Ethereum ETF Flows Flip Positive

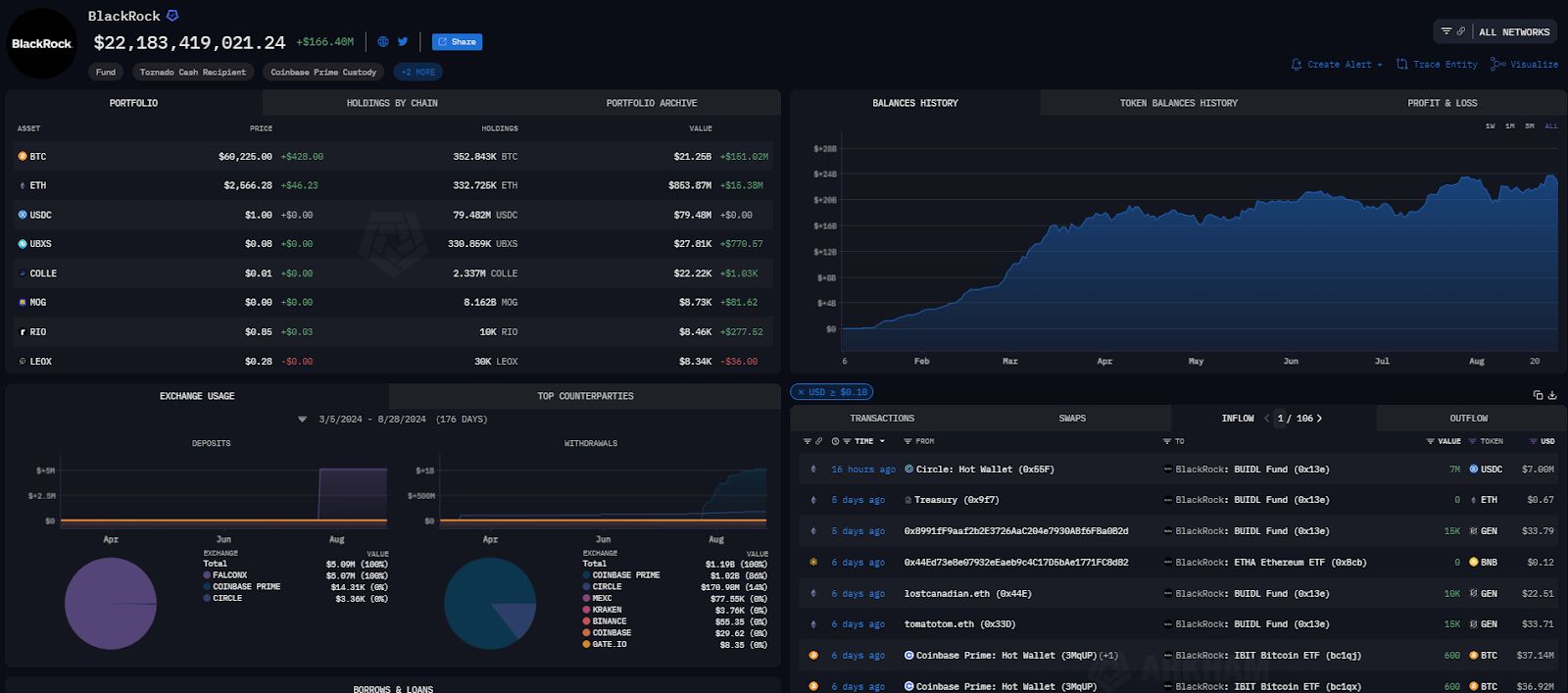

Ethereum spot ETFs have finally seen their first positive inflow day after two weeks of constant outflow since August 14. The day saw $8.4M in inflows to BlackRock’s ETHA after five consecutive days of no inflows for the ETF, while Fidelity’s FETH also saw $1.3M in inflows on the same day. The net positive inflow was also supported by Grayscale’s 3.9M outflow, its smallest outflow since 13th August.

The $5.9M net positive inflow may come as a relief to traders after days of negative flows and ETH’s relative weakness against other cryptocurrency majors. Ethereum founder, Vitalik Buterin, added to the negative sentiment with his recent comments on the circular nature of the current state of the Ethereum DeFi ecosystem, claiming them to be unsustainable.

On the same day, Bitcoin spot ETFs saw a collective outflow of $105.3M, with the majority coming from 21Shares’ ARKB. The outflows could possibly signal a rotation to Ethereum spot ETFs or simply a general derisking with a weakening equities market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Sets Higher Lows—Can Bulls Target $88K Resistance?

Solana Faces 50% Drop Risk as $125–$137 Range Holds the Key Amid Market Volatility

Panama City Council makes history as the first government institution accepting crypto payments

Share link:In this post: Panama City council voted in favor of becoming the first public institution of government to accept payments in cryptocurrencies. Citizens will now be able to pay taxes, fees, tickets and permits entirely in crypto starting with BTC, ETH, USDC, and USDT. The city partnered with a bank that will receive crypto payments and convert them on the spot to U.S. dollars, allowing for the free flow of crypto in the entire economy.

EnclaveX launch brings fully encrypted, cross-chain futures trading to retail investors