Hyper Focused on Bitcoin: Make Volatility Great Again

10xResearch2024/08/09 02:57

By:Markus Thielen

👇1-12) As highlighted in

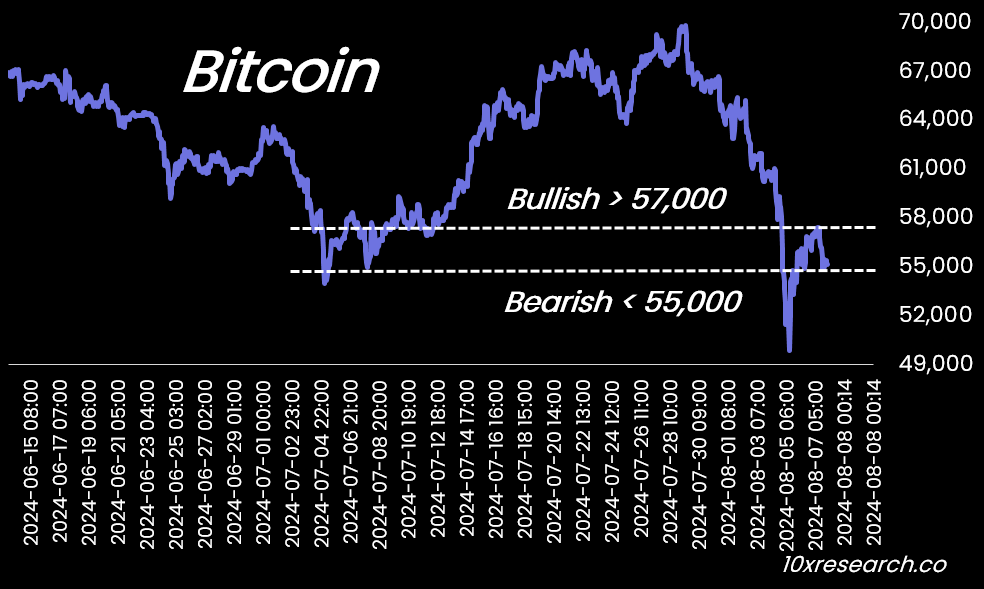

yesterday’s chart, Bitcoin breaking above 57,000 signaled a potential tactical bottom during this high-volatility period despite our medium-term caution due to weak economic data. Monday's -18% intraday drop illustrated the risks of attempting to catch a falling knife. However, as Bitcoin aimed to establish a base within the 55,000 to 57,000 range, a break above this level offered a favorable risk/reward scenario with a tight stop loss.

Chart from

yesterday’s report

, Bitcoin breakout > 57,000. Today: 61,900

👇2-12) This market is moving rapidly for traders. Although investors missed the chance to buy on Monday and Tuesday, we've observed significant buying activity over the past 24-36 hours. Tether has minted $1 billion, Circle has minted $1.6 billion, and Binance has reported $2.4 billion in inflows since the market drop on August 5. Additionally, a US judge has approved FTX's repayment of $12.7 billion to creditors, potentially redirecting a significant portion (50%) back into crypto by December. Bitcoin successfully closed the CME gap at 63,000, which had been open since the market drop on August 5.

👇3-12) As more institutions enter the Bitcoin market, volatility has decreased over the years, with institutions often acting as sellers of volatility by selling puts and calls to generate yield. The SEC is expected to approve Bitcoin ETF options by the September 21 deadline, potentially launching later in Q4. This development will likely attract market makers' interest and provide traders with affordable convexity for directional bets. More regulated derivatives exchanges are set to launch this year. For options insights, check out

https://options-insight.com/tools/

👇4-12) Over the past two months, 30-day realized volatility has more than doubled, culminating in a significant spike in implied volatility on Monday. It became evident that a major downside move was imminent this week. Traders could have capitalized on this by purchasing inexpensive put options when volatility was low and then shifting their positions to call spreads (buying one 60k call and selling two 70k calls) to benefit from a rising BTC price and a likely decline in volatility, thus profiting from selling two higher strike calls.

Bitcoin: 30-day realized volatility back to the 5-year average at 61%

👇5-12) Markets did not rebound on Tuesday despite being oversold on Monday. Instead, on Thursday, a lower-than-expected number of jobless claims, a strong leading indicator for the monthly US employment report, triggered a significant short-cover rally. Although the 4-week average of jobless claims increased, the market will remain sensitive, volatile, and tactical around employment and economic growth data points, showing less sensitivity to lower inflation in either scenario.

👇6-12) Last week, a weak ISM Manufacturing PMI print heightened recession concerns, which were somewhat alleviated when the ISM Services PMI rebounded above 50. From an economic cycle perspective, we do not anticipate the economy suddenly accelerating during the summer months or amid US election uncertainty. However, there is a scenario where countries, fearing potential tariffs from Trump, might restock ahead of the election outcome.

👇7-12) The likelihood of the US economy and labor market weakening this fall remains high, and better economic data suggests reduced Fed stimulus. Next week’s inflation report (August 14) could have negative implications if it exceeds the previous 3.0% figure. As a result, all developments must be viewed through a tactical lens at this time. Volatility could remain high.

Bitcoin (RHS) vs. BTC and ETH liquidations (LHS, $mln)

👇8-12) Although liquidations exceeding $300 million (BTC + ETF) have often indicated local, tactical bottoms, we remain cautious about taking long-term positions. The most recent liquidation of $622 million has resulted in significant losses for many traders. If the funding rate stays near or below zero, it signals that futures traders are not currently driving the market, unlike their role in the February 2024 run-up to all-time highs.

👇9-12) Futures liquidations are much smaller and likely less noticeable than the 2020/2021 bull market. However, yesterday, they signaled that many short positions would be stopped, with Bitcoin moving above 57,400 toward 58,000. This helped start this short cover rally.

👇10-12) Volatile periods inevitably revive FOMO during rallies and panic during crashes. However, the macroeconomic conditions necessary for a significant upside price spike are currently absent. The GDP print on July 25 was much higher at 2.8% compared to the previous three months, which were in the 1.3-1.6% range. The market will be particularly sensitive if we receive a GDP print of around 1.5% on August 29 (this is an assumption, not a prediction). Data volatility is expected to persist at economic turning points, and Bitcoin’s volatility will likely follow suit.

👇11-12) From a seasonal perspective, Q3 is typically the most volatile and challenging quarter for trading. Despite the optimism around Bitcoin Spot ETFs in the summer of 2023, Bitcoin saw a sell-off into mid-September before staging a significant rally in Q4.

👇12-12) In this environment, a tactical approach that prioritizes early profit-taking and disciplined risk management is essential. Incorporating options could help manage FOMO and mitigate risks, especially as markets can quickly reverse the emergence of a new narrative. After the 57,000 breakout, we would wait for another high(er) risk-reward instead of piling into new, long-term positions. It is all tactical now.

13

7

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

BTC Weekly Candle Closes at $80K After Bounce From 74.4K Support

CryptoNewsNet•2025/04/12 16:55

Hedera price targets $0.19 after brief 1% spike

Coinjournal•2025/04/12 16:00

Dogecoin price set for 364% rally as RSI breakout pattern emerges

Coinjournal•2025/04/12 16:00

Grayscale expands altcoin list to 40 in April 2025 update, adds Dogecoin and PYTH trusts

Coinjournal•2025/04/12 16:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$85,181.51

+2.18%

Ethereum

ETH

$1,646.5

+5.14%

Tether USDt

USDT

$0.9998

+0.03%

XRP

XRP

$2.15

+6.75%

BNB

BNB

$596.79

+1.77%

Solana

SOL

$132.03

+9.45%

USDC

USDC

$0.9999

+0.01%

Dogecoin

DOGE

$0.1677

+4.94%

TRON

TRX

$0.2465

+1.32%

Cardano

ADA

$0.6592

+5.73%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now