Bitcoin ETP Launched by Fidelity International on London Stock Exchange

- The Fidelity Physical Bitcoin ETP is backed entirely by Bitcoin and attempts to follow its price.

- An ongoing charge figure (OCF) of just 0.35% gives a competitive advantage.

Launched on the London Stock Exchange (LSE), Fidelity International’s Physical Bitcoin Exchange Traded Product (ETP) is a revolutionary step. Professional investors are taking notice of this as a major development for cryptocurrencies in the UK. This announcement has boosted crypto market players’ confidence amidst a lot of chatter in the ETF sector.

Following the FCA’s decision to permit crypto asset-backed Exchange Traded Notes (ETNs) for professional investors, Fidelity has introduced its new product. Companies like Fidelity, WisdomTree, and Global X are now able to provide crypto products to customers in the UK. This is because of the shift in regulations.

Growing Investor Interest

The Fidelity Physical Bitcoin ETP, on the other hand, is backed entirely by Bitcoin . And attempts to follow its price fluctuations. With an ongoing charge figure (OCF) of just 0.35%, a considerable decrease from its previous 0.75%, it gives a competitive advantage. The rising interest in cryptocurrency around the world was highlighted by Stefan Kuhn, Head of ETF Index Distribution in Europe at Fidelity.

Moreover, he said that the first Bitcoin exchange-traded funds (ETFs) which were approved in the US by the SEC , caused this spike. Also, digital assets provided via safe and regulated exchanges are becoming more popular. And the FCA’s approval is a reflection of that, says Kuhn. An easy and safe way for UK-based professionals to invest in bitcoin is via the Fidelity Physical Bitcoin ETP, he said.

Furthermore, as the custodian, Fidelity Digital Assets (FDA) guarantees the utmost dependability and security. Also, Bitcoin ETP, which debuted in February 2022 on the SIX Swiss Exchange and the Deutsche Börse Xetra, is now available to investors in the UK directly.

Highlighted Crypto News Today:

Worldcoin Expands to Austria Amid Growing European Presence

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honda prepares to send its hydrogen tech to space

Share link:In this post: Honda is working with Sierra Space and Tec-Masters, two space technology companies, to try their high-differential pressure water electrolysis system. Honda aims for hydrogen to help it get all of its cars off carbon by 2040. Honda says it will work with NASA to get the equipment to the ISS on Sierra Space’s Dream Chaser space plane.

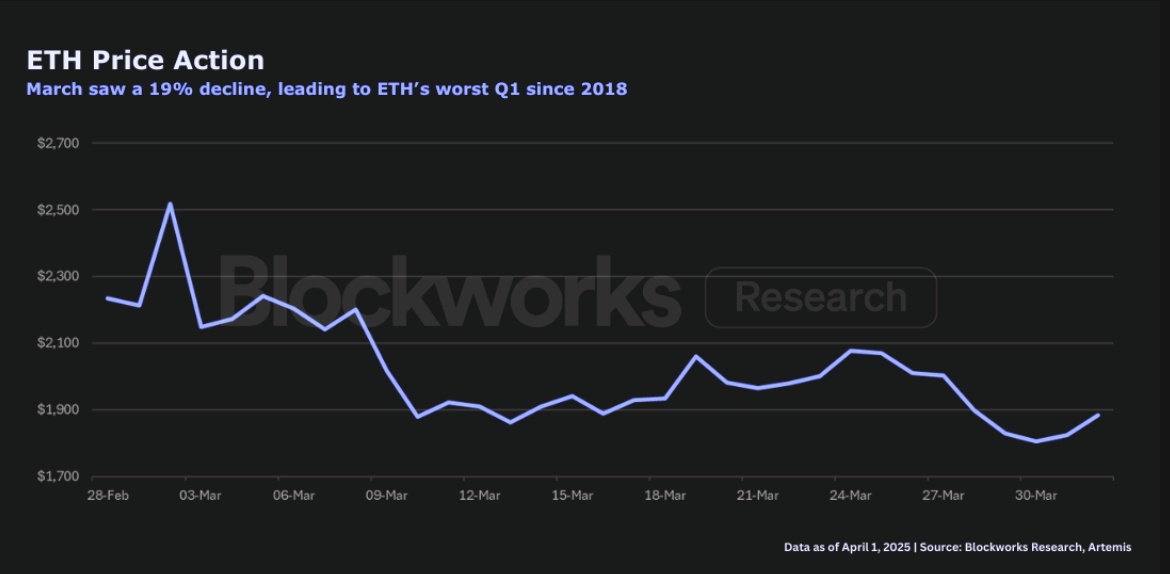

ETH just had lowest quarterly return since Q2 2022: Blockworks Research

The network is at a “pivotal juncture,” Blockworks Research’s Marc-Thomas Arjoon said

Riot Platforms Hits Post-Halving Bitcoin Production High as It Expands AI Capacity

Solana Price Pattern Points to a 65% Surge as Key Metric Beats Ethereum by Far