed a total net outflow of $105.19 million. Fidelity FBTC noted an outflow of $10.37 million, Ark Invest and 21 Shares ARKB witnessed $59.27 million outflow, and VanEck Bitcoin Trust ETF saw an outflow of $10.07 million.

Price Action of Ethereum (ETH)

The Ethereum price has experienced a brief recovery of 0.98% in the last 24 hours. At the time of writing, Ethereum (ETH) trades at $2,545. Whereas, the daily trading volume has dropped by 25.58% to $16.50 billion as per CMC data . The lowest and highest price of ETH traded is noted at $2,457 and $2,558, respectively.

Looking ahead, the short-term 9-day MA is found at $2,637 and the long-term 21-day MA at $2,627. Meanwhile, ETH is heading towards the neutral zone as the daily RSI stood at 41.07.

Highlighted Crypto News

Crypto.com Expands Global Retail Services Starting with UAE

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Solana Faces 50% Drop Risk as $125–$137 Range Holds the Key Amid Market Volatility

Panama City Council makes history as the first government institution accepting crypto payments

Share link:In this post: Panama City council voted in favor of becoming the first public institution of government to accept payments in cryptocurrencies. Citizens will now be able to pay taxes, fees, tickets and permits entirely in crypto starting with BTC, ETH, USDC, and USDT. The city partnered with a bank that will receive crypto payments and convert them on the spot to U.S. dollars, allowing for the free flow of crypto in the entire economy.

EnclaveX launch brings fully encrypted, cross-chain futures trading to retail investors

(Source:

(Source: