BREAKING: Top U.S. Bank to Allow Consultants to Promote Bitcoin ETF

A few days ago, Bloomberg reported that Morgan Stanley will enable thousands of its financial advisors to start recommending spot Bitcoin exchange-traded funds (ETFs) to clients in the near future.

The firm has reportedly informed its 15,000 advisors that they can begin offering clients the option to invest in BlackRock Inc.’s iShares Bitcoin Trust (IBIT) or the Fidelity Wise Origin Bitcoin Fund (FBTC). Despite multiple reports, including one by CNBC, Morgan Stanley chose not to comment on the development at the time.

According to new information from multiple sources on X (Twitter), including Poloniex and Cointelegraph , the bank’s financial advisors are officially allowed to offer clients trading in Bitcoin ETFs as of today, a historic first for a major bank.

The new policy restricts offers to clients who meet certain criteria: they must have a net worth of at least $1.5 million, possess a high-risk tolerance, and be interested in speculative investments.

Morgan Stanley’s move may influence other banks that are cautious about entering the digital asset space to reconsider their stance. After the U.S. Securities and Exchange Commission approved several spot Bitcoin ETFs in January, those funds have significantly exceeded expectations in terms of assets and flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 jumps 1.6%, Nasdaq 2.2% as Big Tech leads rally on trade optimism

Share link:In this post: The S&P 500 rose 1.6% and the Nasdaq jumped 2.2% as tech stocks like Nvidia and Amazon rallied. China confirmed there are no trade talks happening with the U.S. and called for removal of tariffs. Trump said he’s open to less confrontation on trade, but no details or negotiations have been set.

Trump teases third term with 2028 hat. Just how far can he go?

Share link:In this post: Trump is now selling a “Trump 2028” hat, openly signaling interest in a third presidential term. The original product description hinted at rewriting the Constitution but was later changed. Trump told NBC News he’s considering legal ways to bypass the two-term limit, including running as vice president.

Stablecoins can expand to $1.6T by 2030, says Citigroup

Share link:In this post: Citigroup predicts $1.6T in stablecoin supply by 2030 in a base scenario and up to $3.7T in a bullish development. Stablecoins may replace cash reserves and some fintech apps. Blockchain may make a comeback for public spending, disbursements and transparent tracking.

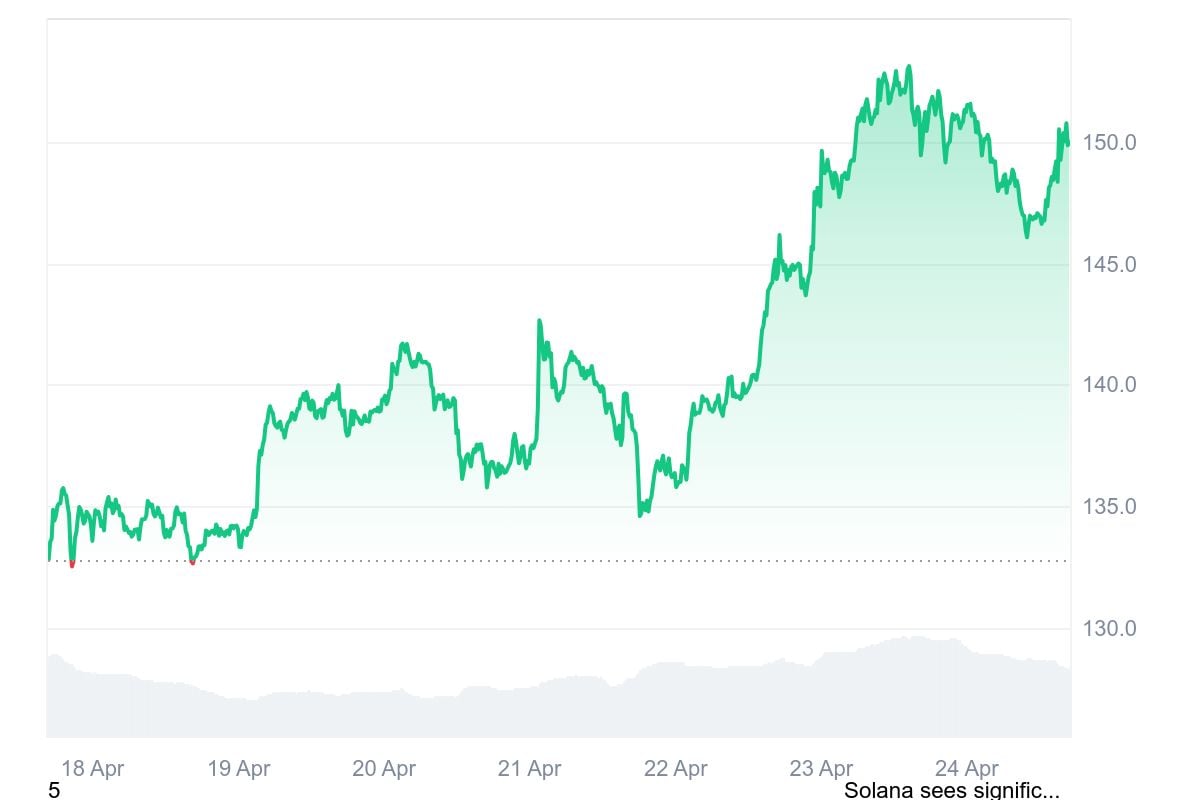

Solana Sell-off Risk Fades as SOL Price Reclaims Key Resistance Level