Bitcoin Faces Resistance at $60,000 Amid Rising Short Positions

Bitcoin's recent attempt to surpass $60,000 was met with strong resistance, resulting in a 2.6% drop to $58,450.

This decline follows a significant increase in short positions, with volumes rising 118% to $18.3 billion across various exchanges. High-leverage positions, particularly on Binance, are at risk of liquidation, indicating potential market volatility.

My guess is all those 50x and 100x leveraged shorts on Binance will be wiped out soon 👇 We see you lads 🤷♂️ pic.twitter.com/MKuvUvGZJC

— HODL15Capital 🇺🇸 (@HODL15Capital) August 19, 2024

In the past day, over $77 million in cryptocurrency positions were liquidated, with Ethereum contributing $19.5 million to this total.

ETF flows into Bitcoin and Ethereum funds have been tepid recently. Bitcoin ETFs had a modest net inflow of $32.5 million, but saw significant outflows from Grayscale’s GBTC. In contrast, Ethereum ETFs faced net outflows of $1.4 million, despite some inflows into funds managed by BlackRock and Fidelity.

The focus now shifts to the upcoming FOMC meeting and statements from Federal Reserve Chair Jerome Powell, which could influence Bitcoin’s price in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

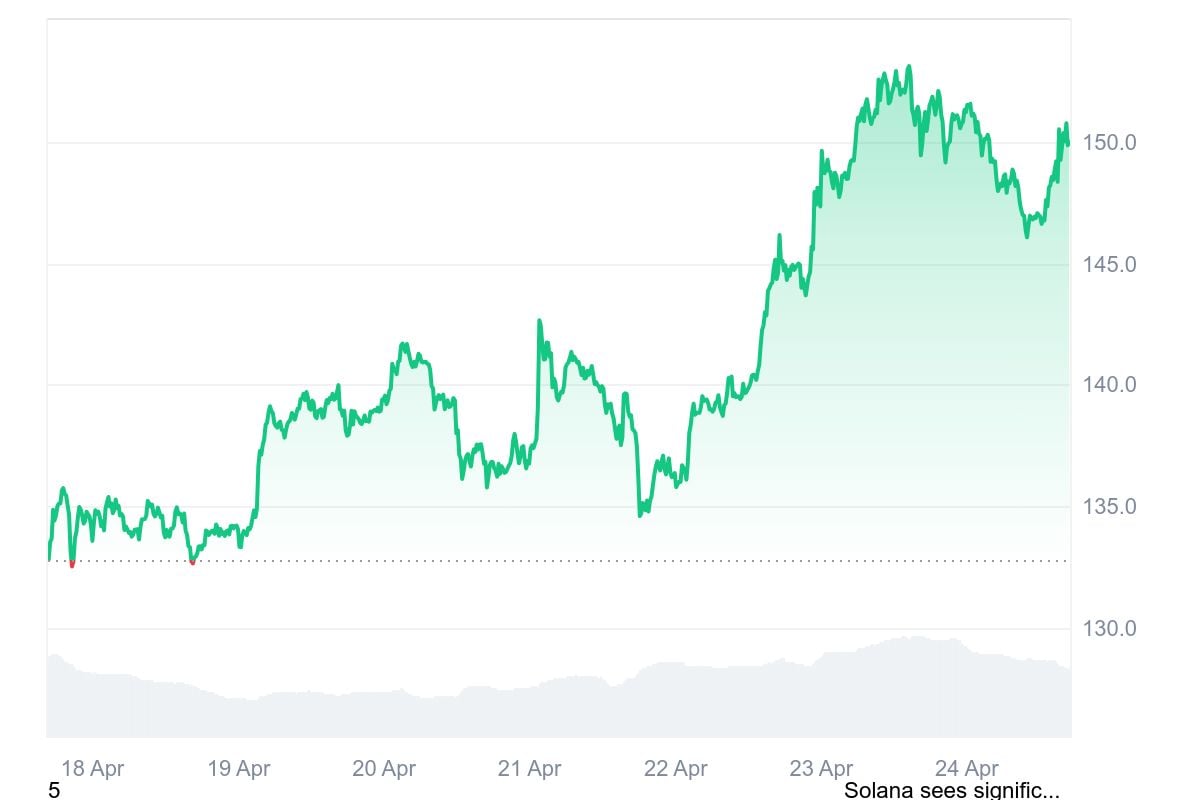

Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level

Tariffs and Bitcoin, what is the connection?

Charles Hoskinson Claims Ethereum May Collapse as Layer 2s Drain Value

Bitcoin Price Breakdown Alert – $78,000 Incoming as Head & Shoulders Pattern Confirmed