Here’s When India Plans to Unveil Crypto Discussion Paper

The inter-ministerial group, tasked with developing a complete cryptocurrency policy, now includes the RBI and SEBI.

While Indian crypto users were granted no relief from the draconian tax rules in the country’s budget for 2024-2025, a “discussion paper” outlining its policy stance on the industry could be released before September this year.

The main objective behind the discussion paper is to gather inputs from relevant stakeholders on the ideas outlined in it.

India’s Crypto Discussion Paper

In an interview with Moneycontrol, India’s Economic Affairs Secretary Ajay Seth said that the discussion paper will include suggestions on how to regulate cryptocurrencies in India, which currently is only covered under anti-money laundering (AML) and electronic funds transfer (EFT) laws.

Other important focus areas will be to explore whether the scope of regulation should be expanded and what the policy stance should be.

An inter-ministerial group, including members from the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), is developing a broader policy on cryptocurrencies. The discussion paper is anticipated to be ready before September.

Seth was quoted saying,

“The policy stance is how does one consult relevant stakeholders, so it is to come out in the open and say here is a discussion paper these are the issues, and then stakeholders will give their views.”

India’s plan to release a discussion paper comes in response to G20 countries’ support of the International Monetary Fund (IMF) and Financial Stability Board (FSB) guidelines during India’s G20 presidency last year. The IMF-FSB synthesis paper advised against a hostile approach, such as an outright ban on crypto activities, highlighting the difficulties in enforcing such a measure.

In a statement to CryptoPotato, the co-founder of CoinDCX, Sumit Gupta, said that he is optimistic about the Indian government’s move to establish an Inter-Ministerial Group to review and release a consultation paper. The exec added,

“This initiative is a significant step toward shaping the future of the rapidly evolving and dynamic Web3 industry in India. As key stakeholders in this sector, we urge the government to actively seek input from domestic businesses. Engaging with local businesses will ensure that the regulatory framework is robust, inclusive, and supportive of innovation.”

No Tax Relief for Indian Crypto Investors

While India lacks a thorough crypto regulatory framework, it requires crypto entities to register with the Financial Intelligence Unit (FIU-IND) to comply with anti-money laundering (AML) and counter-terrorism financing standards set up by international organizations like the Financial Action Task Force (FATF).

This move provided a significant credibility boost for the industry. However, the existing tax system has been extremely controversial as it imposes a 30% tax on cryptocurrency gains and a 1% Tax Deducted at Source (TDS) on crypto asset transfers, raising concerns among investors and industry professionals regarding its effects on the country’s crypto market.

In another setback for the Indian crypto sector, investor hopes were dashed when Finance Minister Nirmala Sitharaman made no changes to the existing crypto tax regulations in her 2024-2025 budget speech.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Bulls Eyeing $2.50 Resistance: Is a Breakout Coming Soon?

Crypto Shockwave: OM Token Crashes Nearly 90%, Triggers Trust Crisis:Deep Flaws in Token Governance?

SAND Breaks Free: Is a 97% Rally Toward $0.52 Just Beginning?

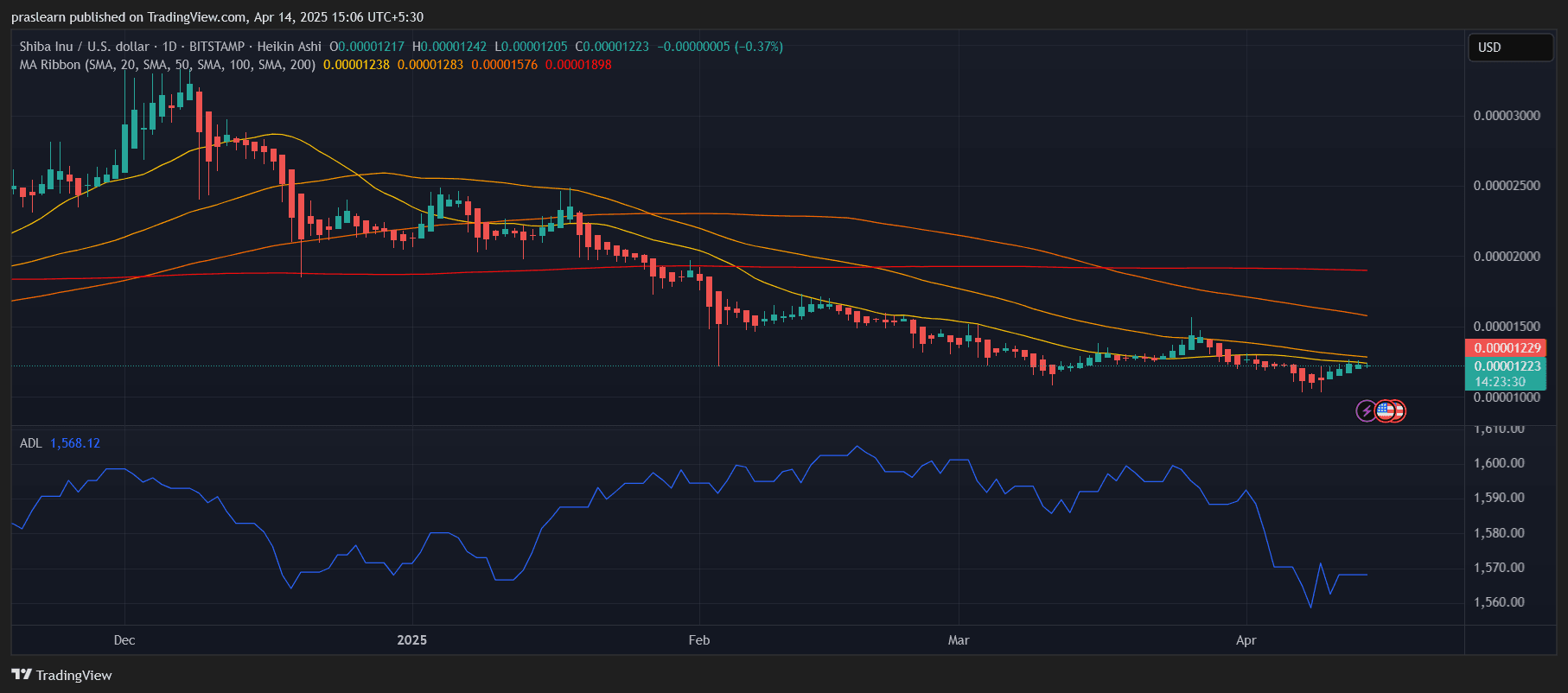

Shiba Inu Ready to Bark Again? Price Action Signals a Breakout