Is Akash Crypto The Best AI Coin Hodl? Here’s how AKT Price is Shaping Up

Akash Crypto Network is cozying up to Nvidia at the intersection of AI and blockchain, hinting at big moves as Nvidia’s earnings loom.

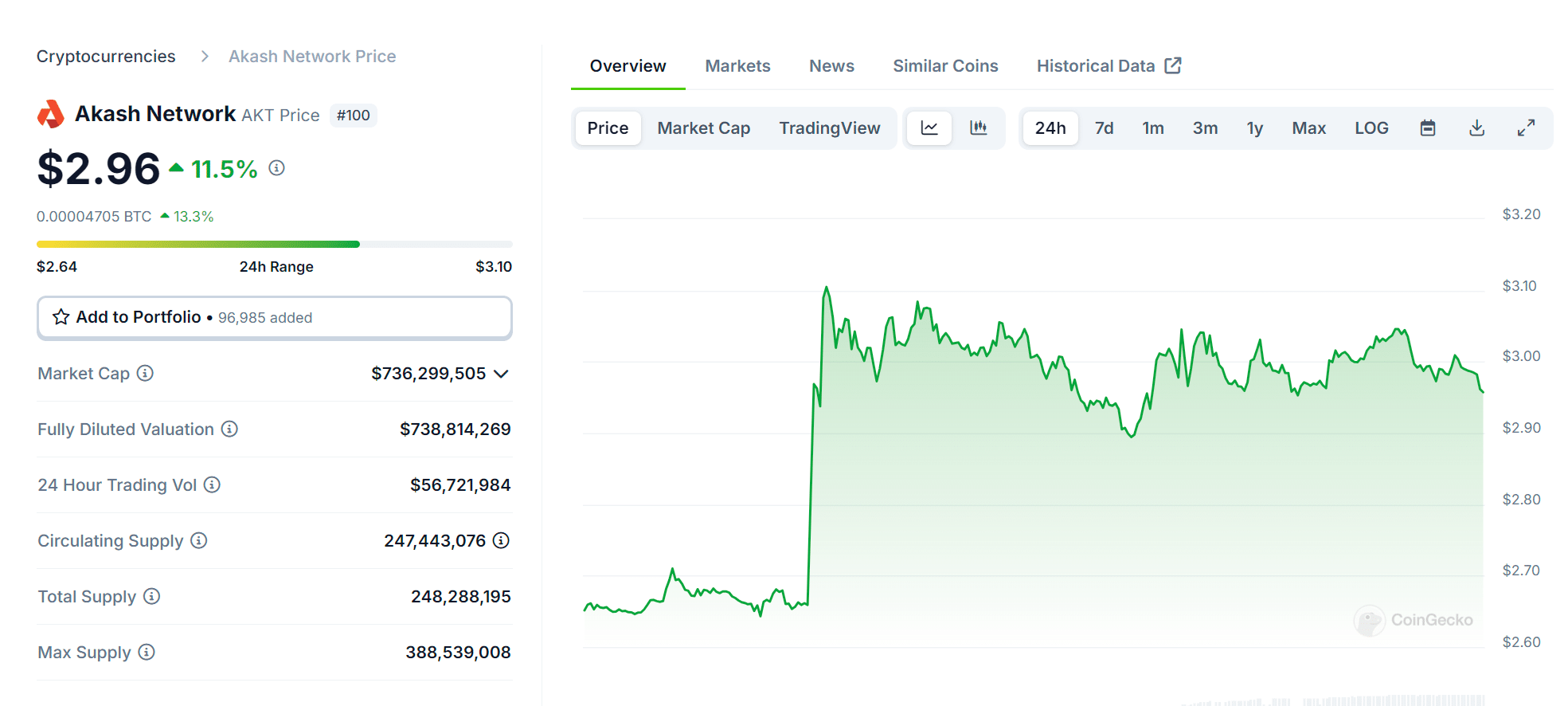

AKT, dancing around $2.90, faces off against the stubborn 50DMA barrier. Breakthrough here: we’re talking momentum that could catapult it past July’s peaks.

( CoinGecko )

( CoinGecko )

The countdown to Nvidia’s earnings has turned AI-centric cryptos into a hotbed of activity. Akash Network is up 10% but other AI crypto while Bittensor, Render Token, and Artificial Superintelligence Alliance have rocketed past 30%.

With Federal Reserve Chair Jerome Powell dropping hints of interest rate cuts in September, investors are recalibrating for what could be a bananas September.

DISCOVER: The Best AI Crypto Coins to Stack in 2024

The Nvidia Connection: A Boost for Akash and Render

Nvidia exploded this year with a 161% leap marking its territory in AI and semiconductors. With a $3.1 trillion market cap its weathered corrections like a seasoned veteran of the market.

All eyes are on its earnings report on Wednesday, which could be the first green flag that risk-on assets like tech and crypto are about to takeoff in September.

Former $NVDA employee shares his view on $NVDA :

– He thinks $NVDA has an aggressive roadmap. According to him, in 2026, $NVDA will make a chip called Rubin. For him, the most significant risk for $NVDA is if they don't execute on their roadmap.

– He also thinks $TSM can be a… pic.twitter.com/guARiJFM8w

— AlphaSense (@AlphaSenseInc) August 23, 2024

Positioned at the critical juncture of blockchain and semiconductors, Akash Network and Render Token are revolutionizing GPU rendering.

With Nvidia products in their toolkit, they depend heavily on Nvidia’s continued success.

Besides Akash, holders of Bittensor, AIOZ Network, Arkham, The Graph, and Internet Computer should pay close attention to Nvidia’s earnings report on Wednesday.

Akash and AI are Set to Outperform

As Nvidia’s financial report looms, the AI crypto world sits on the edge.

A solid performance could jolt AI tokens and stocks into the spotlight, sparking a frenzy of interest and investment. Yet, with opportunity comes risk—like other tech high flyers like Tesla and Microsoft, Nvidia’s price-to-earnings ratio is 44% above the historical average.

If earnings don’t meet expectations, the same momentum that would send it surging will crash it into the Earth’s crust.

EXPLORE: Aave is On the Verge of Titanic Breakout As Volumes Surge into Altcoins

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Experts Anticipate a Surge for SUI Cryptocurrency Based on Positive Indicators

In Brief SUI cryptocurrency shows optimism through positive technical indicators. Experts believe SUI is poised for a potential upward movement. Institutional predictions suggest significant price levels could be reached for SUI.

Massive OM Token Burn Sparks Investor Debate and Market Tension

In Brief Mullin announced a significant burn of 300 million OM tokens to reduce supply. Investor confidence is shaken as whale movements raise concerns about potential sell-offs. Market sentiment remains crucial as analysts call for additional measures for recovery.

Who is Patrice Evra, French football legend, set to speak at Token 2049 Dubai?

Elon Musk Takes Dig at Crypto Scammers Posing as “Hot Girls”