FTX Says Its Reorganization Plan Approved by 95% of Creditors

The once-mighty FTX has reached a pivotal point in its bankruptcy journey.

Creditors are rallying behind the new reorganization plan, signaling strong preliminary support.

Does this mean you’re getting money back if you lost money on the exchange? The short answer is yes, but not all of it.

FTX Creditor Approval Highlights

For the beleaguered FTX and its affiliates, this was a win for their customers. They announced that their revamped reorganization plan has the majority backing from every creditor class, straight from Delaware’s court.

“Over 95% of creditors who had already submitted their votes favored the plan. This represents 99% of voted claims by value.” – FTX

With solid preliminary backing, FTX’s reorganization plan looks set to clear the US bankruptcy code hurdles. Two-thirds of the solicited claims weighed in, and the final tally is heading to court ahead of the October 7 hearing.

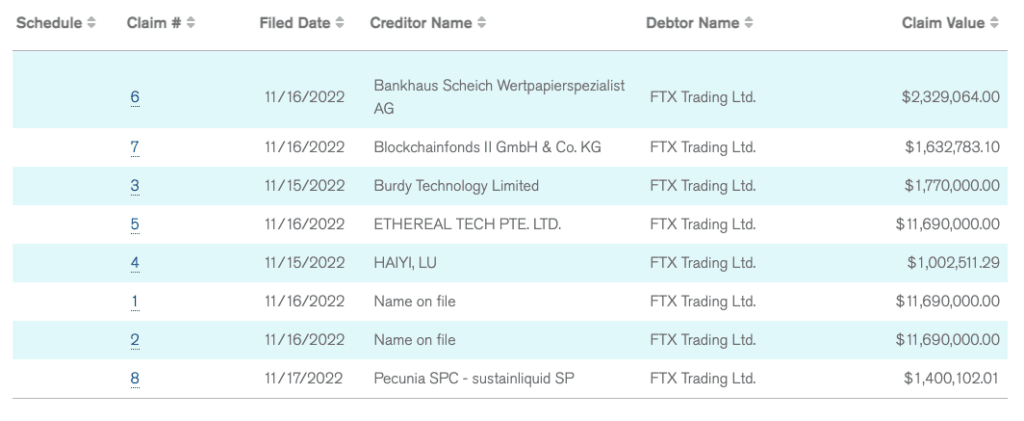

( FTX Creditors )

( FTX Creditors )

Not all FTX customers are satisfied with the plan despite strong initial support. activist Sunil Kavuri, representing FTX customers, voiced concerns over the valuation of crypto holdings within the plan.

Kavuri said customers were unhappy with the valuation of the crypto holdings within the plan.

He and a group of FTX creditors objected to the reorganization plan, stating that receiving cash reimbursement would incur unnecessary taxes for creditors. Kavuri also claimed that the plan violates creditors’ property rights, and asserted that FTX should return the coins in their original form.

CEO’s Statement on Creditor Support

FTX’s Chief Restructuring Officer, John Ray III, is betting big on the reorg plan, and the voting numbers back him up.

“Importantly, the Plan’s innovative structure provides for the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors and resolves complex disputes with dozens of governmental and private stakeholders.” -John Ray III, CEO of FTX

John Ray III, appreciative of stakeholder collaboration, reiterated their commitment to creditors and the court. When the company crashed on November 2, 2022, the crypto market cap was $840 billion. Now, it’s at $2.1 trillion, painting a complex backdrop for how all this plays out.

As the October 7 confirmation hearing approaches, all eyes will be on FTX to see how these issues are resolved and if… dare we say it… comeback?

EXPLORE: Bybit Introduces Digital Rupee Payments For Indian Users

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KindyMD Boosts Bitcoin Strategy with $51.5M Funding

KindyMD and Nakamoto Holdings secure $51.5M more in PIPE funding, raising total to $763M to support a Bitcoin treasury strategy.A Strategic Bet on BitcoinBuilding a Bitcoin-Native Future

Is Qubetics the Best Coin to Buy Today, While Bitcoin Trades at $105K and Immutable X Falls 18.56% This Week?

Qubetics advances its crypto presale as the best coin to buy today, while Bitcoin trades at $105K and Immutable X falls 18.56% this week.Qubetics Introduces Non-Custodial Multi-Chain Wallet for Maximum ControlBitcoin Trades Steady Near $105,000 as Corporate Treasury Buys ContinueImmutable X Slides 18.56% This Week, While Trading Volume Drops SharplyConclusion: Practicality and Presale Security Define the Best Coin to Buy Today

Velo Price Surge: Can $VELO Reach $1? 🚀

After a 3,700% rally, $VELO is eyeing a $1 breakout. Discover why the altcoin may surge 88× and what could drive its next move.What to Watch

Norway to Pause Power‑Intensive Bitcoin Mining

Norway to temporarily ban high‑energy Bitcoin mining in autumn 2025 to conserve power for other industries.Limited Local Benefit from High‑Energy MiningWhat’s Next: Autumn 2025 Ban and Broader ImpactEnvironmental and Energy Policy Implications