The Stakes Are High!!! Critical Dates for Bitcoin Traders

10xResearch2024/08/08 03:57

By:Markus Thielen

Institutional Crypto Research Written by Experts

👇1-14) Many of our

10x Research subscribers sold Bitcoin in the $64,000 to $68,000 range and are now waiting for favorable re-entry levels. We anticipated a break from the $60,000-$70,000 Bitcoin range, but a new, potentially much lower range has yet to be established. The recent dip had us itching to buy, but our back test of Monday's significant intraday move suggested caution.

👇2-14) Additional selling from Jump Trading was noted on Wednesday (besides Sunday/Monday), with the risk manager taking control of positions and showing less concern about where prices would get filled. The persistent liquidation pressure from various players remains a significant concern for Ethereum.

👇3-14) Instead of seizing the dip opportunity, Bitcoin Spot ETFs have experienced continuous outflows recently, with no significant inflows from stablecoins. The absence of buyers during this dip is alarming and raises concerns about the market's direction.

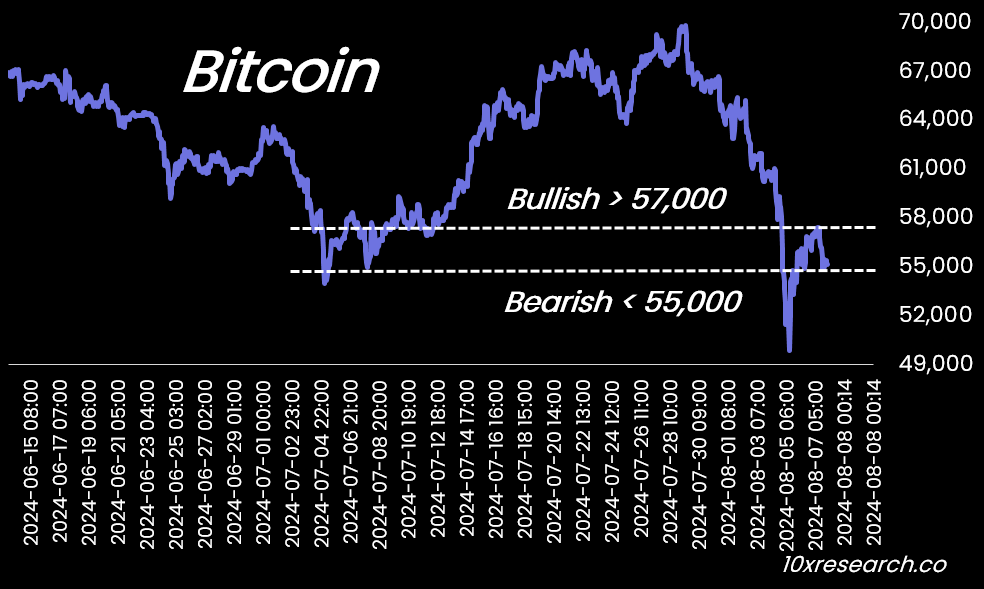

The Stakes Are High: Bullish > 57,000? And Bearish < 55,000?

👇4-14)

Yesterday, we noted Bitcoin's attempted rebound but highlighted the significant resistance in the $56,000-$57,000 range, a barrier to the rally sparked by the Japanese central bank's statement. However, the Bank of Japan has not pressed the rewind button, only the ‘pause’ button, as they will likely hike rates again. Our key message emphasized that even if the market moves past the hype surrounding the Japanese carry trade news, the downside risk for the Nasdaq persists, and Bitcoin could see further declines.

👇5-14) Markets often latch onto a single narrative, leading to misleading signals once the initial news fades (such as the Bank of Japan carry trade). The recent earnings reports from major US tech companies have prompted investors to reevaluate. As the primary driver of stock returns over the past years, this earnings season has implications for a deeper stock market decline.

👇6-14) Many of these companies' earnings reports needed to clarify how their significant AI investments would translate into future earnings. NVIDIA, a key market driver and main beneficiary of AI spending, will report its earnings on August 28. Weaker margins, as indicated by SMCI (-20% after earnings), could push the Nasdaq even lower unless investors anticipate and act on any negative news. Google also reported a 5% decline in its network advertising business, indicating that companies are pulling back from ad spending.

👇7-14) Weak US consumer credit data, which dropped from $11.3bn to $8.9bn (below the expected $10bn), mainly due to rare negative credit card debt and soaring delinquencies, signals a collapsing personal savings rate. This is significant for crypto as it suggests the fiat-to-crypto onramp will remain constrained due to maxed-out US consumers.

👇8-14) Comparisons between the current Bitcoin run and the 2020/21 bull run should consider the COVID stimulus checks that fueled the GameStop and crypto trading frenzy. Now, that money has dried up, posing a risk to the US economy that could impact Bitcoin, especially altcoins.

👇9-14) Some may dismiss the 0.50% increase in the US unemployment rate above the 12-month moving average (the Sahm rule), but a 10% stock market decline is unlikely to spur a hiring spree. It will likely add to labor market turmoil, especially with the uncertainty surrounding the next US president, Trump or Harris.

👇10-14) Historically, since 1900, there's a 44% chance of a US recession in the first year of a new presidency (2025). Hence, the negative feedback loop is from a weakening economy to weaker stock prices and economic data.

👇11-14) The Fed acted too late despite lower consumer spending and declining advertisement revenue signaling reduced inflation. As warned on

October 3, investors should sell after the first rate cut if linked to weaker economic growth, which our ISM Manufacturing index analysis confirms. An ISM reading near 42 (last at 46.8) would indicate a recession and a weak economy for the incoming president, with the previous GDP boost driven by inventory building.

👇12-14) Despite the CPI report on August 14 and the NVIDIA earnings call on August 28, key data releases on September 2 (ISM) and September 6 (labor market) are critical. Fed Chair Powell’s speech at Jackson Hole on August 22-24 and the September 18 Fed meeting will be pivotal in setting market expectations.

👇13-14) Despite the pause in the Japanese carry trade unwind, US economic uncertainty persists, impacting the predictability of US tech earnings. The Bitcoin rally stalled on July 21 when Biden dropped out, reducing the likelihood of a Trump win, adding to election uncertainty. Without clear signs of Bitcoin investors buying the dip through ETFs or fiat-to-crypto stablecoin onramps, Bitcoin may settle within the $50,000 to $60,000 range, with a broader risk range of $40,000 to $60,000.

👇14-14) The outcome of the events on those key dates will decide the new battleground range. Mark your calendar….

The new battleground: $50,000 to $60,000? Or $40,000 to $60,000?

5

4

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Bitcoin Loses 7-Month Trend Support and 64.4% Level Sparks Shift

Cryptonewsland•2025/07/13 10:30

BTC’s Weekly Candle Hints at $135K Fibonacci Target

Cryptonewsland•2025/07/13 10:30

Shiba Inu Eyes July Rebound After June’s 11% Dip

Cryptonewsland•2025/07/13 10:30

JASMY’s RSI Breaks 60: Is a Major Trend Reversal Underway?

Cryptonewsland•2025/07/13 10:30

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$117,803.49

-0.30%

Ethereum

ETH

$2,949.94

-0.99%

XRP

XRP

$2.79

-1.87%

Tether USDt

USDT

$1

-0.01%

BNB

BNB

$690.32

-0.52%

Solana

SOL

$161.88

-0.64%

USDC

USDC

$0.9999

-0.01%

Dogecoin

DOGE

$0.1972

-2.54%

TRON

TRX

$0.3019

-1.12%

Cardano

ADA

$0.7296

-0.14%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now