Orbiter Finance hits $50M annual revenue amid Layer-2 surge

Orbiter Finance has achieved a significant milestone, securing over $50 million in annual revenue, largely driven by the growing adoption of Layer-2 (L2) blockchain solutions.

This success places Orbiter among the most profitable decentralised cross-chain protocols in the L2 space, surpassing other third-party cross-chain bridges in revenue generation.

Layer-2 solutions have become increasingly popular as they enhance blockchain scalability by offloading transaction processing from the main chain.

This reduces congestion, lowers fees, and increases transaction throughput, making these solutions highly sought after in the decentralised finance (DeFi) sector.

Orbiter Finance has capitalised on this trend, processing over 24 million transactions and serving more than 4 million users globally.

The protocol operates within the Ethereum (CRYPTO:ETH) ecosystem, facilitating asset transfers across multiple L2 networks such as zkSync (CRYPTO:ZK) and Arbitrum (CRYPTO:ARB).

Its innovative use of zero-knowledge (zk) technology has been a key factor in its success, allowing Orbiter to capture over 50% of the cross-chain market share.

This strategic move into zk technology has proven to be a major driver of Orbiter’s growth, setting the stage for its continued leadership in the DeFi space.

In addition to its impressive transaction volume, Orbiter Finance has processed over $16 billion in transaction volume to date.

The Maker system, a crucial revenue engine within the protocol, has significantly contributed to this achievement.

The company’s focus on seamless cross-chain transactions ensures that users can interact with the blockchain without perceiving any fragmentation among L2 solutions.

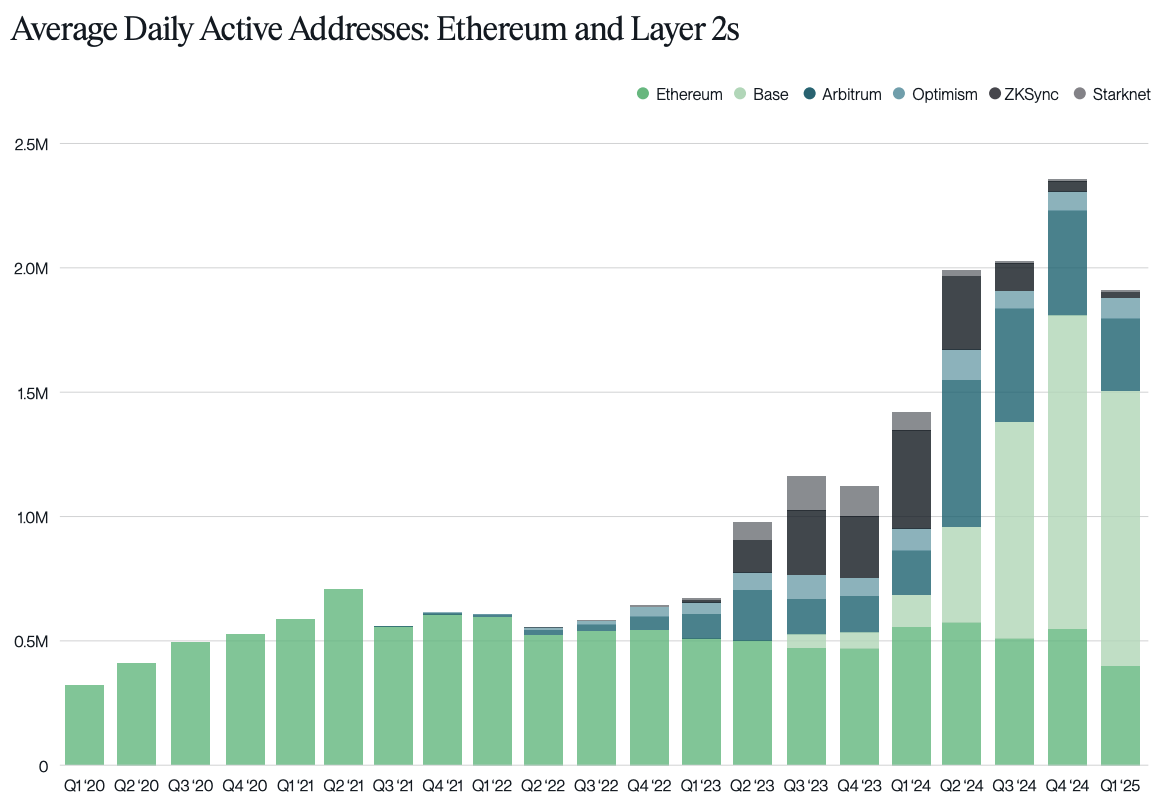

As the demand for scalable and efficient blockchain solutions continues to rise, L2 networks like Arbitrum, Optimism (CRYPTO:OP), and Base have become central to the DeFi narrative.

The total value locked (TVL) in L2 networks now stands at $18.19 billion, reflecting the growing importance of these solutions in the broader crypto ecosystem.

Orbiter Finance's success underscores the ongoing shift towards more scalable blockchain infrastructures, with the company poised to maintain its leadership position in the evolving DeFi landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Over $4 Billion Moved by Cryptocurrency Scams in Paraguay

Justin Sun Stands Firm: No Plans to Sell Ethereum Assets

In Brief Justin Sun insists on retaining Ethereum assets despite market downturns. Plans for collaborations with Ethereum developers aim to enhance Tron's vision. Strategic partnerships could strengthen Tron's market position moving forward.

Crypto Capo Predicts Bitcoin Surge as Market Signals Shift

In Brief Crypto Capo predicts a potential Bitcoin surge beyond $85,000. Render shows promise if it bounces back from its support level. Investors are advised to monitor market dynamics closely.

Stablecoin transactions outpaced Visa payments last quarter: Bitwise

Q1 may have been “frustrating,” but things are looking brighter for Q2