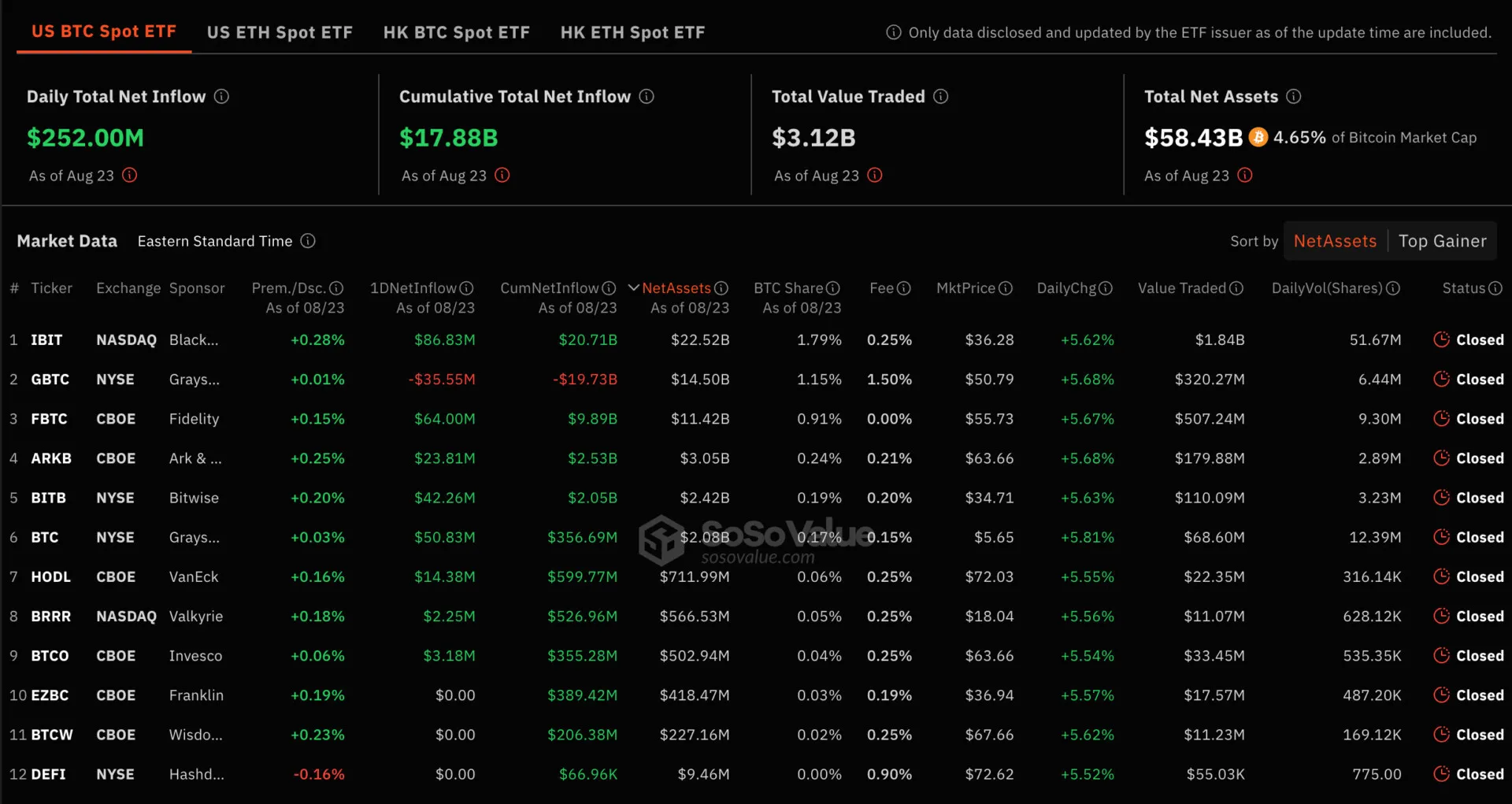

Bitcoin spot ETFs see $252M inflow, highest since July 23

Bitcoin spot ETFs just saw a huge inflow of $252 million yesterday, the biggest since July 23. Despite some funds like Grayscale’s GBTC seeing outflows, others like BlackRock and Fidelity pulled in big money.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Temu, Shein respond to tariffs by raising prices for American buyers

Share link:In this post: Shein and Temu have sharply raised prices for U.S. shoppers in response to the new Trump-era tariffs on Chinese goods. Some products on Shein have surged by up to 377%, while Temu has doubled prices on select items to offset potential tariff costs. Reports suggest this is just the first wave, with other major retailers expected to follow suit as the tariff regime fully kicks in.

EURC gains popularity in April, tracking the Euro rally

Share link:In this post: The Euro rally sparked speculation for EURC, Circle’s alternative currency stablecoin. EURC volumes increased in April, as the supply expanded to over 211M tokens. EURC is expanding its volumes on DEX, with new liquidity pools added to Solana markets Orca and Meteora.

Bitcoin's Bull Run Reloads: Analyst Expects BTC to Break All-Time Highs

XRP price rises 10% in a week as long-term holders reduce selling