Explore Orderly (ORDER): Benchmarking the top projects of the track, the potential increase may be 2923.6%.

远山洞见2024/08/24 06:10

By:远山洞见

I. Project introduction

Orderly Network is an innovative second-layer (L2) decentralized trading platform designed to combine the speed and liquidity advantages of centralized exchanges (CEX) with the transparency, asset autonomy, and on-chain settlement characteristics of decentralized finance (DeFi). By aggregating the liquidity of multiple blockchains, Orderly Network provides a unified order book, supports cross-chain transactions, ensures a wider asset pool and tighter spreads. This mechanism enables users to trade at market prices, reducing slippage and improving trading efficiency.

Orderly Network is based on the NEAR blockchain and utilizes its efficient sharding technology to achieve horizontal scaling and fast transaction confirmation. Its on-chain order book system supports various financial instruments including spot and perpetual contracts, and provides a powerful infrastructure for decentralized applications (dApps). Developers can easily create and expand their applications by integrating Orderly Network's SDK and API.

*

II. Project highlights

Orderly Network has the following key project highlights:

1. Order book-based trading infrastructure. Orderly Network provides professional-level order book trading services, supporting spot and perpetual contract trading. Its efficient matching engine and low-latency architecture ensure that users can enjoy a fast and accurate trading experience.

2. Full-chain liquidity aggregation. The platform aggregates liquidity resources from multiple blockchains, covering mainstream on-chain assets such as NEAR, Ethereum, BSC, etc. By integrating these liquidity, Orderly Network provides a wider range of asset trading options and tighter spreads, reducing transaction slippage.

3. Modularization design and developer friendliness. Orderly Network adopts Modularization design, allowing developers to quickly integrate and build customized trading applications using the API and SDK provided by the platform. This flexibility greatly reduces development costs and promotes the development of various innovative financial tools.

4. Seamless cross-chain transaction experience. Orderly Network is promoting a seamless cross-chain transaction experience, allowing users to trade assets on different blockchains without complex bridging operations. The platform ensures the smoothness and efficiency of cross-chain transactions through a unified order book mechanism.

5. High scalability based on the NEAR blockchain. Orderly Network is built on the NEAR blockchain and utilizes its sharding Technology Implementation for efficient horizontal scaling. This infrastructure supports the platform in processing large amounts of orders and data, ensuring efficient operation even in high transaction volume situations.

6. Diversified uses of the native token ORDER. ORDER tokens are not only an important tool for Platform Governance, but also used to incentivize traders and market makers, enhancing participation in the entire ecosystem. Holders can obtain protocol rewards and increase trading returns by staking tokens.

III. Market value expectations

Orderly Network has solid fundamentals and high market participation. As of early July 2024, Orderly Network's protocol trading volume has reached $61 billion, lock-up volume has reached $42 million, and cumulative net fee income has reached $6.50 million. The project was incubated by members of the Woo Network team and has received strong endorsement from top institutions, including many well-known institutions such as Foresight. The previously disclosed seed round financing amount reached $20 million. Its order book collaborates with top market makers such as Jump and Kronos, further enhancing the platform's liquidity and market depth. In addition, Orderly Network has also collaborated with Google Cloud to develop off-chain components for DeFi infrastructure.

The total amount of Orderly is 1 billion, and the initial circulation ratio of the project is 13.56%. Compared with the same track Uniswap or SushiSwap and PancakeSwap, the potential market value has potential.

- SushiSwap (SUSHI): Circulating market value 161 million USD, token unit price 0.61U

-

PancakeSwap (CAKE): Circulating market value 458 million USD, token unit price 1.84U

Uniswap (UNI): Circulating market capitalization 4.10 billion USD, token unit price 6.98U

If the circulating market value of ORDER is the same as that of UNI/SUSHI/

CAKE, the price and increase of ORDER token are:

- Benchmarking SUSHI: The price of ORDER token can reach $1.19, an increase of 18.73%.

- Benchmarking CAKE: ORDER token price can reach $3.38, an increase of 237.76%.

Benchmarking UNI: ORDER token price can reach $30.24, an increase of 2923.6%.

IV. Economic model

The total supply of Orderly Network's native token ORDER is 1,000,000,000 tokens. The distribution and functions of the tokens are as follows:

Token distribution:

Community rewards (55%): used for retrospective airdrops (13.3%), trading rewards (15%), market-making rewards (10%), builder rewards (8.35%), and future product launches (8.35%).

Strategic investors (15%): Allocated to early backers and strategic investors.

- Teams and consultants (20%): Assigned to the founding team, contributors, future employees, and consultants.

Foundation (10%): for ecosystem funding, marketing, partnerships, and liquidity provision on CEX and DEX.

*

Token function:

Governance rights: Holders can pledge ORDER to participate in the decentralized governance of the platform and decide key decisions for the future.

Reward mechanism: Staking ORDER can increase the reward shares of traders and market makers, and earn VALOR, which determines the user's profit in the protocol treasury.

Ecological incentives: More application scenarios will be introduced in the future to support the development and expansion of the platform.

According to the token release curve, the release of ORDER tokens will gradually increase over about 4 years, ensuring stable growth in market supply.

*

V. Team and financing

Financing situation:

Since its establishment, Orderly Network has successfully completed multiple rounds of financing, attracting the favor of many well-known investors.

- Strategic financing round (August 16, 2024): Orderly Network received $5 million in financing from OKX Ventures, Nomad Capital, Manifold Trading, Presto, Origin Protocol and LiquidityTech Protocol.

Expand Seed Round (November 1, 2022): In this round of financing, Orderly Network is valued at $200 million, with Laser Digital as the investor.

- Seed round (June 9, 2022): Orderly Network received $20 million in seed round financing at the beginning of its establishment, with a valuation of $200 million. The investors in this financing round are strong, including Pantera Capital, Dragonfly, IOSG Ventures, Sequoia China, GSR, Amber Group, etc.

Team members:

The core team of Orderly Network is composed of experienced experts in the industry, driving the rapid development of the project.

-Ran Yi Co-founder

Ran Yi has extensive entrepreneurial experience and has held multiple important positions in the blockchain industry, making him an important pillar of the team.

-Arjun Arora Chief Operations Officer

Arjun Arora has extensive experience in market operations and management, focusing on driving global expansion and strategic implementation of the company's business.

Audrey Yang Chief Growth Officer

Audrey Yang has held senior management positions in several well-known companies, bringing strong market expansion capabilities and rich industry resources to Orderly Network.

VI. Risk Warning

1. The crypto market is highly volatile, and the value of tokens may be influenced by market sentiment and the external environment.

2. Although Orderly Network provides an efficient liquidity solution, the liquidity of tokens may be affected when market demand is insufficient or user engagement rates decrease.

VII. Official links

Website:

https://orderly.network/

Twitter:

https://x.com/OrderlyNetwork

Telegram:

https://t.co/ni7Mf4Qzvt

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

Fartcoin Soars After Breakout: What Investors Need to Know

In Brief Fartcoin experiences a significant breakout with increased trading volume. A newly created wallet purchases over 1 million FARTCOIN, signaling bullish interest. Investors see price movements as opportunities for potential gains.

Cointurk•2025/04/17 14:34

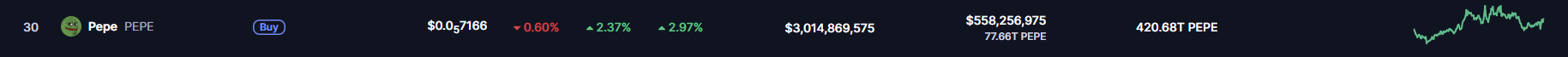

PEPE Price Prediction: Will the Memecoin Hit Its December High Again?

Cryptoticker•2025/04/17 11:00

Mantle (MNT) Heading Toward Key Support – Double Bottom Setup Hints at a Possible Reversal

CoinsProbe•2025/04/17 07:55

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,568.51

-0.47%

Ethereum

ETH

$1,583.07

-0.66%

Tether USDt

USDT

$0.9997

-0.01%

XRP

XRP

$2.07

-1.56%

BNB

BNB

$589.11

+0.91%

Solana

SOL

$132.85

+3.24%

USDC

USDC

$0.9999

+0.00%

TRON

TRX

$0.2481

-2.63%

Dogecoin

DOGE

$0.1553

-0.29%

Cardano

ADA

$0.6200

+1.10%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new Bitgetters!

Sign up now