Binance & CZ Must Tackle Fresh Troubles as New Lawsuit Emerges

- Crypto exchange Binance is facing new legal woes.

- Binance and CZ have been named in a lawsuit for misconduct.

- The exchange previously faced sanctions over money laundering ties.

Binance , the largest crypto exchange by trading volume, has recently faced intense legal challenges, including sanctions and convictions for regulatory violations. The troubles culminated in a hefty financial penalty , the ousting of its founder Changpeng Zhao (CZ) , and his criminal sentencing, marking an end to its most intense chapter.

While the dust has only begun to settle for the exchange and Zhao, a new looming battle threatens to reopen old wounds and extend their woes even further.

Binance, the “Get-Away Driver” for Laundering

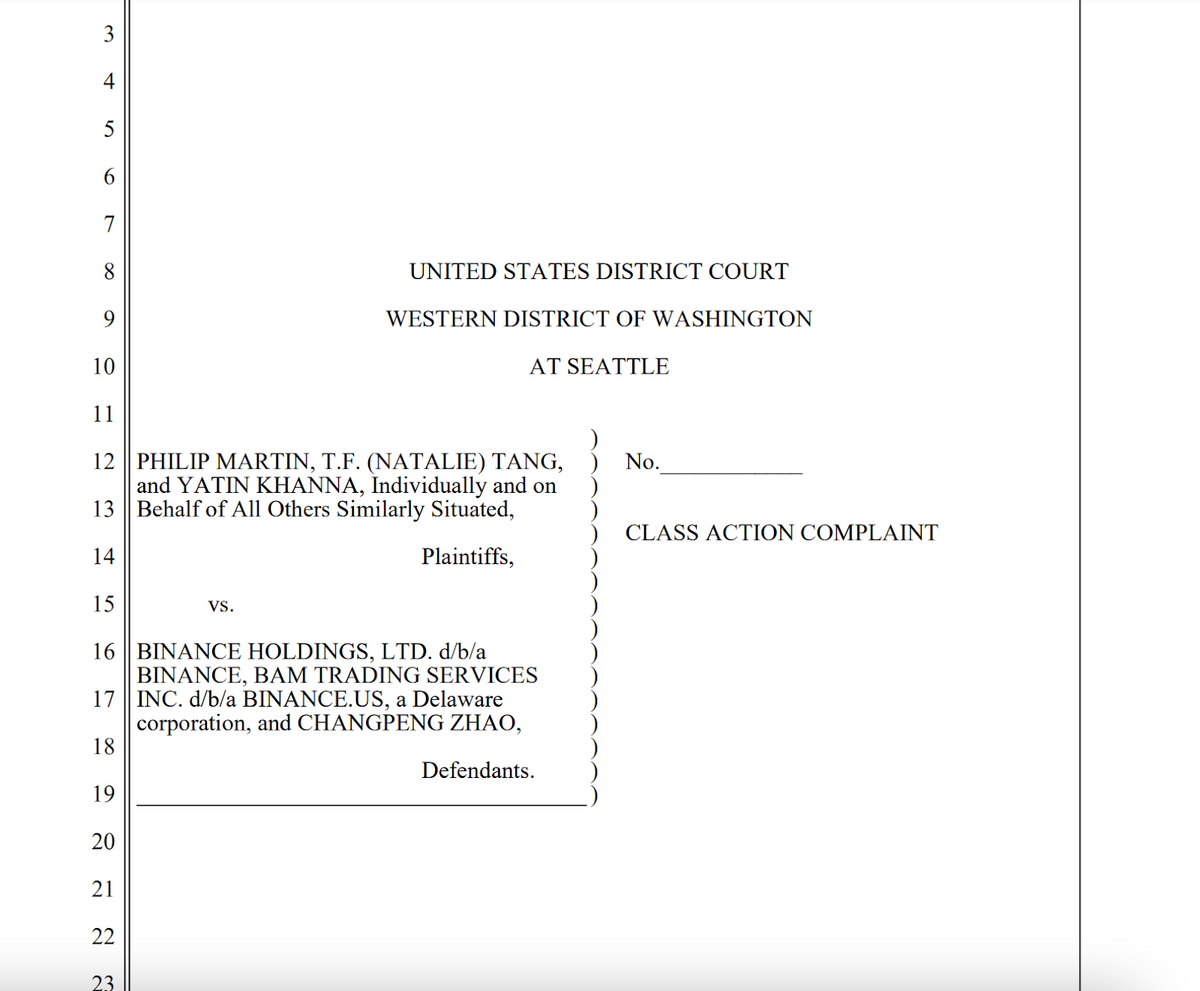

Binance and its former CEO, Changpeng Zhao, have again been thrust into the spotlight for all the wrong reasons. On August 16, 2024, a group of plaintiffs filed a class action lawsuit in the United States District Court for the Western District of Washington, Seattle, against the two with fresh allegations over its money laundering ties.

Sponsored

According to the lawsuit, under CZ’s leadership, Binance failed to prevent money laundering and violated U.S. laws, leading to substantial financial losses for three investors. Plaintiffs argue that bad actors funneled stolen funds through the exchange, using its platform to obscure their trail and any chances of recovery.

The lawsuit added that Binance’s involvement constitutes illegal racketeering in violation of the Racketeer Influenced and Corrupt Organizations Act (RICO) statute. It added that without Binance’s role, the transparency of blockchain would have given victims a better chance to recover their stolen assets.

“Defendants’ willful disregard of these important laws and regulations turned Binance.com into a magnet and hub for criminals,” the lawsuit stated, adding that, “Binance.com became a critical part of their efforts to launder crypto which was stolen or obtained by other unlawful means. Binance.com became a preferred-choice as the “get-away driver” for a large number of bad actors.”Another focal point of argument was the exchange and CZ’s conviction by the DOJ. The plaintiffs added that Zhao’s guilty plea and apology are admissions of guilt for putting profits before the law, and they are now seeking compensation for damages.

Binance and CZ in Hot Water with New Lawsuit

Weighing in on the allegations, Consensys Lawyer Bill Hughes emphasized that the case marks another legal headache for Binance. While he characterized the lawsuit as a “predictable follow-on civil action,” which typically emerges after government prosecutions, he stated that it constitutes a tough spot for both Binance and CZ.

Sponsored

Hughes highlighted the strength of the plaintiff’s legal team, noting their history of taking on major cases against entities such as Facebook, opioid manufacturers, and Wells Fargo.

“Their pockets are deep and they smell the blood in the water,” he stated.He, however, pointed out that the plaintiffs might face challenges in proving their key argument that Binance’s role played a role in the asset thefts. Nonetheless, Hughes warned that if the case goes far into discovery, the effectiveness of blockchain tracing tools and asset recovery could come under scrutiny, further complicating matters for the exchange.

On the Flipside

- CZ is presently serving his prison term , with an expected release date of September 29, 2014.

- Following its conviction by the DOJ, Binance paid a whopping $4.3 billion in fines, the largest financial penalty ever imposed on a money services business.

- The courts have dismissed most past class action lawsuits against Binance. However, in March 2024, an appellate court revived a similar class action lawsuit from 2020.

Why This Matters

The latest class action lawsuit represents a new legal battle for Binance and CZ. With their reputation already damaged by previous enforcement actions, this new lawsuit adds further pressure, and the case outcome holds significant implications for the duo’s future.

Read this article for more about Binance’s legal troubles:

SEC Wins Key Claims in Lawsuit Against Binance: What Now?

Here’s how this Japanese investment firm is furthering its BTC-focused vision:

Metaplanet Boosts Bitcoin Holdings with $3.4 Million Acquisition

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Whale Sells $5.48M in TRUMP Token, Gains $483K

A crypto whale offloaded 630,339 TRUMP tokens for $5.48M, pocketing nearly $483K in profit at $8.70 per token.Whale Exits TRUMP Token with Nearly Half a Million in ProfitSmart Profit-Taking or Early Exit?Whale Moves as a Market Signal

Buy Low, Fly High: Arctic Pablo at $0.000099 Eyes $0.008 Surge, While Fwog And Pudgy Penguins Push Boundaries

Explore Arctic Pablo Coin's presale, Pudgy Penguins' gaming expansion, and Fwog's market trends. Discover the Top New Meme Coins to Invest in April 2025.Arctic Pablo Coin (APC): Staking and RewardsArctic Pablo Coin (APC): Presale Reaches Frostbite CityPudgy Penguins: Expanding into Mobile GamingFwog: Gaining Momentum in the Meme Coin MarketWrapping Up: Arctic Pablo Coin (APC) Stands OutFor More Information:

Australian Court Overturns License Ruling Against Block Earner, Sides with Fintech in Landmark Crypto Case

In a significant legal win for Australia’s crypto and fintech industry, the Federal Court has overturned a previous ruling that required digital finance firm Block Earner to obtain a financial services license for its discontinued fixed-yield crypto product.

Symbiotic Raises $29 Million to Build Universal Staking Coordination Layer

Symbiotic, a decentralised finance (DeFi) protocol, has secured $29 million in a funding round led by Paradigm and cyber.Fund.