Intention and Inflows Could Help Polkadot (DOT) Price Escape Consolidation

Polkadot’s price has not had the best luck in recovering the losses it witnessed during the early June crash.

Nevertheless, the investors have not lost optimism as they continue to pour money into the asset to push a price rise.

Polkadot Investors Remain Bullish

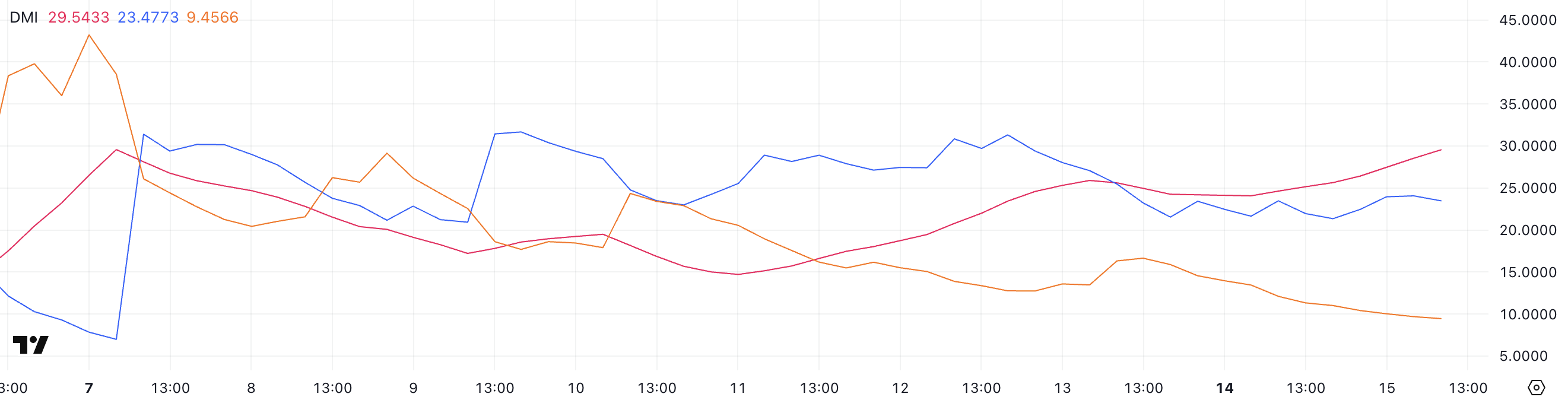

Polkadot’s price is acting the opposite of what the investors are expecting. Polkadot investors are increasingly optimistic, placing long bets in anticipation of a price rise. This optimism is reflected in the consistently positive funding rate, indicating strong sentiment among traders.

One notable aspect of Polkadot’s market activity is the steady inflow of investments. Since mid-June, these inflows have been on a consistent upward trend, suggesting growing interest and confidence in the project.

The positive funding rate is a key indicator of investor sentiment. It shows that traders are willing to pay a premium to hold long positions, betting on future price increases for DOT. This optimism can drive further investment and interest in the cryptocurrency.

Overall, the increasing inflows and positive funding rates are encouraging signs for Polkadot . These factors indicate a strong belief in the project’s potential, potentially leading to sustained price growth in the future.

Read more: What Is Polkadot (DOT)?

DOT Price Prediction: Escape Ahead

The factors mentioned suggest a bullish outlook, indicating a strong potential for a rally. However, a confirmed recovery will only occur if the altcoin breaks out of the current consolidation range between $6.5 and $5.5.

These levels have been holding Polkadot’s price captive for over a month now. Once the upper limit of this consolidation is breached, DOT would be able to enable a rise to $7 to recover the recent losses.

Read more: Polkadot (DOT) Price Prediction 2024/2025/2030

On the other hand, a failed breach could continue the consolidation. The current bullish momentum could diminish by the time DOT reaches $6.5 again , which would invalidate the positive outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Recent Surge Towards $90,000 Faces Possible Pullback Amid Tariff Uncertainty

Solana’s Recent 20% Surge Suggests Potential to Test Key Resistance Levels Amid Rising DEX Activity

Bitcoin trader sees gold 'blow-off top' as XAU nears new $3.3K record

Bitcoin is in no mood to copy gold's bull run yet, but on the horizon is a "terminal" end to the record XAU/USD winning streak, a trader predicts.